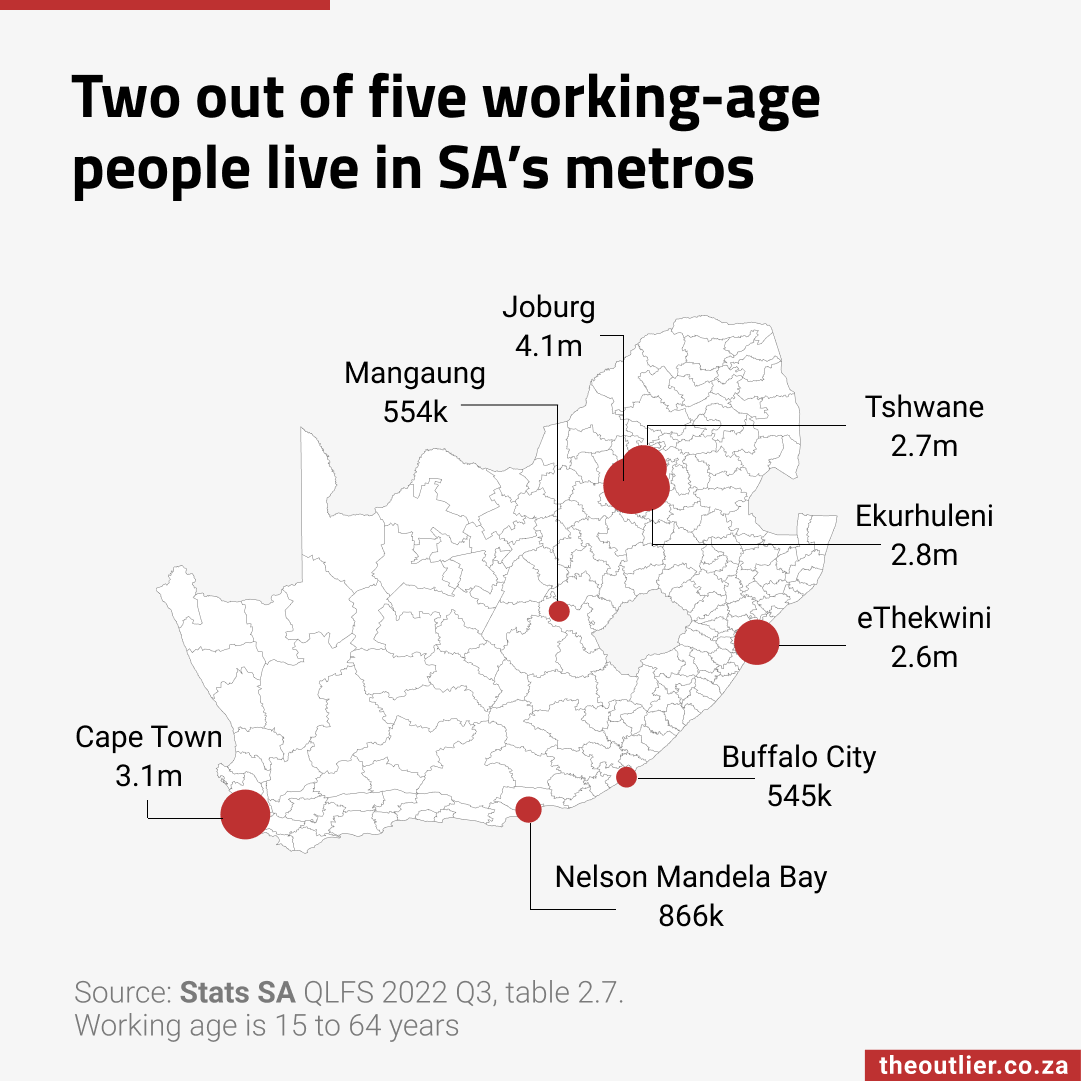

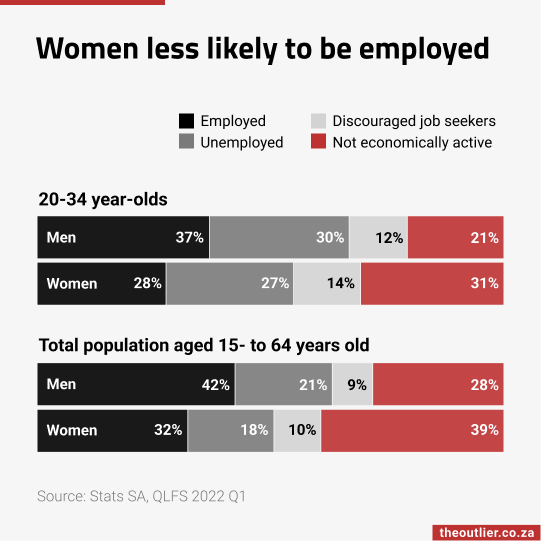

There were 3.6-million new entrants to the job market among the unemployed in Statistics South Africa’s Quarterly Labour Force Survey for April to June this year. These are people who have never worked before but are currently looking for jobs, most of them likely young and searching for their first opportunity.

As the population grows, more young people enter the labour market every year. But the share of new entrants among the unemployed has also risen, from 41% a decade ago to 43% today. That small percentage shift translates into a massive jump in numbers: from 1.9-million to 3.6-million. It’s a clear sign that South Africa is not creating enough entry-level jobs for people without work experience.

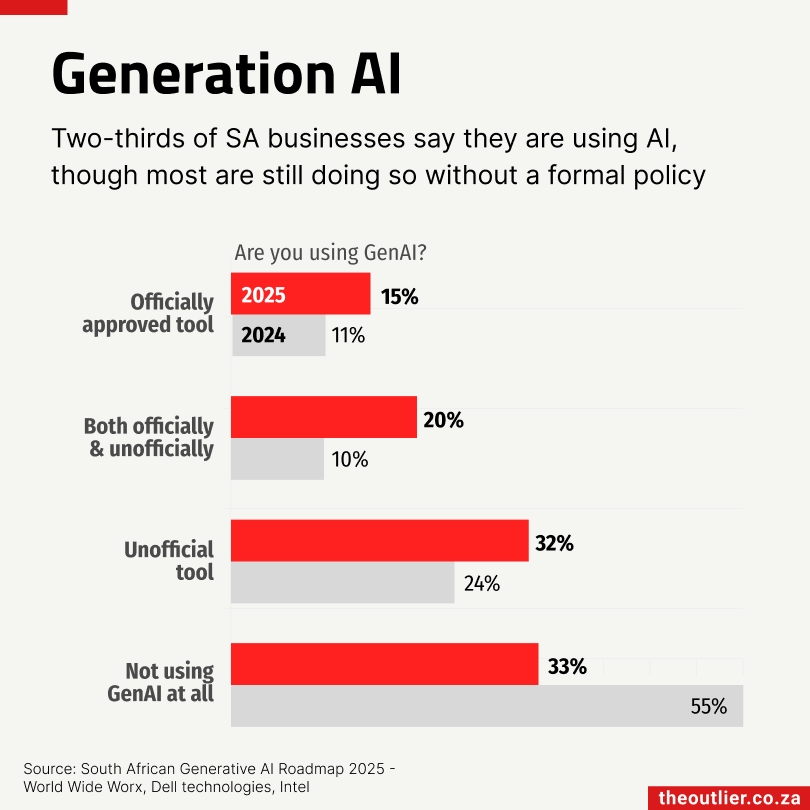

South African enterprises are integrating Generative AI (GenAI) into their operations fairly quickly, but most are doing so without formal strategies, says Arthur Goldstuck from World Wide Worx.

In the latest South African Generative AI Roadmap 2025, Goldstuck says that GenAI usage in large enterprises has increased from 45% in 2024 to 67% in 2025.

The GenAI report surveyed over 100 mid-sized and large enterprises across industry sectors.

From a benefit point of view, most users cited an increase in competitiveness (86%) as a reason for using AI, followed by improved productivity (83%) and enhanced customer service (66%).

But only 14% of the companies surveyed had a formal, company-wide GenAI strategy, according to the report.

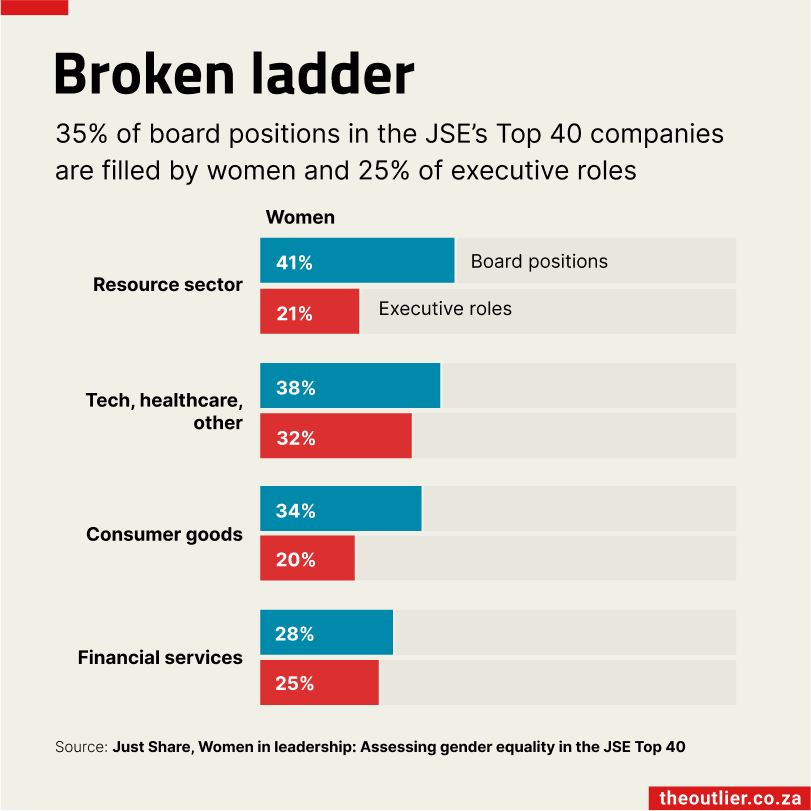

In Africa, only one in five of the sources quoted in the news is a woman, according to the most recent Who Makes the News?, Global Media Monitoring Project, a study done every five years.

South African media is better at quoting women than those in Kenya and Nigeria, but still, 75% of those quoted are men.

Quote This Woman+ is working to change this.

QW+ connects journalists from around the world with African women experts. This August, they’re running an #EachOneReachOne campaign to add 100 new experts to their database, which already contains more than 700 woman+ experts in fields ranging from gender rights, politics, economics and crime to AI, tech, education and climate change.

Help them reach that goal by nominating yourself or a woman+ whose expertise you know deserves to be heard.

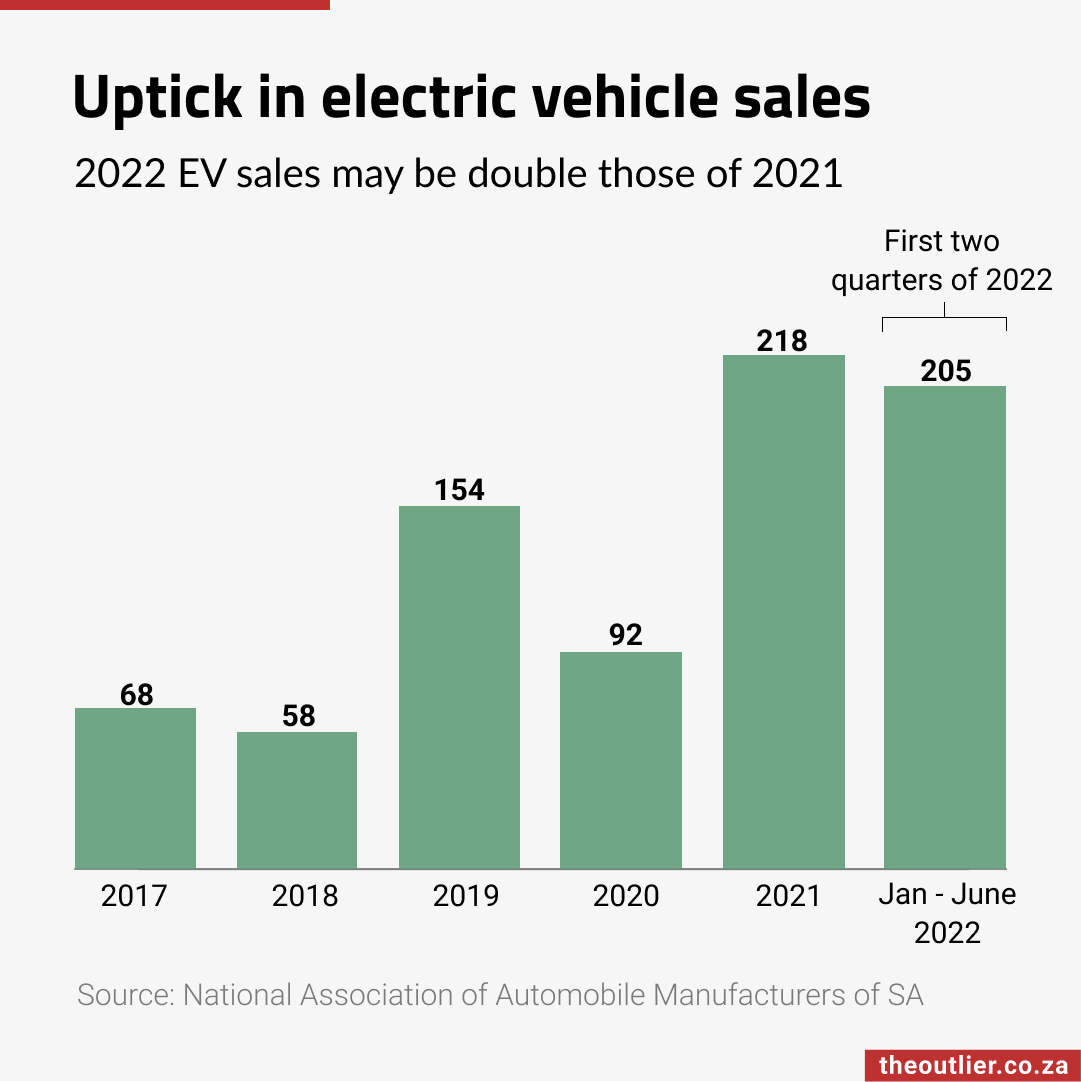

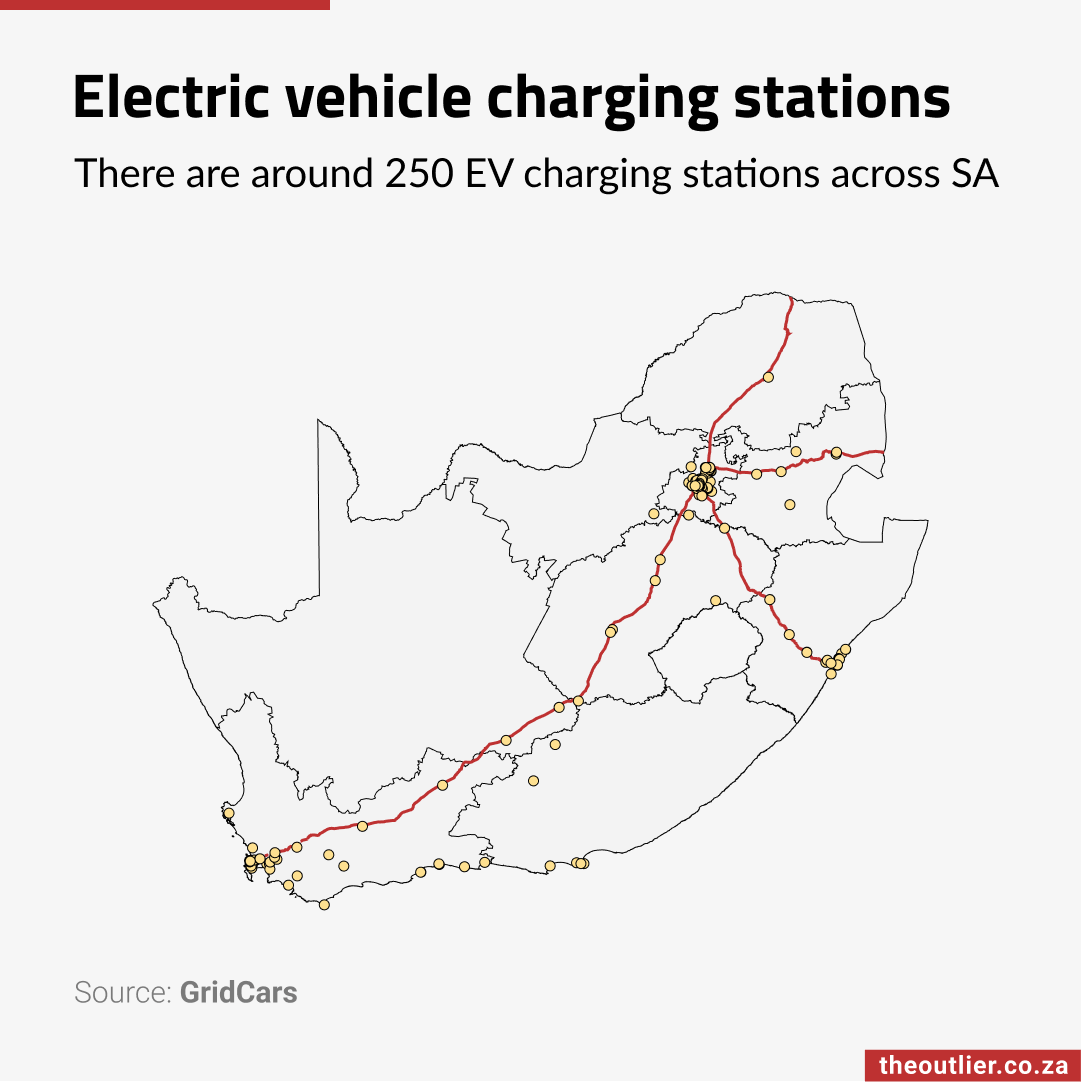

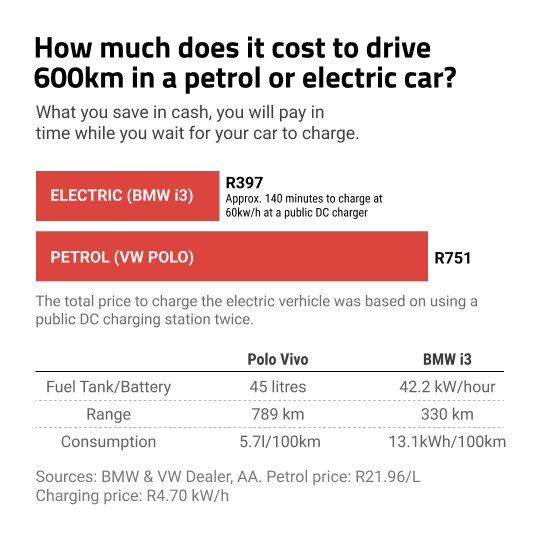

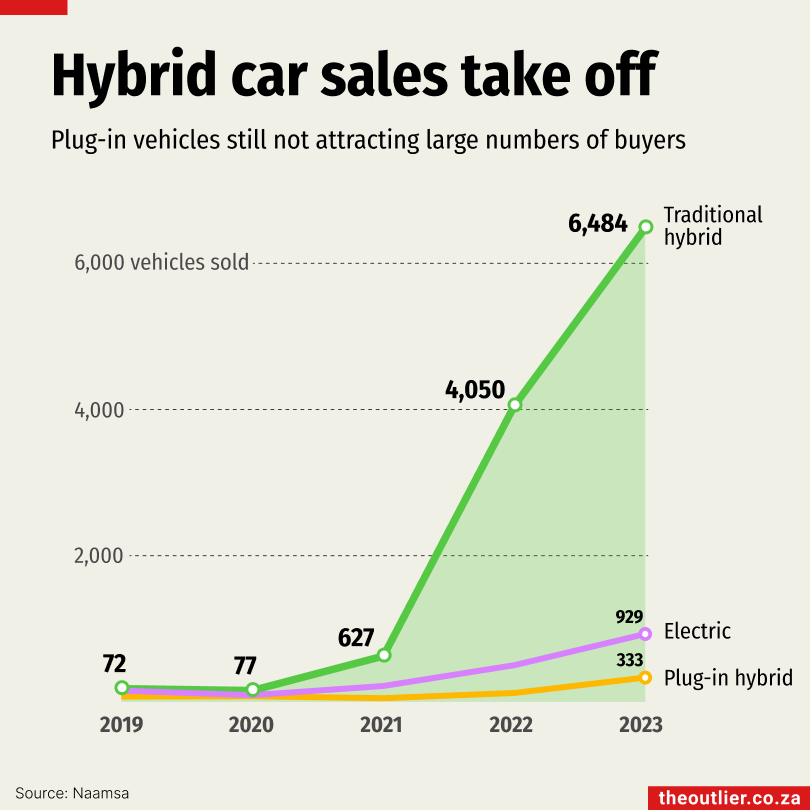

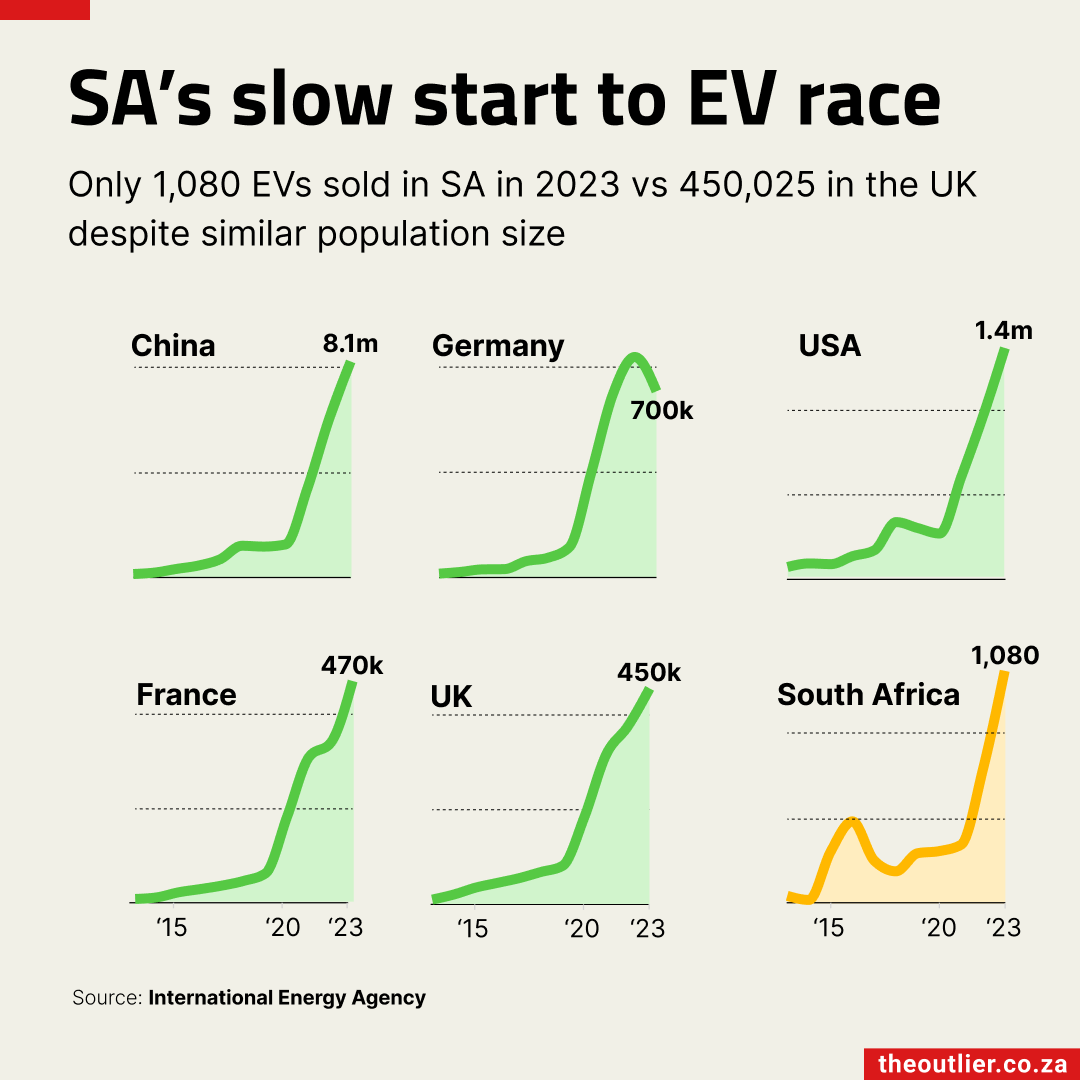

There are about 13-million vehicles on South Africa’s roads. Less than 1% of them are plug-in electric vehicles, said Hiten Parmar of non-profit Electric Mission in a webinar hosted by EE Publishers on 6 August 2025. That doesn’t sound particularly positive, but car sales data shows that South Africa is on the right track.

Sales of battery electric vehicles in South Africa have accelerated from just 160 in 2019 to 1,200 in 2024. Add plug-in hybrids, and the 2024 total approaches 2,000.

For South Africans, the cost of electric vehicles is a factor. That and anxiety about there being enough charging stations. Eighty to ninety percent of charging takes place at home, says Parmar. Plus, there are 385 charging stations in South Africa at present, according to Plugshare. So, that road trip from Jo’burg to Durban is doable; our highways are covered.

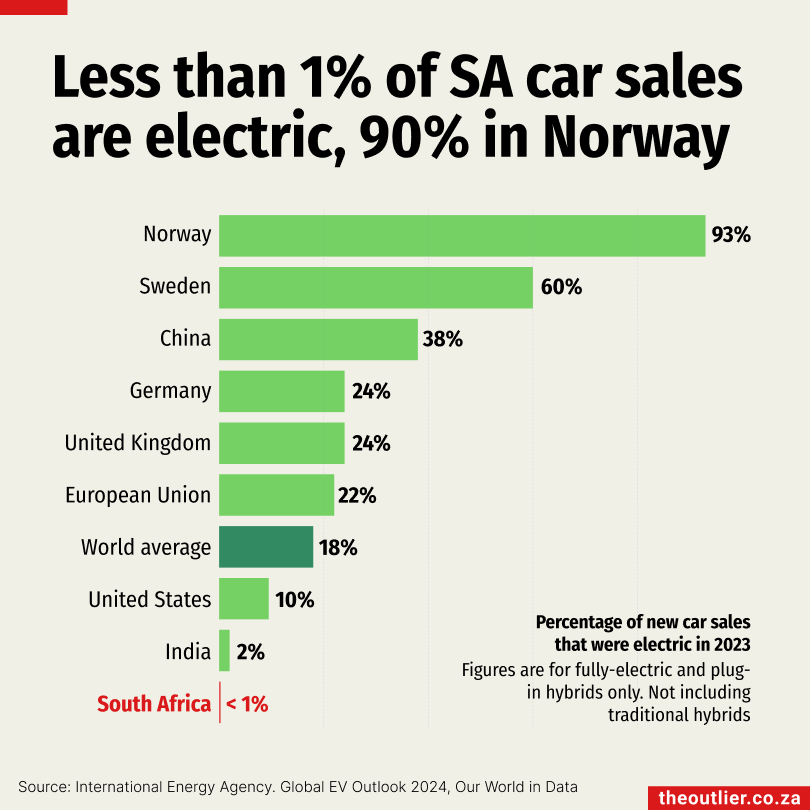

Last year, about one in every five cars sold globally was an electric vehicle. Norway leads the charge, with 92% of new cars sold being electric. China is close to 50%, while the United States sits at 10%. In South Africa, it’s just three in every 500, a small share, but the trend is heading in the right direction.

Sales of battery electric vehicles in South Africa have accelerated from just 160 in 2019 to 1,200 in 2024. Add plug-in hybrids, and the 2024 total approaches 2,000.

Two big hurdles remain: price and concerns about charging infrastructure. Most charging, 80% to 90%, happens at home, says Hiten Parmar of non-profit Electric Mission in a webinar hosted by EE Publishers on 6 August 2025. Still, there are now 385 charging stations in South Africa, according to Plugshare, making road trips from Jo’burg to Durban feasible.

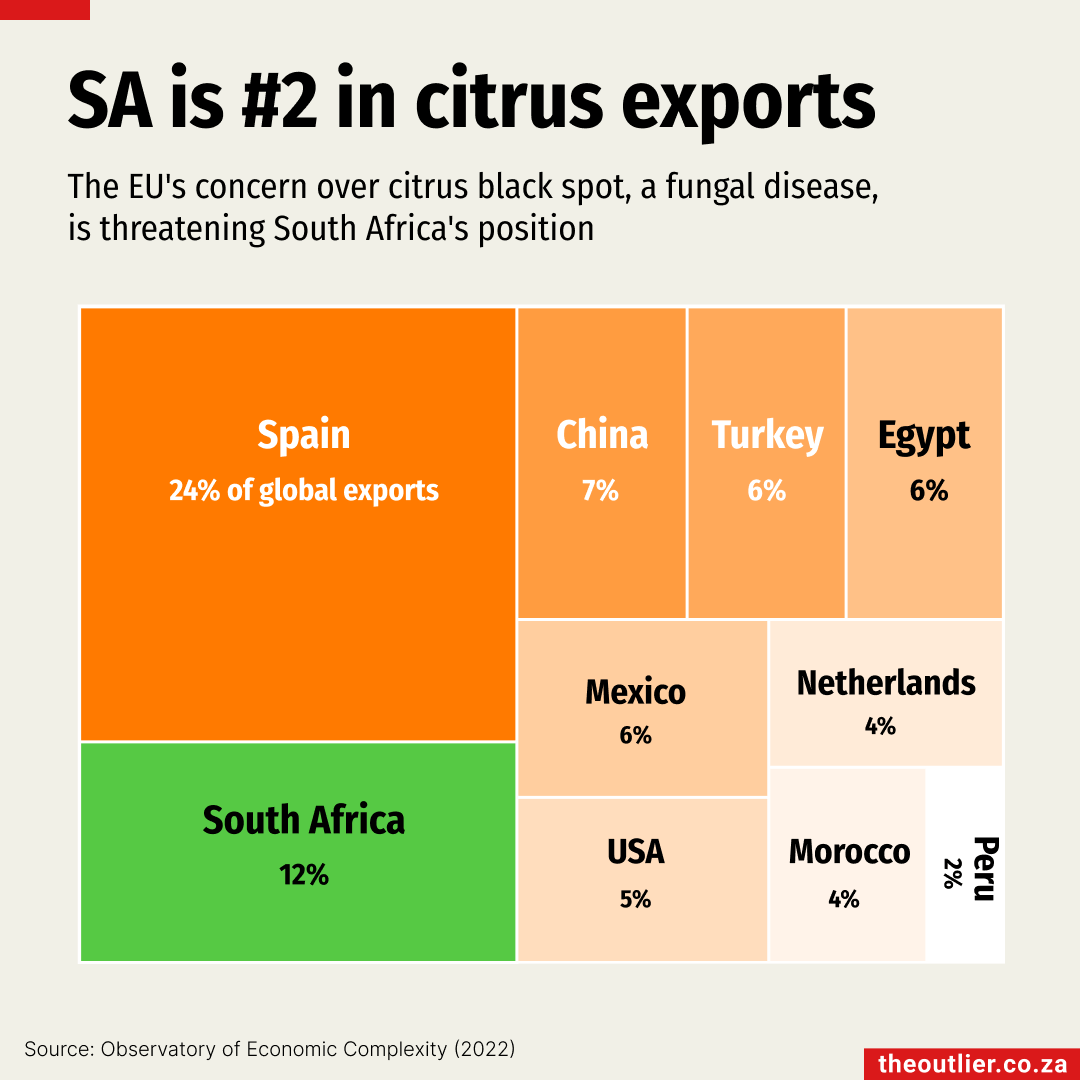

South Africa failed to broker a last-minute deal to avoid the 30% trade tariff imposed by US President Donald Trump, which will come into effect on 7 August 2025. It is a development that has become a source of “great anxiety” for citrus growers in the Western and Northern Cape, according to the Citrus Growers’ Association of Southern Africa (CGA).

The two provinces export around 7-million 15kg cartons of citrus to the US each year. But rerouting that fruit is no simple task.

Diverting fruit to other markets could depress prices in those markets through oversupply, which would negatively impact the entire Southern African citrus industry, explained the CGA.

South Africa is the world’s second-largest exporter of citrus. In the 2024 season, more than 2-million tonnes of oranges, mandarins, grapefruits and lemons were shipped overseas. The two biggest markets are Europe (36%) and the Middle East (19%). North America, which includes the United States and Canada, takes 9% of the exports.

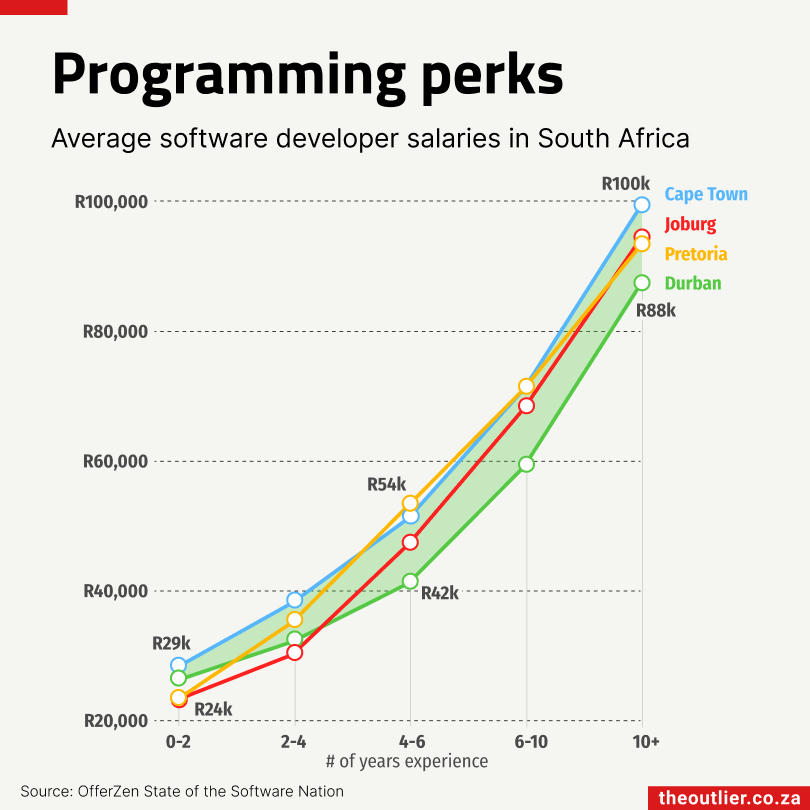

Cape Town developers continue to out-earn their peers in other parts of South Africa. According to the latest OfferZen State of the Software Nation report, experienced developers with more than ten years of experience in Cape Town earn about R100,000 per month. That’s roughly R12,000 more than their coastal counterparts in Durban, who earn around R88,000. In Johannesburg and Pretoria, senior developers earn similar amounts, R95,000 and R94,000, respectively.

Interestingly, Durban developers start strong, with entry-level salaries averaging R27,000 a month, only slightly behind Cape Town’s R29,000. But over time, Durban developers appear to fall behind their peers elsewhere in the country.

For mid-level developers (those with four to six years of experience), Pretoria offers the highest average salary at R54,000 per month, followed by Cape Town at R52,000 and Johannesburg at R48,000.

Beef mince is at its highest price in eight years, according to Statistics South Africa’s Consumer Price Index. It was R14/kg more expensive in June than it was at the beginning of the year.

The increase is largely due to a widespread outbreak of foot-and-mouth disease (FMD), a highly contagious virus that affects cattle, which has caused supply shortages. Infected cattle have been quarantined, and animal movement has been restricted until herds are vaccinated. There have been 270 reported outbreaks of the disease across five provinces.

South Africa currently relies on Botswana to supply its FMD vaccines. The Botswana Vaccine Institute is one of just five FMD vaccine producers in Africa.

At the Foot-and-Mouth Disease Indaba on 21 July 2025, Agriculture Minister John Steenhuisen admitted that South Africa had been unprepared. “The national FMD vaccine bank was depleted,” he said.

“Onderstepoort Biological Products [a state-owned vaccine manufacturer] currently lacks the infrastructure to produce FMD vaccines at the scale and speed required to respond to outbreaks,” said Steenhuisen.

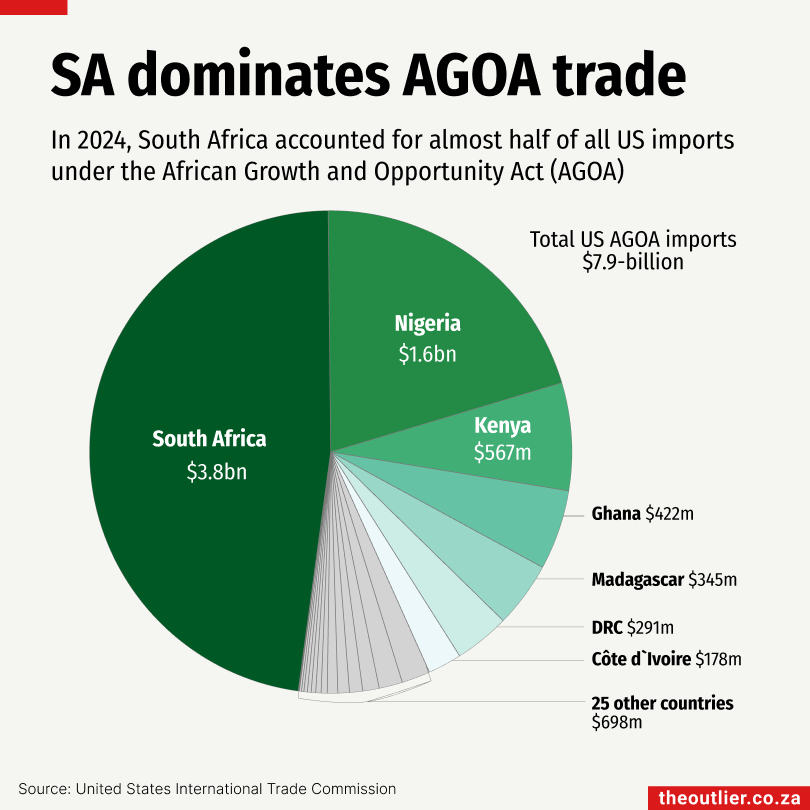

US President Donald Trump’s 30% tariff on South African imports has dealt a blow to the African Growth and Opportunity Act (AGOA), which is set to expire in September 2025. AGOA allows eligible sub-Saharan African countries duty-free access to the US market for thousands of products, aiming to boost economic growth through exports.

In 2024, South Africa accounted for nearly half ($3.8-billion) of the $7.9-billion in US imports under AGOA. The country’s top export under the agreement is transport equipment. That year, South Africa exported 24,681 vehicles to the United States, according to the Automotive Business Council (Naamsa).

“The US tariffs directly threaten thousands of jobs in our sector, disrupt hard-won industrial capabilities, and risk devastating communities such as East London, where the auto sector forms the economic heartbeat of the town,” said Naamsa CEO Mikel Mabasa. “If we cannot retain export markets like the US, we risk turning vibrant industrial hubs into ghost towns.”

South Africa’s automotive industry supports over 110,000 formal sector jobs, according to Naamsa.

US President Donald Trump’s 30% tariff on South Africa has dealt a blow to the African Growth and Opportunity Act (AGOA), which is due to expire in September 2025. AGOA provides duty-free access to eligible sub-Saharan African countries for thousands of products, aimed at promoting economic growth through exports.

Thirty-two countries are eligible for AGOA.

In 2024, South Africa accounted for almost half ($3.8-billion) of the $7.9-billion in US imports under AGOA, followed by Nigeria ($1.6-billion) and Kenya ($567-million), according to US International Trade Commission data.

Nigeria mainly exports crude oil, while Kenya’s key exports are textiles.

Roughly 25% of South Africa’s total exports to the US fall under AGOA, according to a 2025 Parliamentary Budget Office report.

South Africa’s top AGOA export is transport equipment.

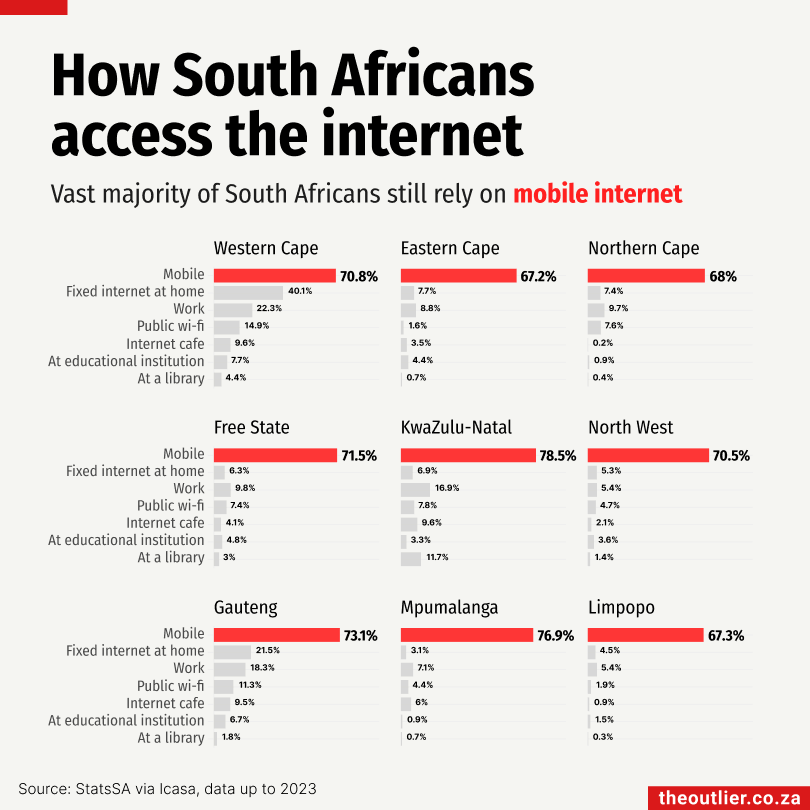

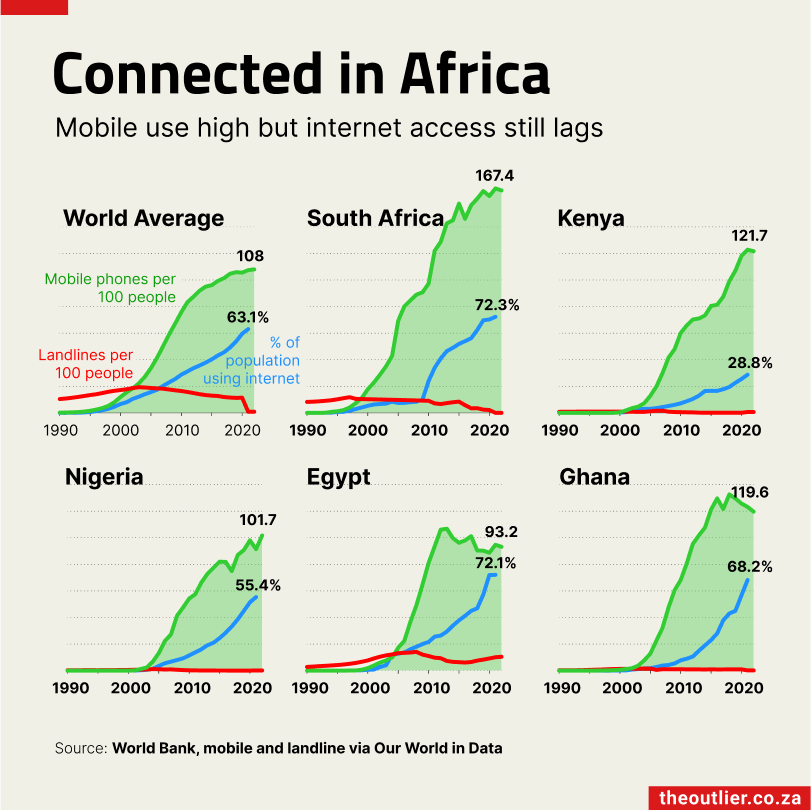

Nearly three-quarters of South Africans go online using a mobile device, with KwaZulu-Natal leading the provinces at 78.5%.

At the other end of the spectrum, just 67.2% of people in the Eastern Cape access the internet via mobile, the lowest rate in the country, reflecting possible challenges in infrastructure or service availability, according to Icasa’s March 2025 State of the ICT Sector in South Africa report.

Access to fixed home internet remains far more limited. Nationally, only 14.5% of South Africans have a home internet connection. The numbers are skewed by relatively high access in the Western Cape (40.1%) and Gauteng (21.5%), while most other provinces are below 10%. In Mpumalanga, just 3.1% of people have fixed home internet.

Beyond the home, South Africans also access the internet through a range of public and workplace options: 14% connect at work, 8% use public Wi-Fi, 6.9% visit internet cafés, 4.6% connect at educational institutions and 3.5% use library networks.

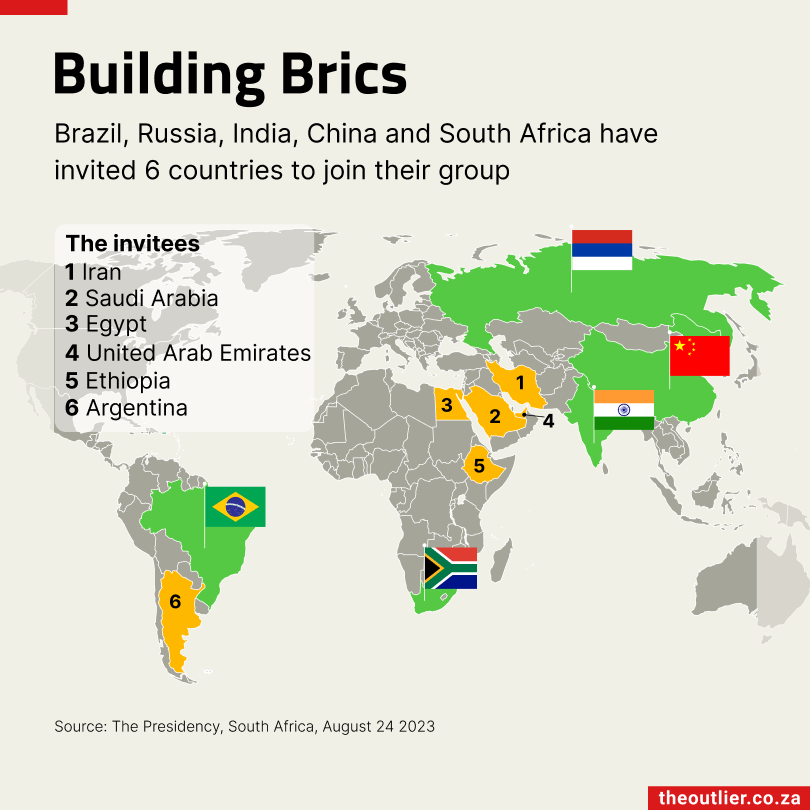

BRICS countries – Brazil, Russia, India, China and South Africa, and new members Egypt, Ethiopia, Indonesia, Iran and the United Arab Emirates – together accounted for half (51%) of global solar electricity generation in 2024, according to energy think tank Ember’s report “Solar BRICS: Emerging economies now lead the world’s clean energy race.”

China alone generated 39% of the world’s solar power in 2024, up from just 12% a decade earlier. South Africa contributed 0.9%.

Five BRICS countries featured among the world’s top 20 solar power producers. China led globally with 839 terawatt-hours (TWh), followed by the United States (303TWh) and India (137TWh). Brazil ranked sixth with 71TWh, and South Africa placed 16th with 20TWh. The United Arab Emirates, which joined BRICS in 2024, was 20th.

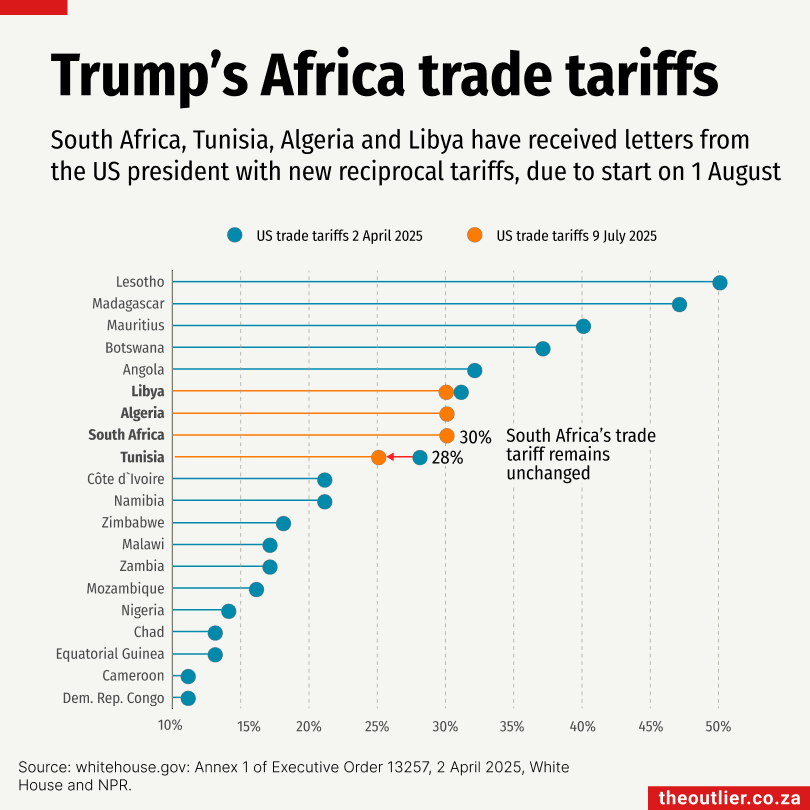

United States President Donald Trump’s reciprocal trade tariffs, first announced on 2 April, were set to take effect on 9 July. However, he extended the 90-day moratorium to 1 August and sent letters to more than 20 countries informing them that their tariffs had been revised. South Africa, Tunisia, Algeria and Libya were the only African countries to receive letters so far.

South Africa and Algeria’s tariffs remain unchanged at 30%. Tunisia’s was slightly reduced from 28% to 25%. Libya’s was marginally reduced from 31% to 30%.

A fact sheet on the White House website, which claims President Trump is “the best trade negotiator in history”, hints at a willingness to pursue further trade talks.

President Cyril Ramaphosa said South Africa would continue its “diplomatic efforts towards a more balanced and mutually beneficial trade relationship”.

South Africa’s platinum, gold, coal, manganese and chrome are among the products that have been excluded from the US tariffs.

Foreign direct investment (FDI) in Africa jumped by a record 75% in 2024, according to UNCTAD’s World Investment Report 2025.

The increase was driven by a $35-billion megaproject backed by the United Arab Emirates, which aims to transform a stretch of the country’s Mediterranean coastline into a major tourism, residential, business and financial hub. The size of the investment made Egypt the top African recipient of foreign direct investment and the ninth-largest globally.

Meanwhile, South Africa, which typically vies with Egypt for the top spot for foreign direct investment, fell to seventh place, behind Ethiopia, Côte d’Ivoire, Mozambique, Uganda and the Democratic Republic of Congo.

South Africa’s strong showing in 2021 was largely due to a one-off share exchange between Prosus NV and Naspers, which inflated its foreign investment figures.

Angola’s FDI has been in negative territory for the past few years due to the repatriation of investments by foreign companies, especially in the oil sector.

Only 32 countries in the world host AI-focused data centres and fewer than 20% of those are in the Southern Hemisphere. The vast majority of data centres are clustered around Europe and the UK, in the United States and China. 90% of the world’s AI data centres are controlled by either the US or China.

A new study from Oxford University has sparked much-needed debates about the future of AI, and who ultimately controls it and who has access to it. The entire continent of Africa, apart from South Africa, and most of South America has none of the infrastructure required to build, train and run AI models.

As University of Pretoria’s ABSA Chair of Data Science Vukosi Marivate says: “This divide isn’t just about technology. It means limited innovation, lost competitiveness, brain drain, lack of data sovereignty, and the economic benefits of AI flowing elsewhere. Access to compute is no longer optional – it’s essential for digital sovereignty and for shaping our own AI future.”

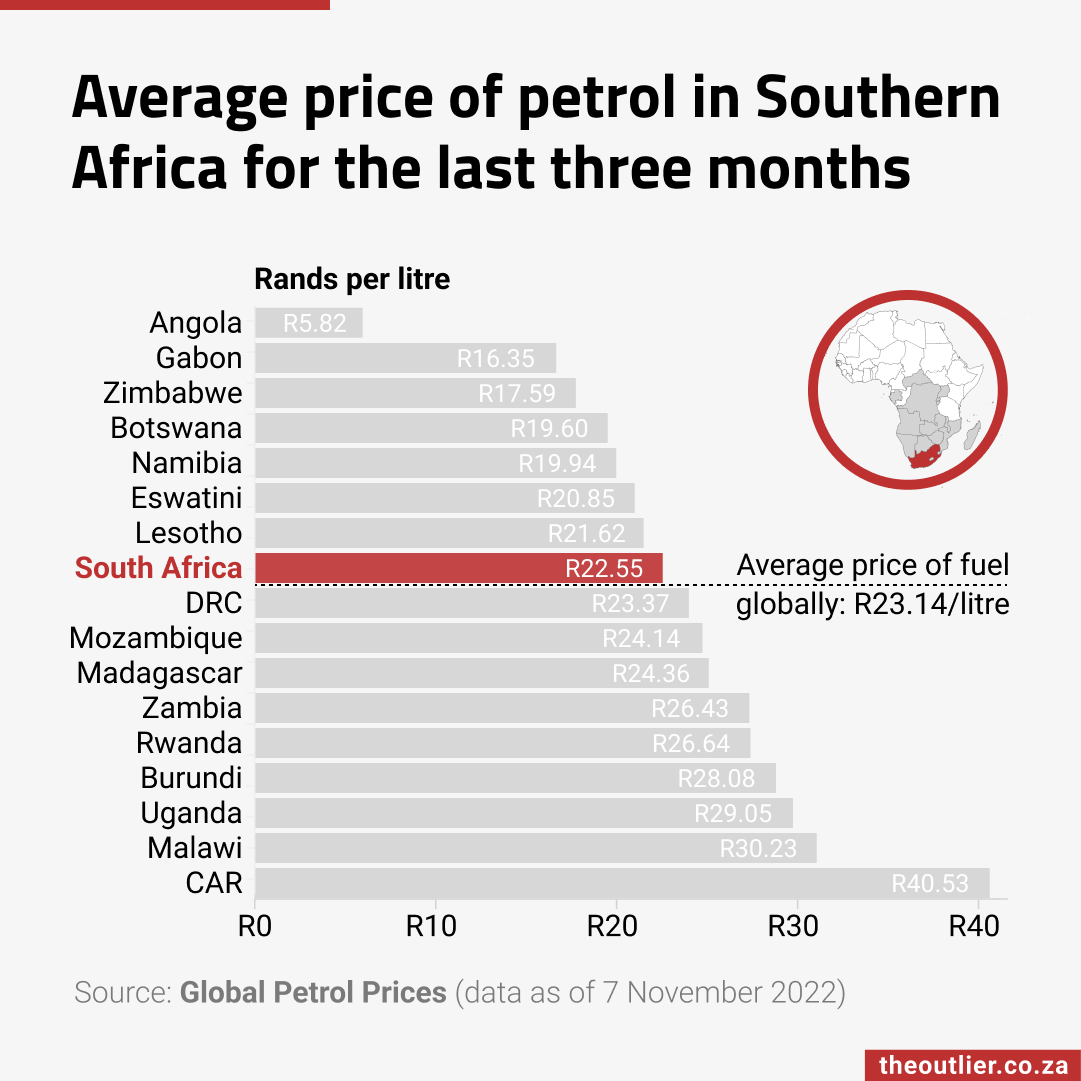

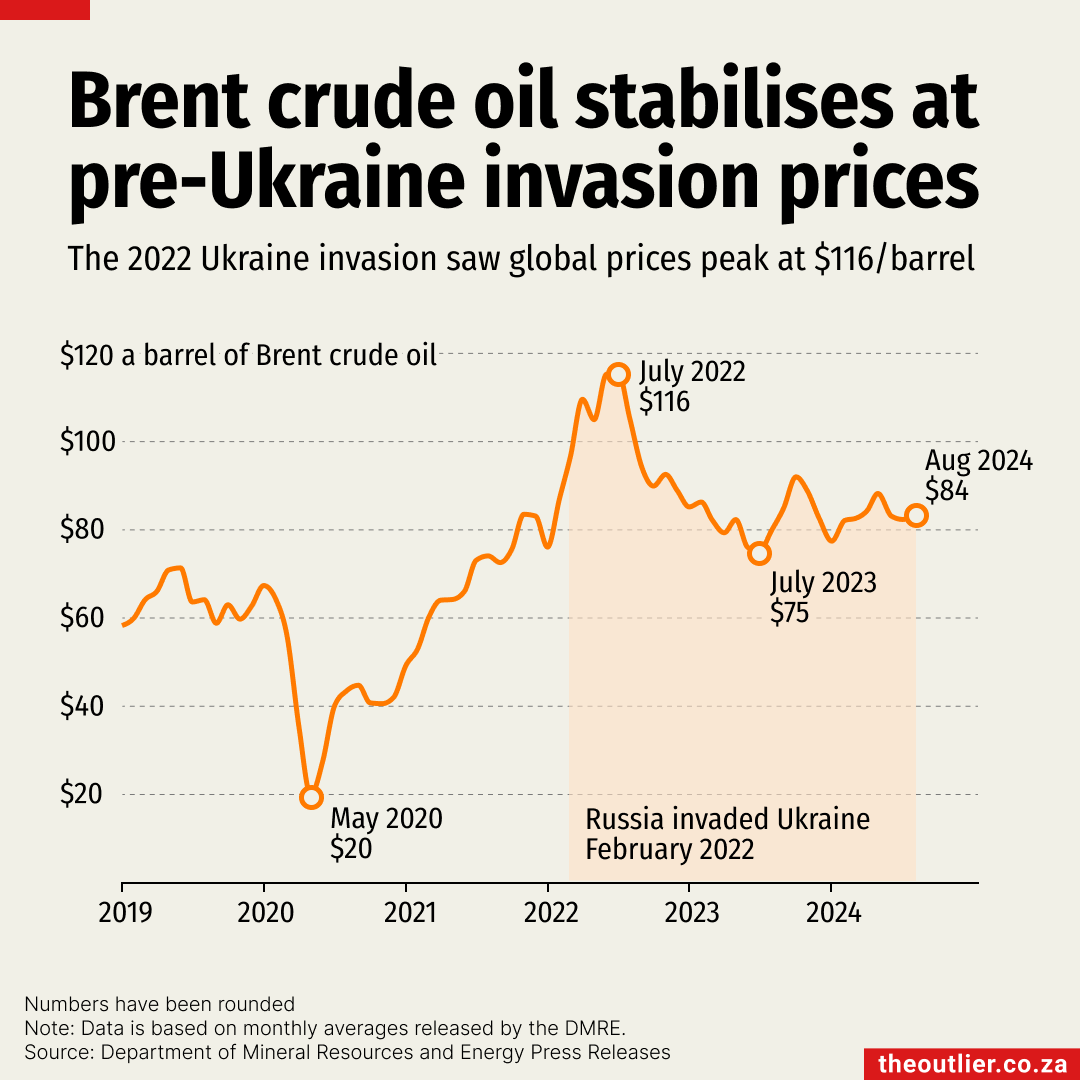

South Africa imports most of its petroleum and crude oil from Nigeria and Saudi Arabia. In 2023, it imported $2.28-billion (46.1%) from Nigeria and $1.62-billion (32.7%) from Saudi Arabia, according to Harvard’s Atlas of Economic Complexity.

In June 2025, Saudi Arabia was exporting 7.2-million barrels of oil per day through the Strait of Hormuz. It is one of six major oil producers – alongside Iran, Iraq, Kuwait, Qatar and Oman – that rely on Hormuz to ship oil, much of it destined for Asian markets.

The Strait of Hormuz is the world’s second-busiest oil transit chokepoint after the Strait of Malacca. In 2023, 20.9-million barrels of crude oil and petroleum products passed through Hormuz each day, compared to 23.7-million through Malacca.

Any blockade or disruption in the strait would likely push up global oil prices – and South Africans would feel it at the pump. Higher fuel costs would ripple through the economy, raising the transport prices, food, and other essentials.

Iran is one of the world’s top crude oil producers, averaging 5.1-million barrels per day in 2024. When Israel launched its war with Iran, oil prices spiked amid fears of supply disruptions.

Part of that anxiety stems from geography: Iran borders the Strait of Hormuz, a critical maritime chokepoint through which a fifth of the world’s oil supply passes en route from the Persian Gulf to the Gulf of Oman.

Six of the world’s biggest oil producers – Saudi Arabia, Iran, Iraq, Kuwait, Qatar and Oman – rely on Hormuz to export their oil, most of it bound for Asian markets.

Tensions escalated further when the United States bombed Iran’s nuclear facilities on 22 June 2025. Fears mounted that Iran would retaliate by blocking the strait.

The Strait of Hormuz is the second-busiest oil transit route in the world, after the Strait of Malacca. In 2023, 20.9-million barrels of crude oil and petroleum products moved through Hormuz daily, compared to 23.7-million through Malacca.

Iran is one of the world’s top crude oil producers, averaging 5.1-million barrels per day in 2024. When Israel launched its war with Iran, oil prices spiked amid fears of supply disruptions.

Part of that anxiety stems from geography: Iran borders the Strait of Hormuz, a critical maritime chokepoint through which a fifth of the world’s oil supply passes en route from the Persian Gulf to the Gulf of Oman.

Six of the world’s biggest oil producers – Saudi Arabia, Iran, Iraq, Kuwait, Qatar and Oman – rely on Hormuz to export their oil, most of it bound for Asian markets.

Tensions escalated further when the United States bombed Iran’s nuclear facilities on 22 June 2025. Fears mounted that Iran would retaliate by blocking the strait.

The Strait of Hormuz is the second-busiest oil transit route in the world, after the Strait of Malacca. In 2023, 20.9-million barrels of crude oil and petroleum products moved through Hormuz daily, compared to 23.7-million through Malacca.

State salaries are under fresh scrutiny as budget pressures mount and government debt soars – but the pay at state-owned enterprises is particularly staggering. The Development Bank of South Africa CEO tops the list, earning R15.5-million a year, nearly R1.3-million a month. The next highest earners are Transnet’s CEO at R8.5-million a year, closely followed by South African Revenue Services’ CEO at R8.2-million.

We’ve compiled the remuneration packages of the 122 state-owned enterprises CEOs using responses from 18 government ministers to parliamentary questions. The electricity and energy minister’s response was incomplete due to a broken link, so Eskom’s financials were used to estimate its CEO’s pay.

The top 15 earners all take home R6-million a year or more – not including performance bonuses. None of the 122 CEOs earns less than R1-million a year.

It won’t come as a surprise that the five richest people in the world are tech billionaires based in the United States, according to Bloomberg’s Billionaires Index.

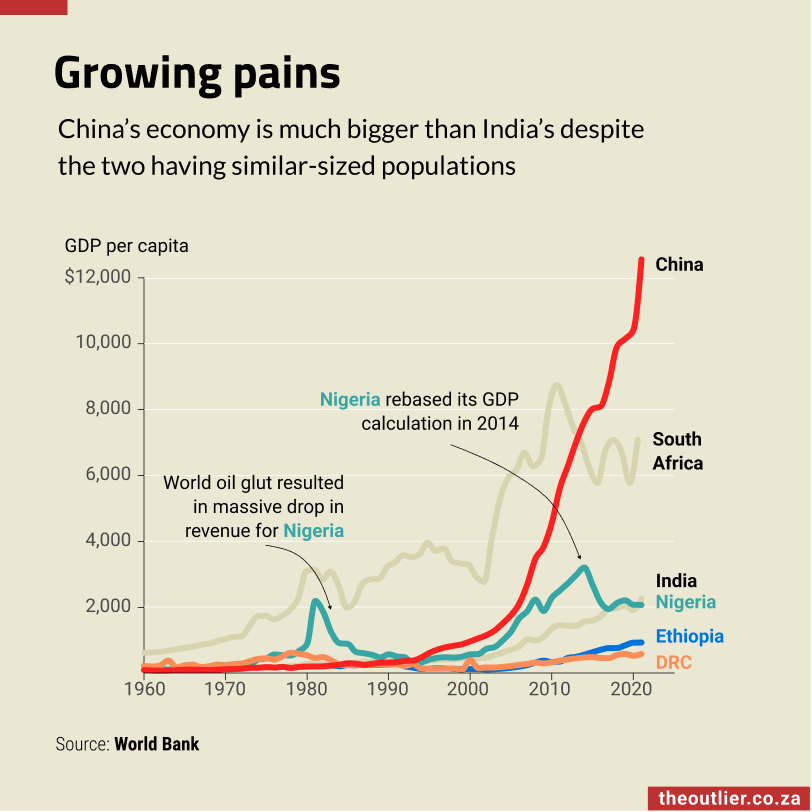

At number one – as of the close of business on 5 June 2025 – is Elon Musk (yes, born in South Africa, but now an American citizen), with a net worth of $368-billion. To put that in perspective, only two African countries have economies larger than Musk’s fortune – South Africa, with a GDP of $400-billion, and Egypt, at $383-billion.

The graphic above compares the net worth of the world’s top five richest men to the GDPs of Africa’s five largest economies, based on the IMF’s World Economic Outlook (April 2025).

Altogether, the combined net worth of the top 10 on Bloomberg’s latest billionaires index stands at $1.97-trillion – exceeding the entire GDP of Sub-Saharan Africa, which the IMF estimates at $1.88-trillion for 2024.

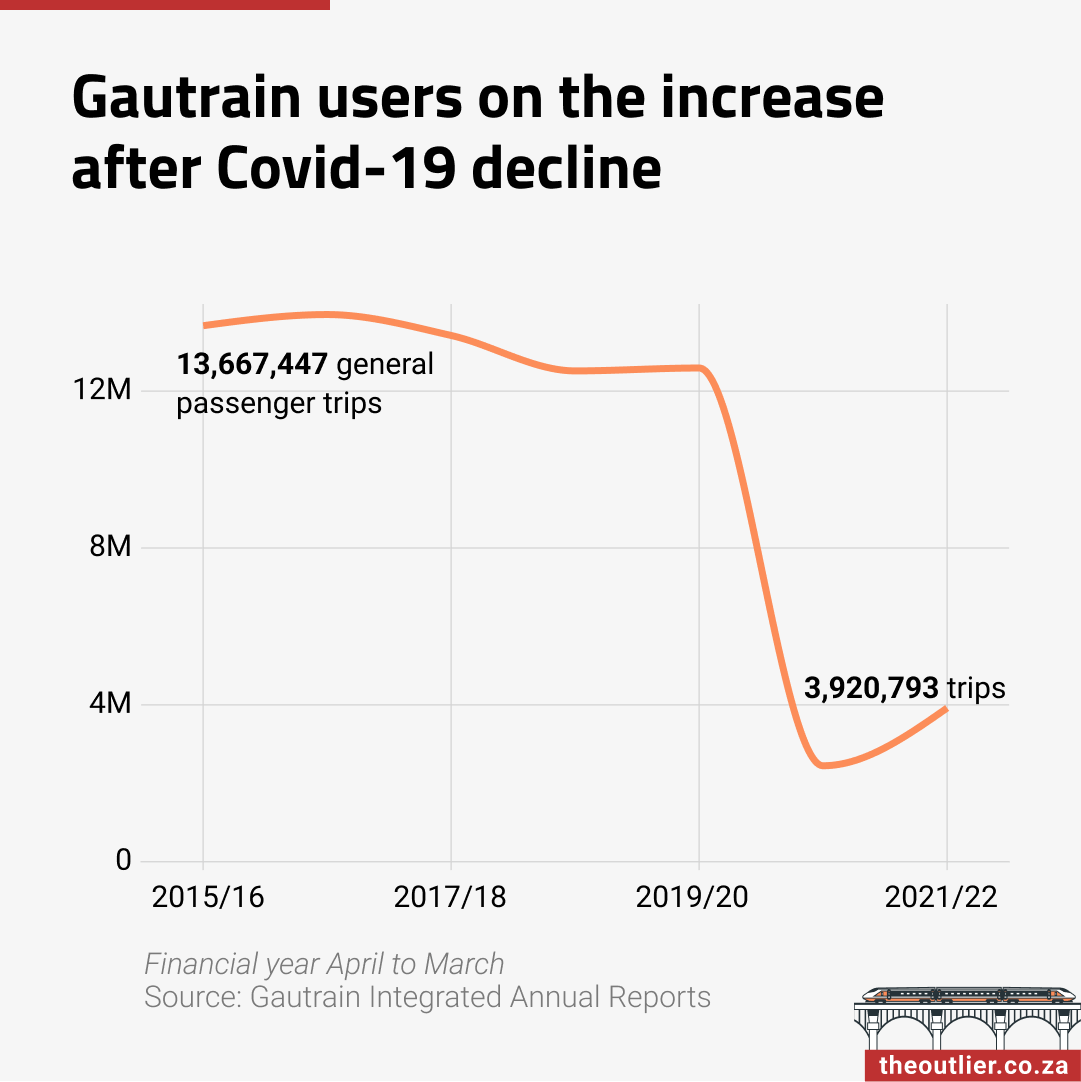

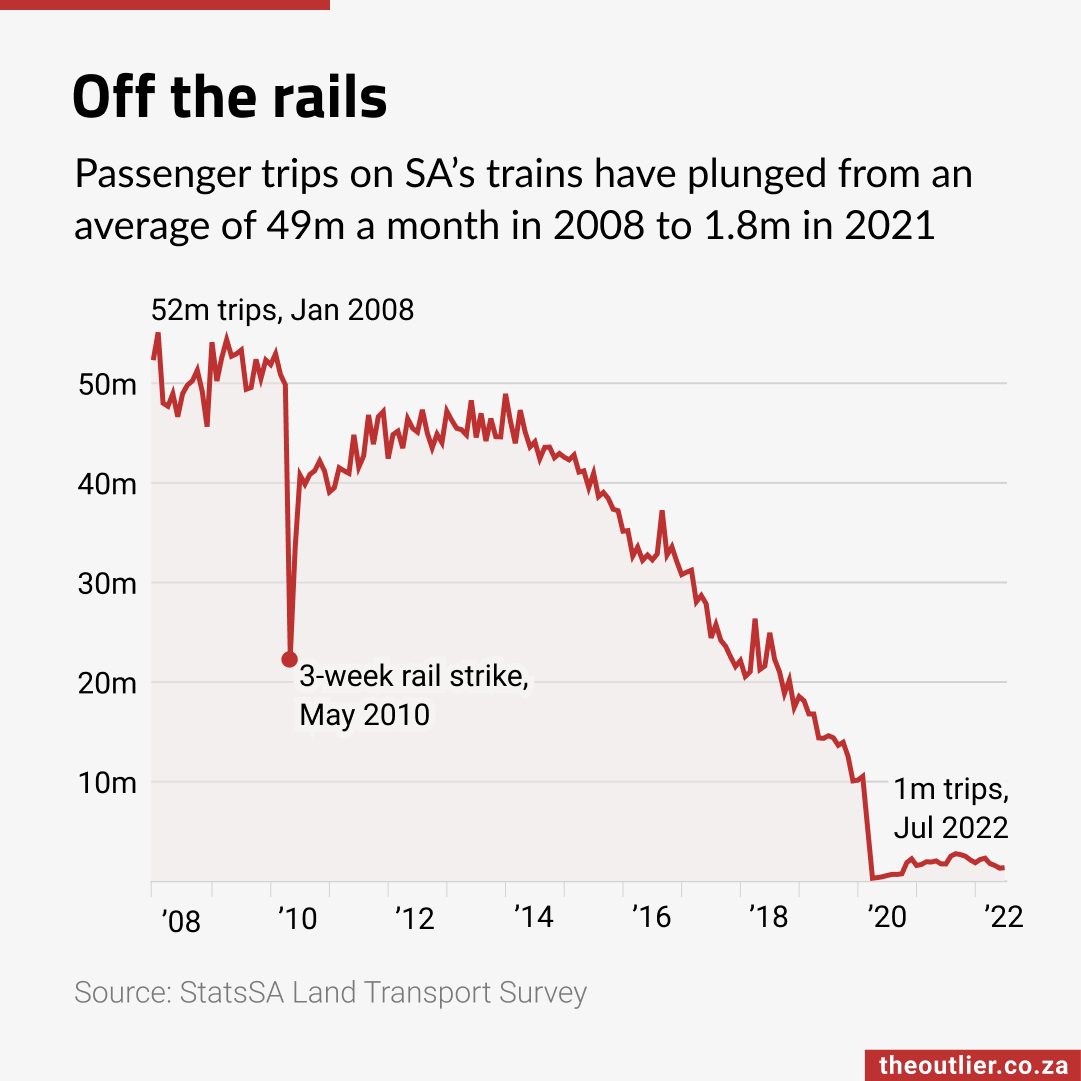

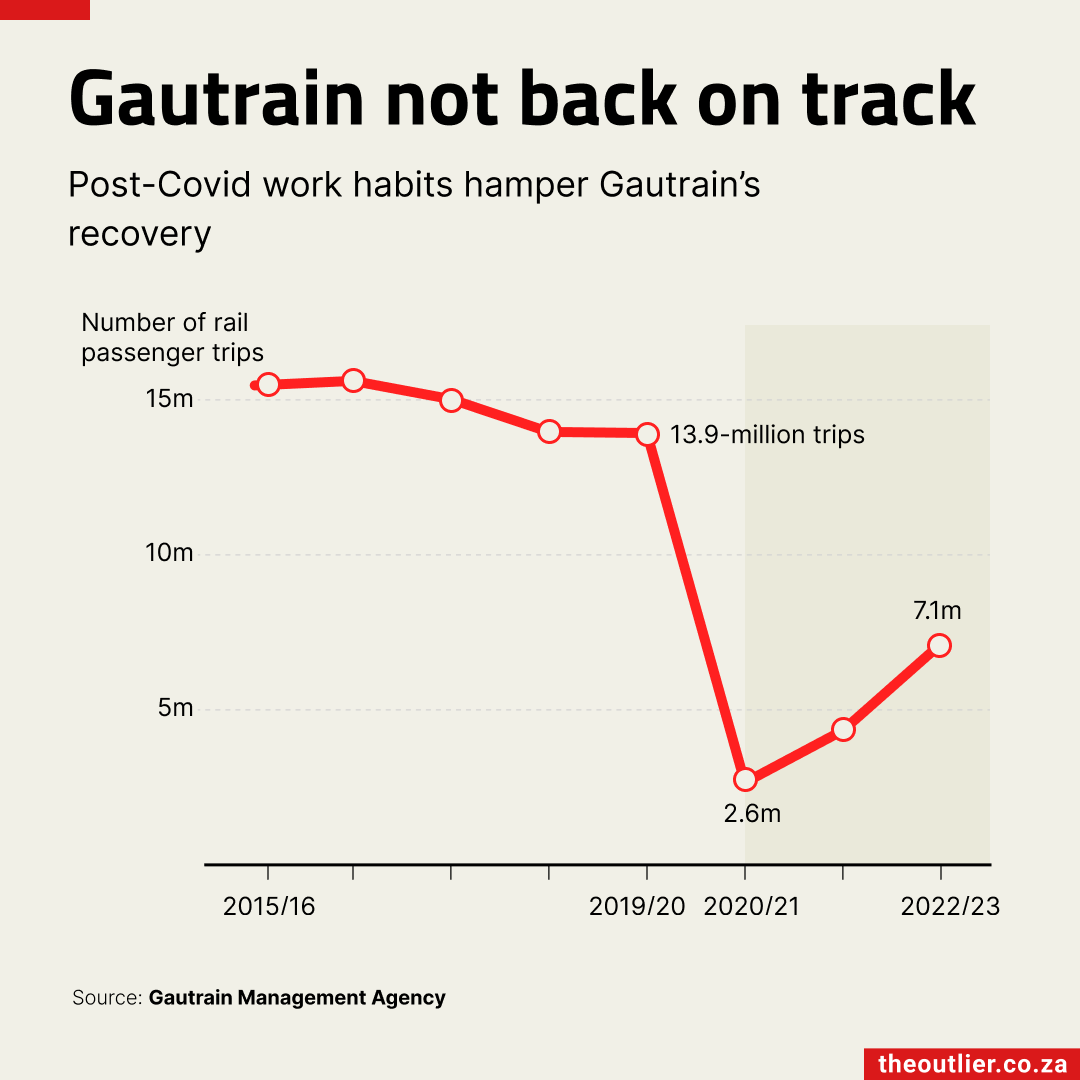

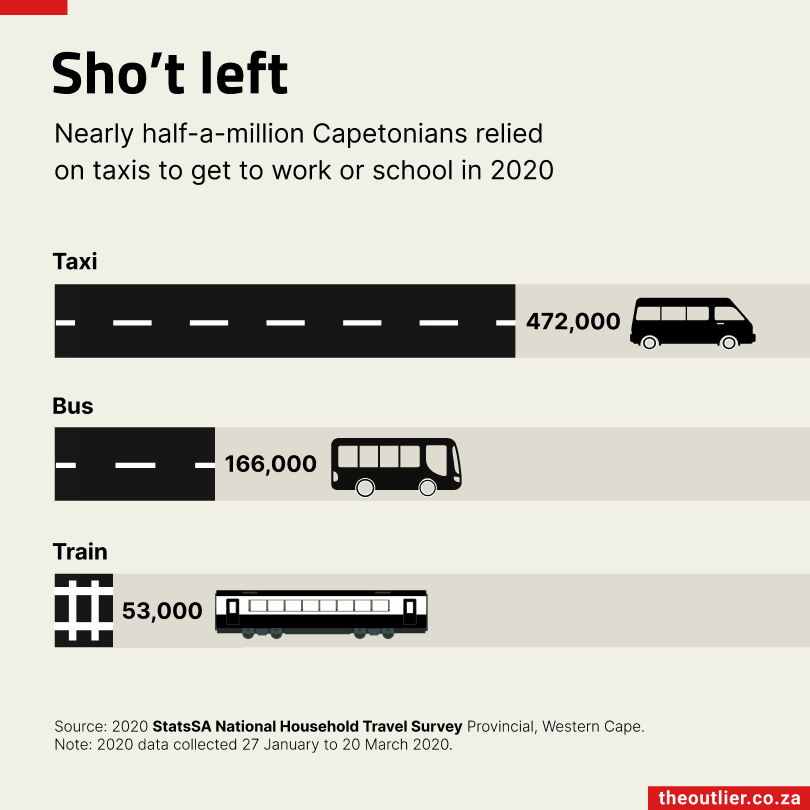

The number of people using South Africa’s trains is slowly recovering, driven by improvements in the commuter rail service network.

In March 2024, Statistics South Africa recorded 4.7-million train journeys. A year later, that figure had risen to 7.4-million. But this is still nowhere near the highs of 2009, when there was an average of 52-million journeys per month.

Over the past year, the Passenger Rail Agency of South Africa (PRASA) has significantly expanded the number of operational lines. By March 2025, 34 of PRASA’s 40 commuter service lines were running – up dramatically from just four in the aftermath of the Covid-19 pandemic.

Train services ground to a halt in late March 2020 during the country’s initial hard lockdown. Although operations resumed as restrictions eased, the recovery was hampered by widespread vandalism and theft at rail stations and along the tracks. The revival of the rail network is a critical step in restoring affordable public transport.

In 2024, over 695,000 Schengen visa applications from across Africa were denied, resulting in more than $70-million lost in non-refundable fees. West Africans bore the brunt of these visa rejections.

A Schengen visa, which allows short stays in 29 European countries, costs €90 (about R1,800) per application and is non-refundable, even if the visa is denied.

Nigeria was hit the hardest, with 45.3% of its 111,201 applications rejected. Only 58,808 were approved – meaning Nigerians lost over $5-million in fees for unsuccessful applications.

Other West African countries followed closely:

– Senegal: $3.3-million lost

– Côte d’Ivoire: $2.6-million

– Ghana: $2.5-million

In East Africa, 28.5% of Kenyan applications were rejected, resulting in $1.9-million in lost fees.

South Africans fared far better, with just 5.6% of 193,768 applications rejected. Still, that relatively low rate translated into more than $1-million in lost fees.

Africans lost over $70-million in rejected Schengen visa fees in 2024. Nigerians were hit hardest, with 45.3% of applications denied, followed closely by Ghanaian applicants at 44.5%.

A Schengen visa, which allows short stays in 29 European countries, costs €90 (around R1,800) and is non-refundable.

Data from the European Commission shows that there were 111,201 applications by Nigerians for Schengen visas in 2024, and only 58,808 of those were granted. That means that over $5-million was spent (and lost) by Nigerians whose visa applications were turned down.

South Africans fared much better, only 5.6% of the 193,768 applications were rejected. Still, that translates to over $1-million (or R19.7-million) in lost fees. People travelling from the United States and China had 4% and 4.5% of their Schengen visas rejected.

The average rejection rate for Schengen visas for all countries is 16.9% while the rejection rate for African applications is 27%.

Mozambique is South Africa’s largest African trade partner, with exports reaching nearly R120-billion in 2024. According to the South African Revenue Service, it ranks among the top five destinations for South African exports. Key goods include chromium ore (26%), ferroalloys (17%), iron ore (8.5%), coal (7%), electrical energy (5%), and cleaning products (2%), along with motor vehicles, corn, cereals, and soya beans.

Trade with Mozambique has grown significantly over the past 14 years, rising from just R13.8-billion in 2010 to nearly R120-billion in 2024. While Mozambique leads among African trade partners, it still lags behind global export destinations such as China (R220-billion), the United States (R157-billion) and Germany (R154-billion).

South Africa’s other major African trade partners are, unsurprisingly, its immediate neighbours: Botswana (R78.9-billion), Namibia (R70.4-billion), Zimbabwe (R69.2-billion), and Zambia (R55.6-billion).

On the import side, Nigeria is South Africa’s largest African source, with imports totalling R46.7-billion in 2024 – comprising almost exclusively crude petroleum, according to the Observatory of Economic Complexity.

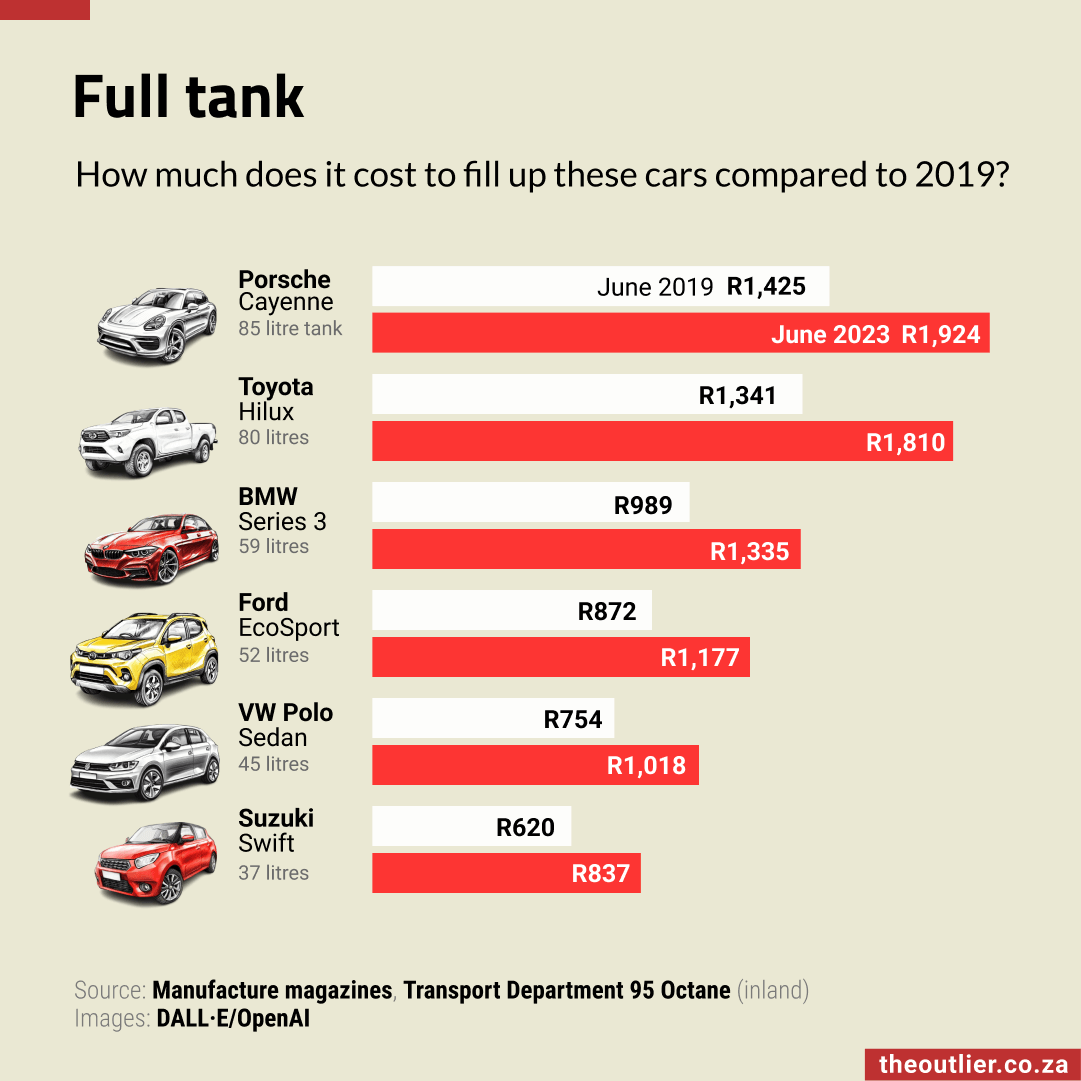

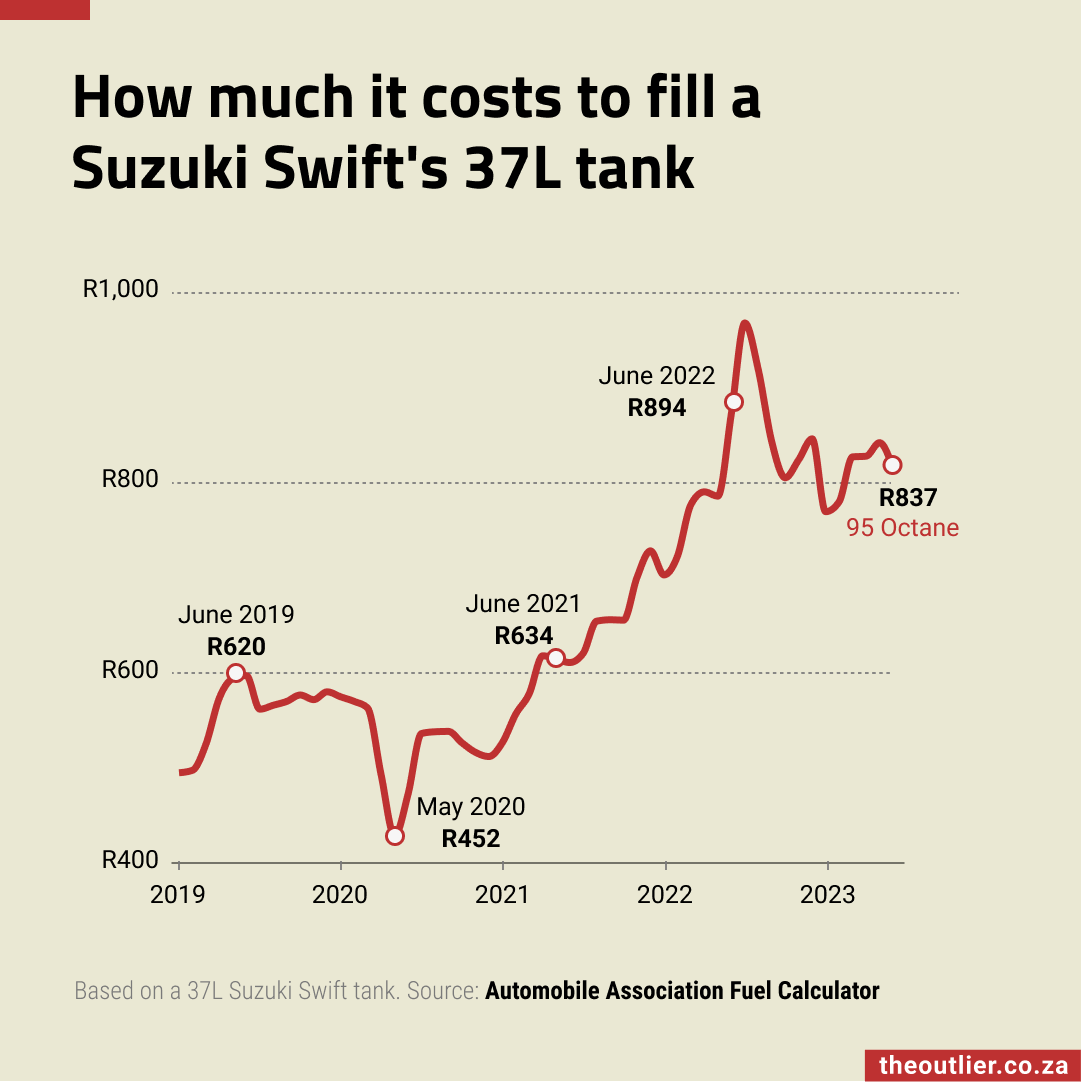

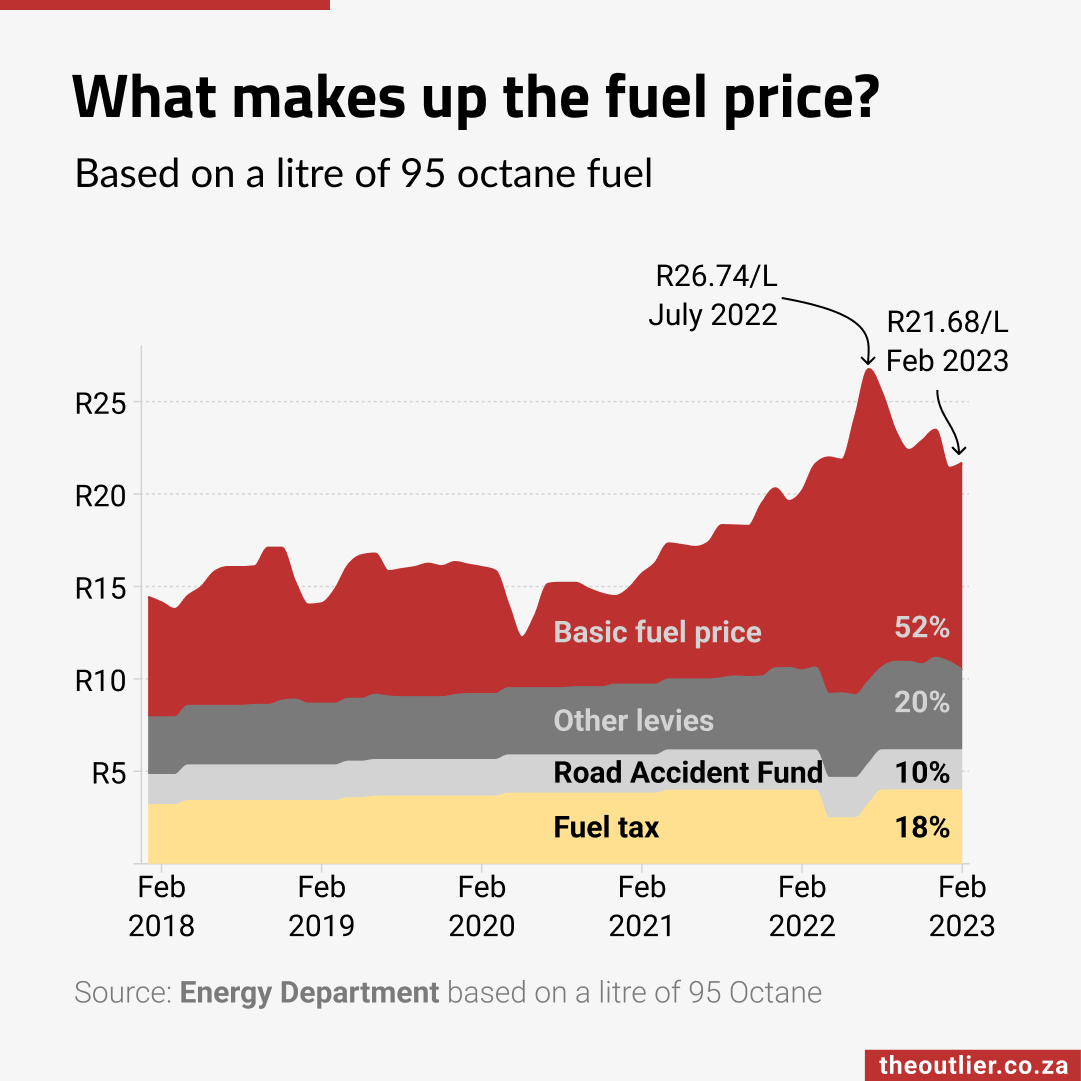

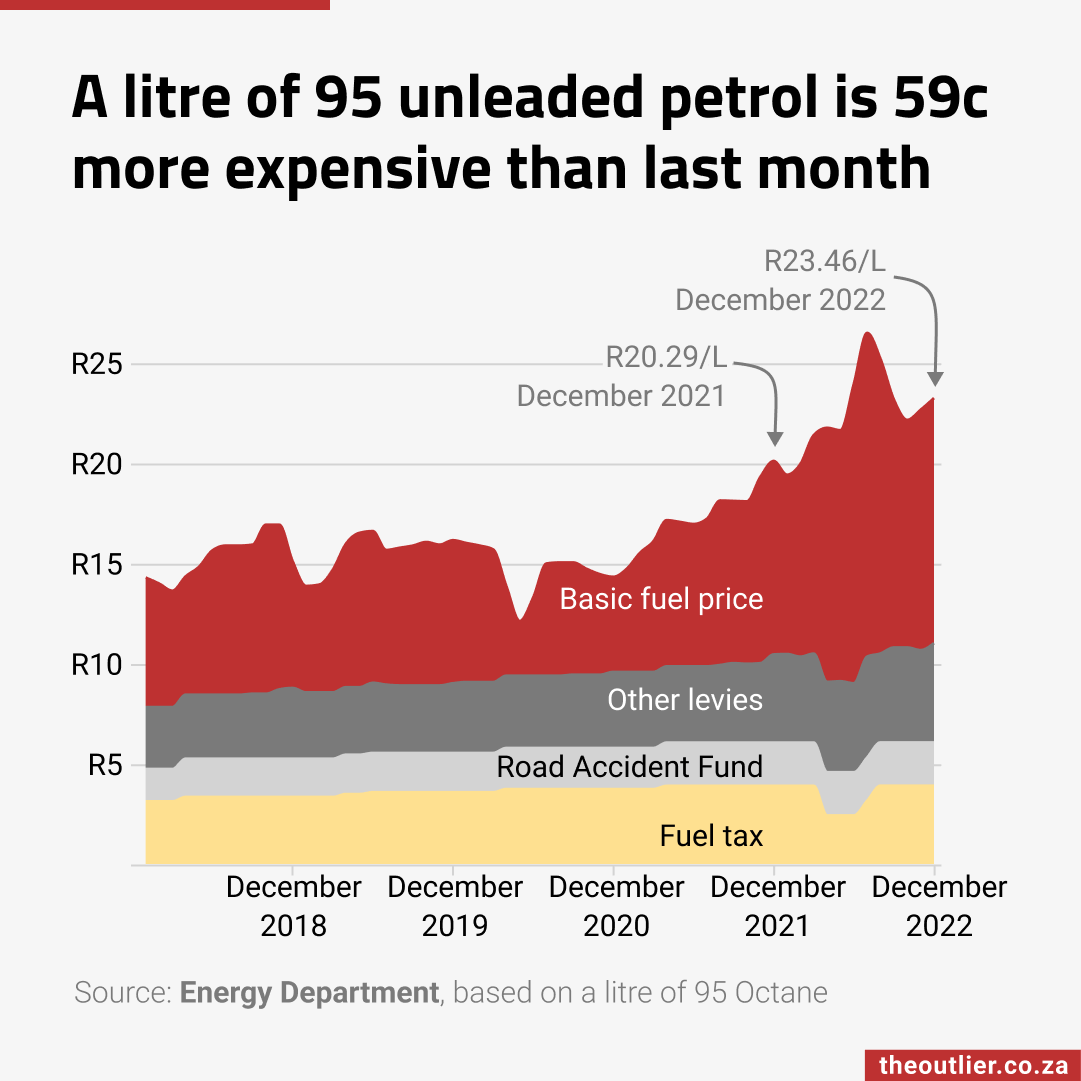

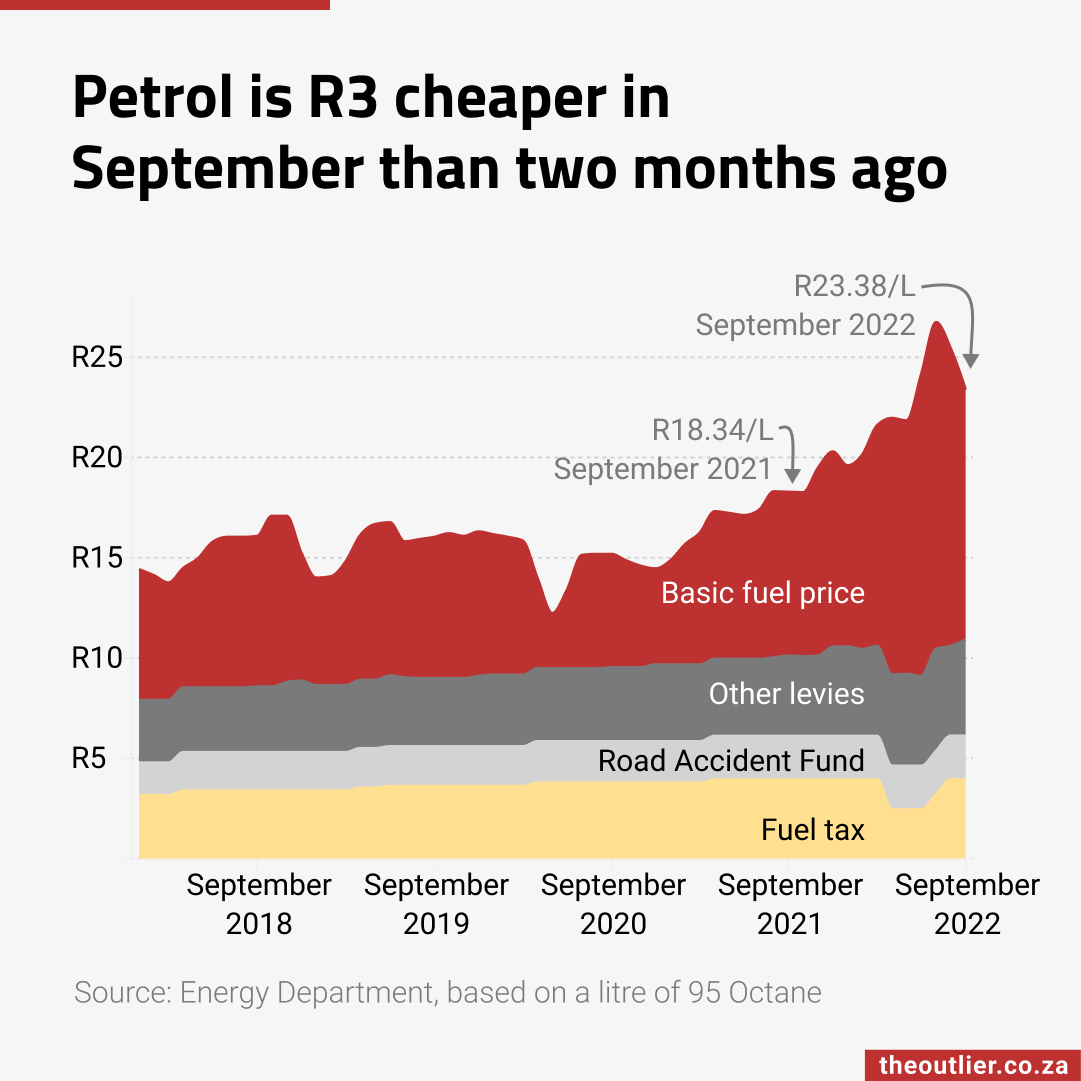

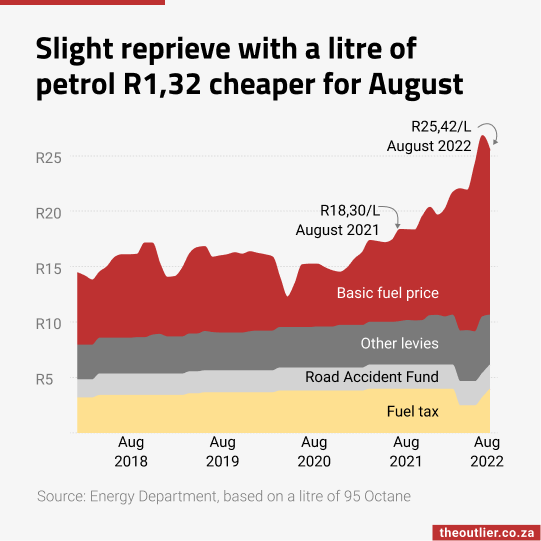

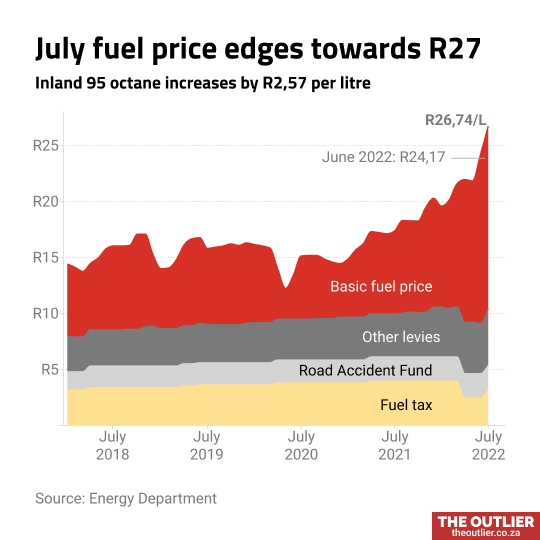

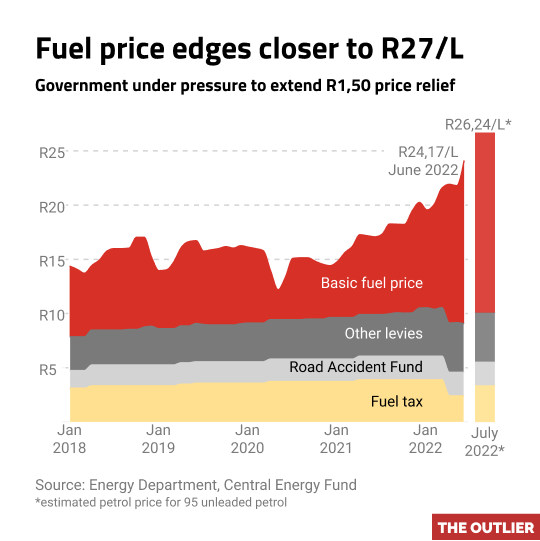

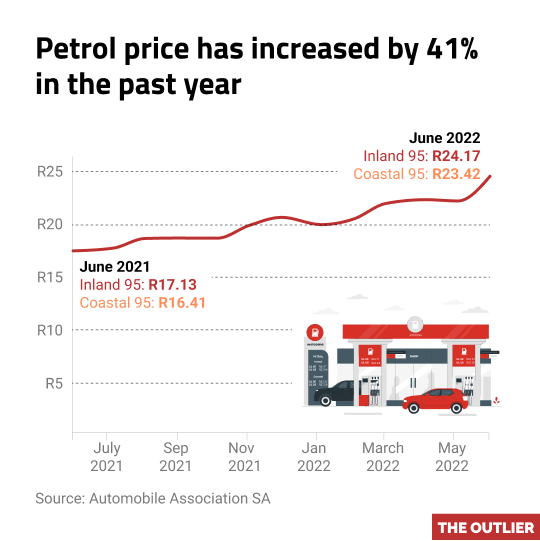

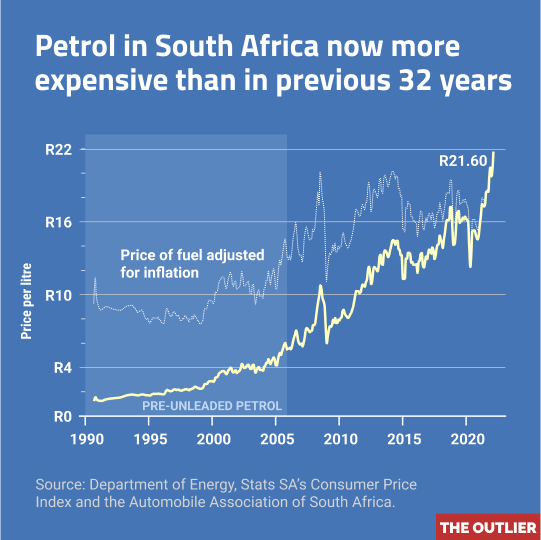

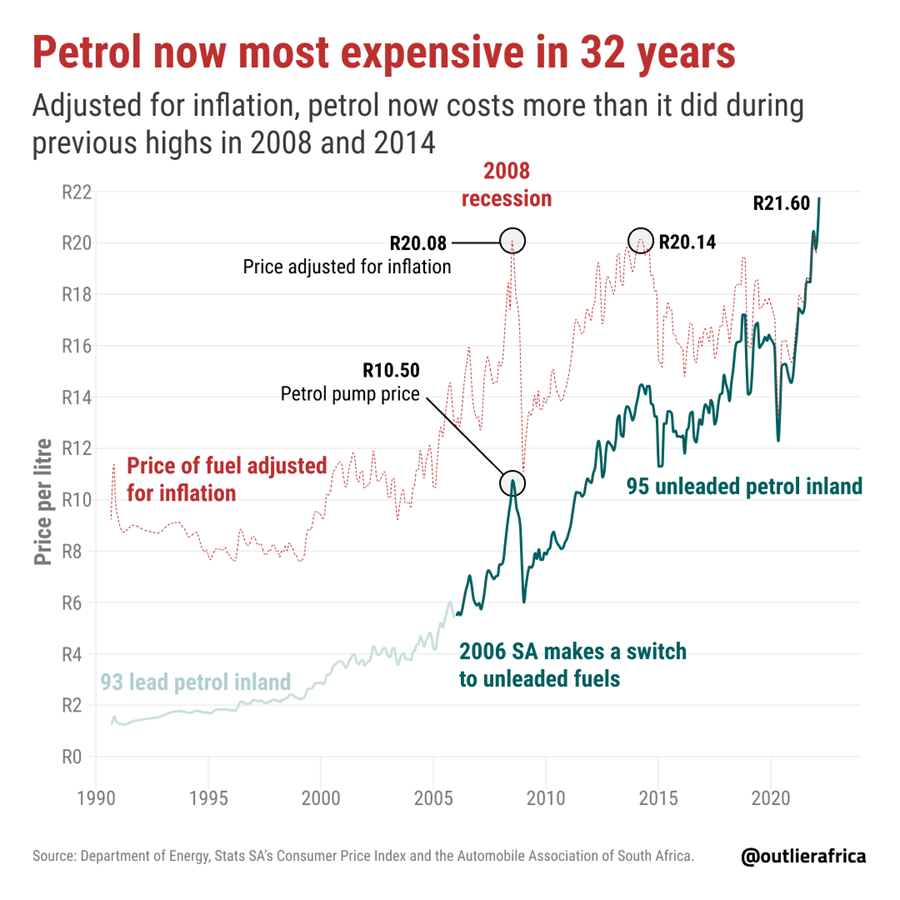

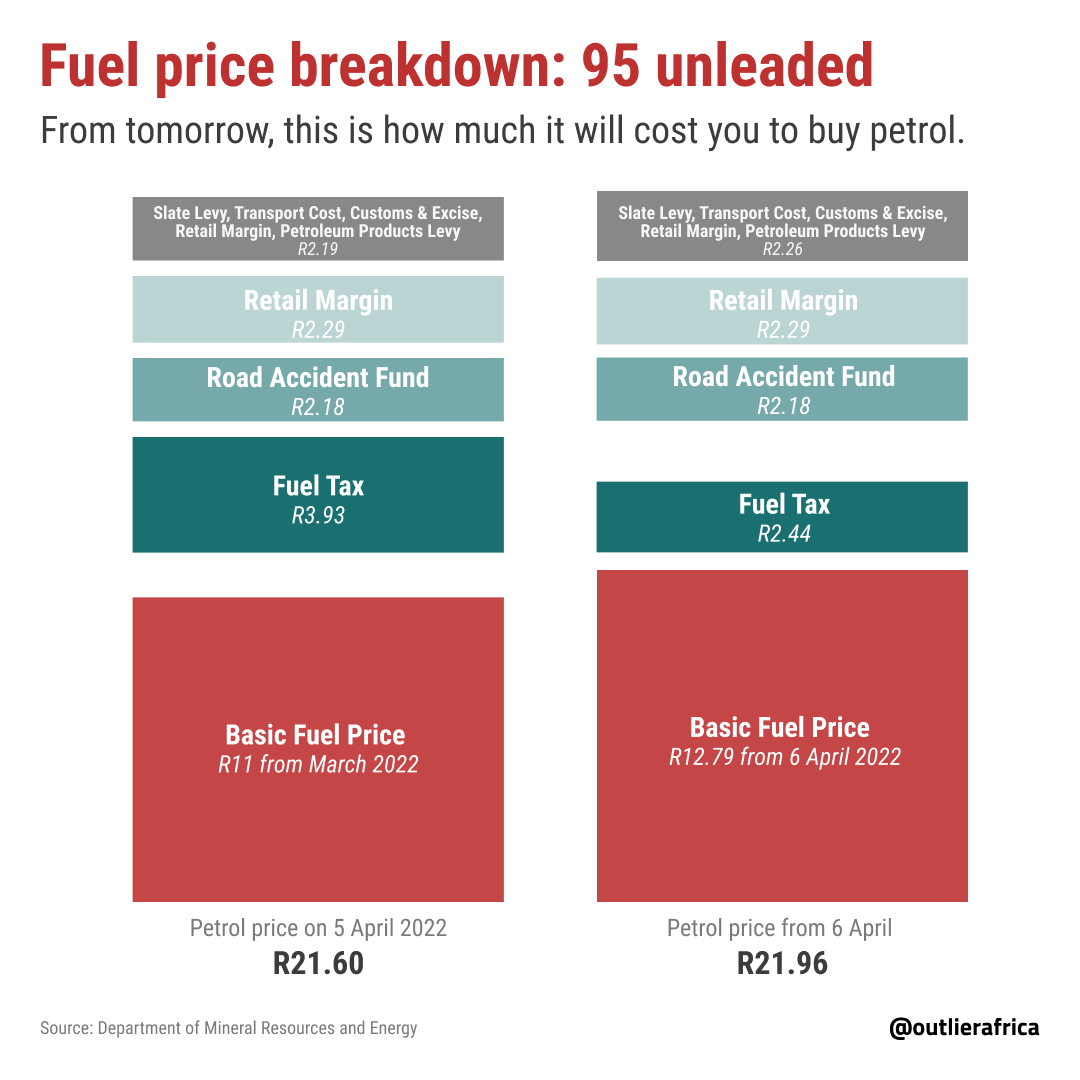

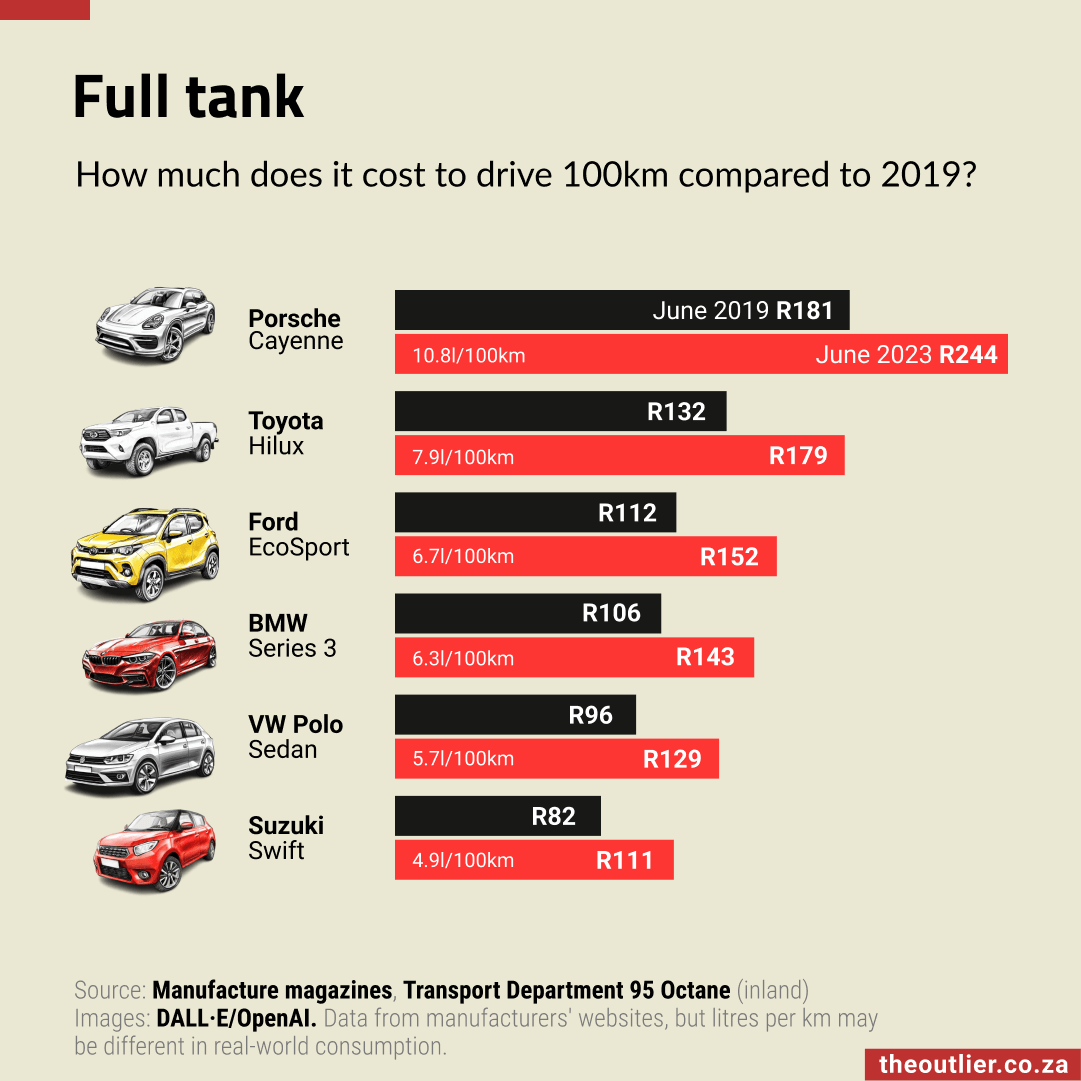

The petrol levy is now R4.01 per litre, its first increase since 2021/22, when it rose from R3.70 to R3.85. The fuel levy had remained unchanged for three years after it was last raised from R3.70 to R3.85 in the 2021/22 financial year. According to the May 2025 Treasury Budget Overview, the freeze was intended “to provide consumers with relief from high fuel price inflation.”

The latest hike – 16c for petrol and 15c for diesel – may seem minor to some, but it hits poorer communities hardest.

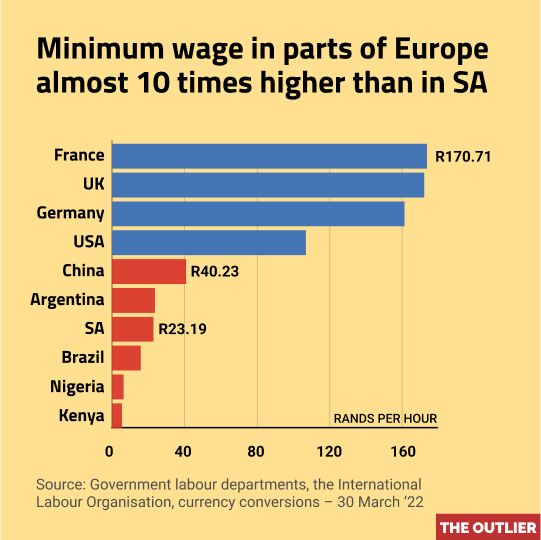

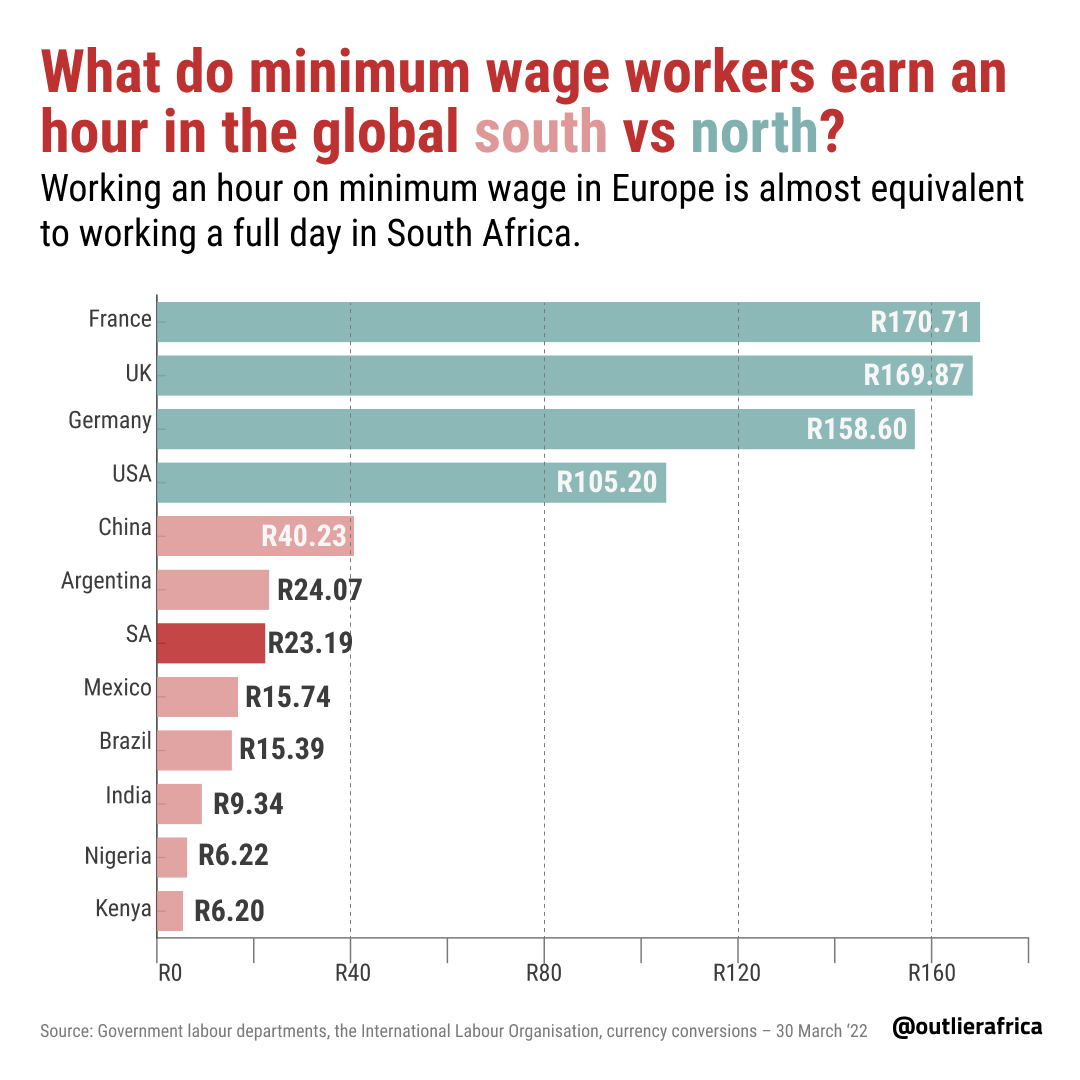

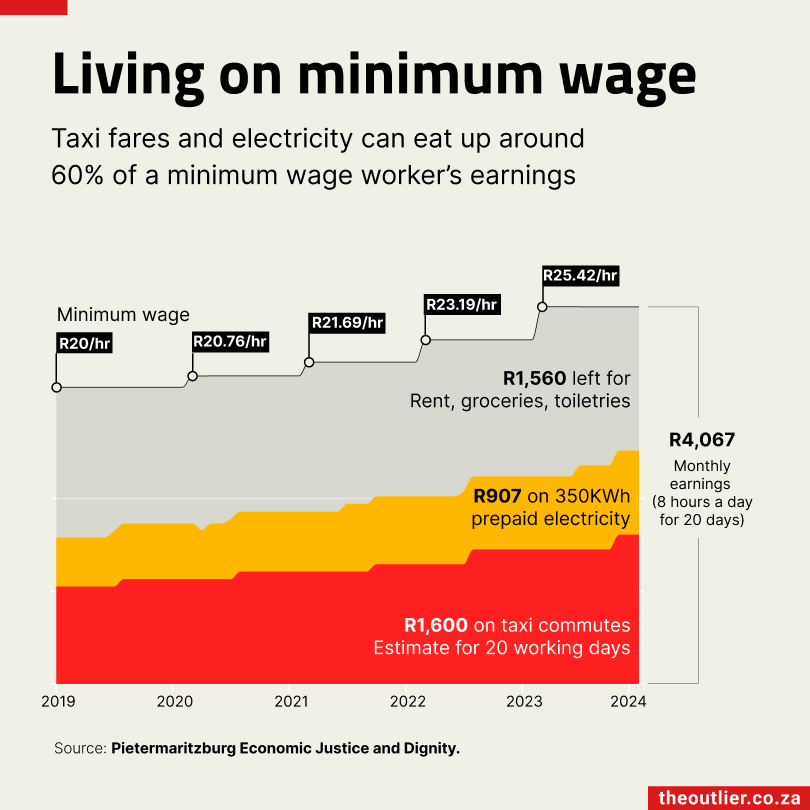

When fuel prices rise, so do transport costs. According to the Pietermaritzburg Economic Justice & Dignity Group, a person earning minimum wage and taking two taxis to and from work can spend more than a third of their monthly income on transport.

Higher fuel costs also push up the price of goods and services across the economy, meaning the impact goes far beyond the pump.

The only silver lining? Despite the levy and carbon tax increases, June’s petrol price decreased – thanks to a lower basic fuel price.

The fuel levy hike is expected to bring in R23-billion by 2028, following increases of 16c for petrol and 15c for diesel. This comes after Treasury opted not to raise value-added tax to 15.5%. In his May 2025 budget speech, Finance Minister Enoch Godongwana said the levy hike was the only new tax proposal being introduced.

The fuel levy had remained unchanged since the 2021/22 financial year when it rose from R3.70 to R3.85. Treasury said the pause was intended to ease pressure from high fuel price inflation.

But the latest increase hits low-income South Africans hardest. Rising fuel prices drive up transport costs – a major expense for the working class. According to the Pietermaritzburg Economic Justice & Dignity Group, someone earning minimum wage and taking two taxis to and from work can spend more than a third of their income on transport alone.

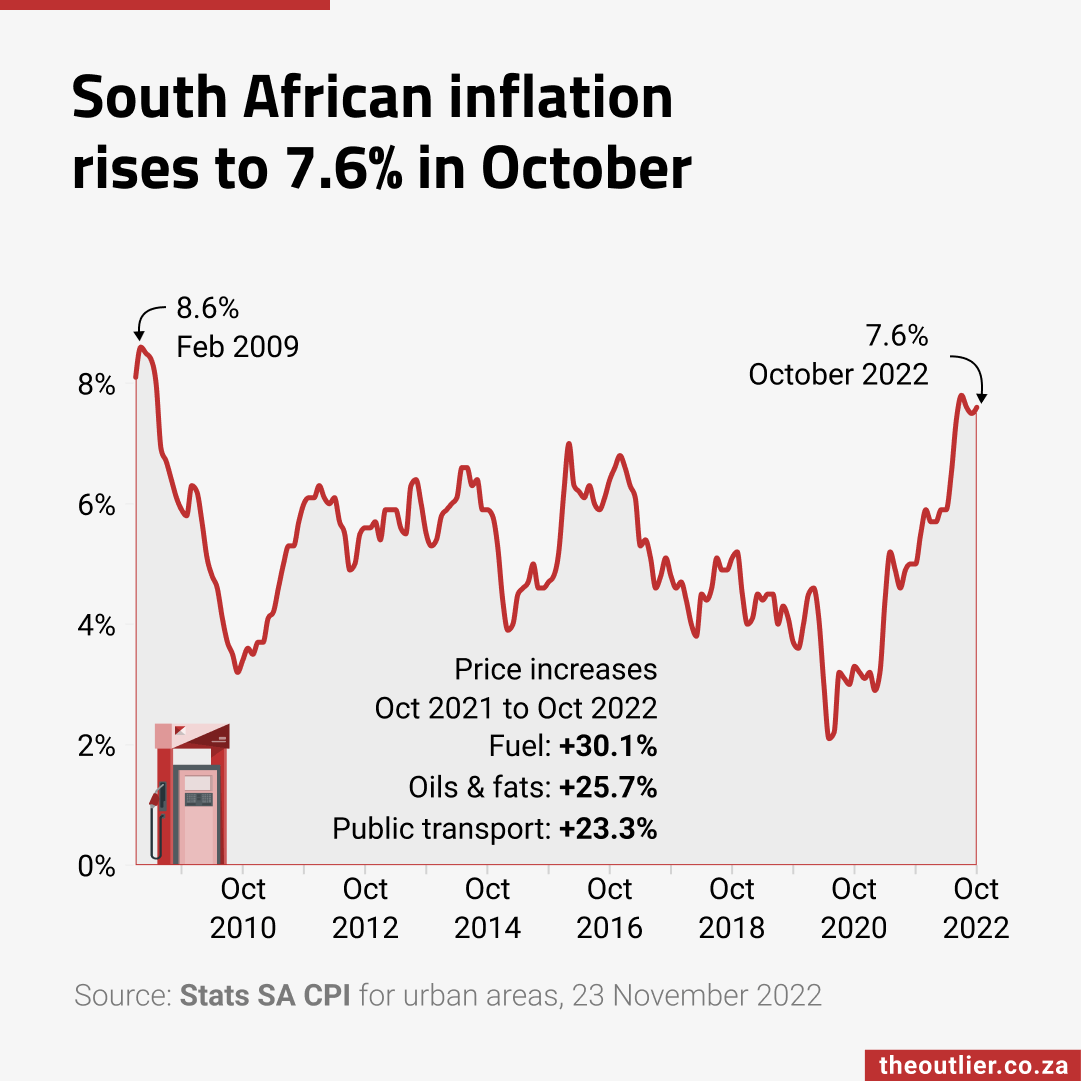

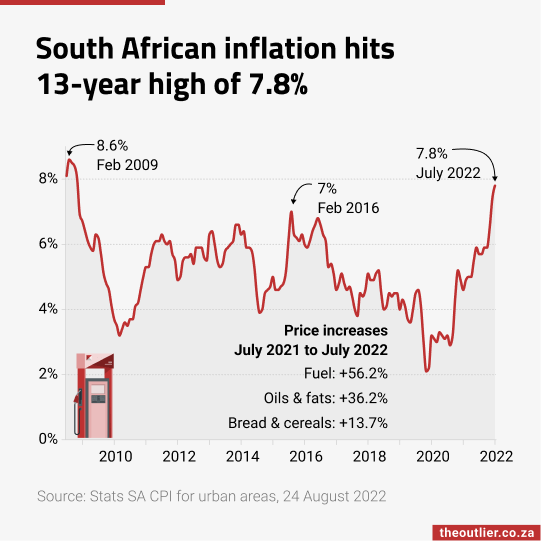

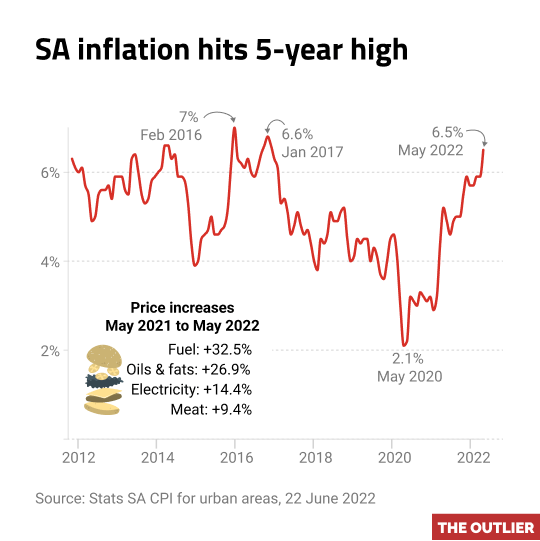

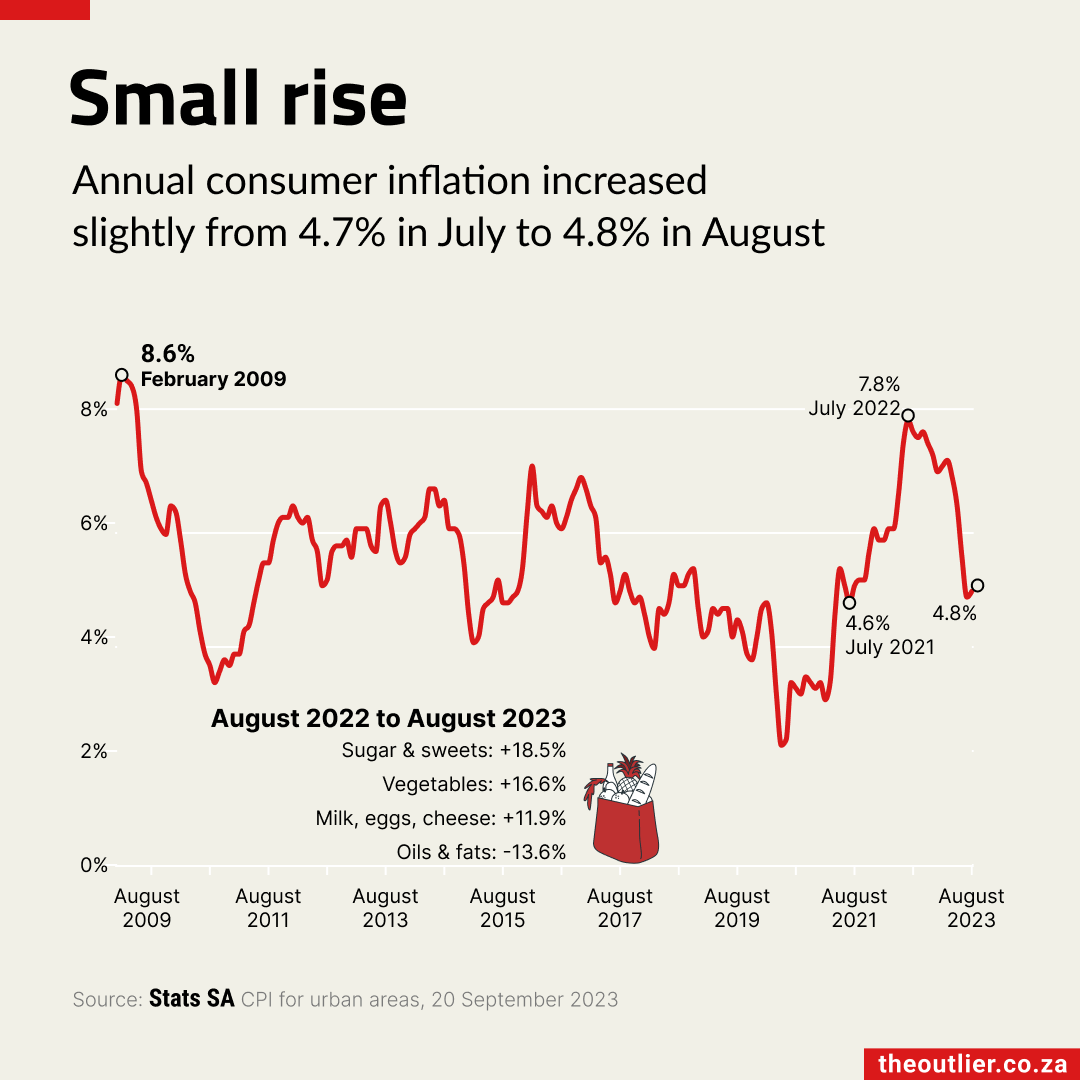

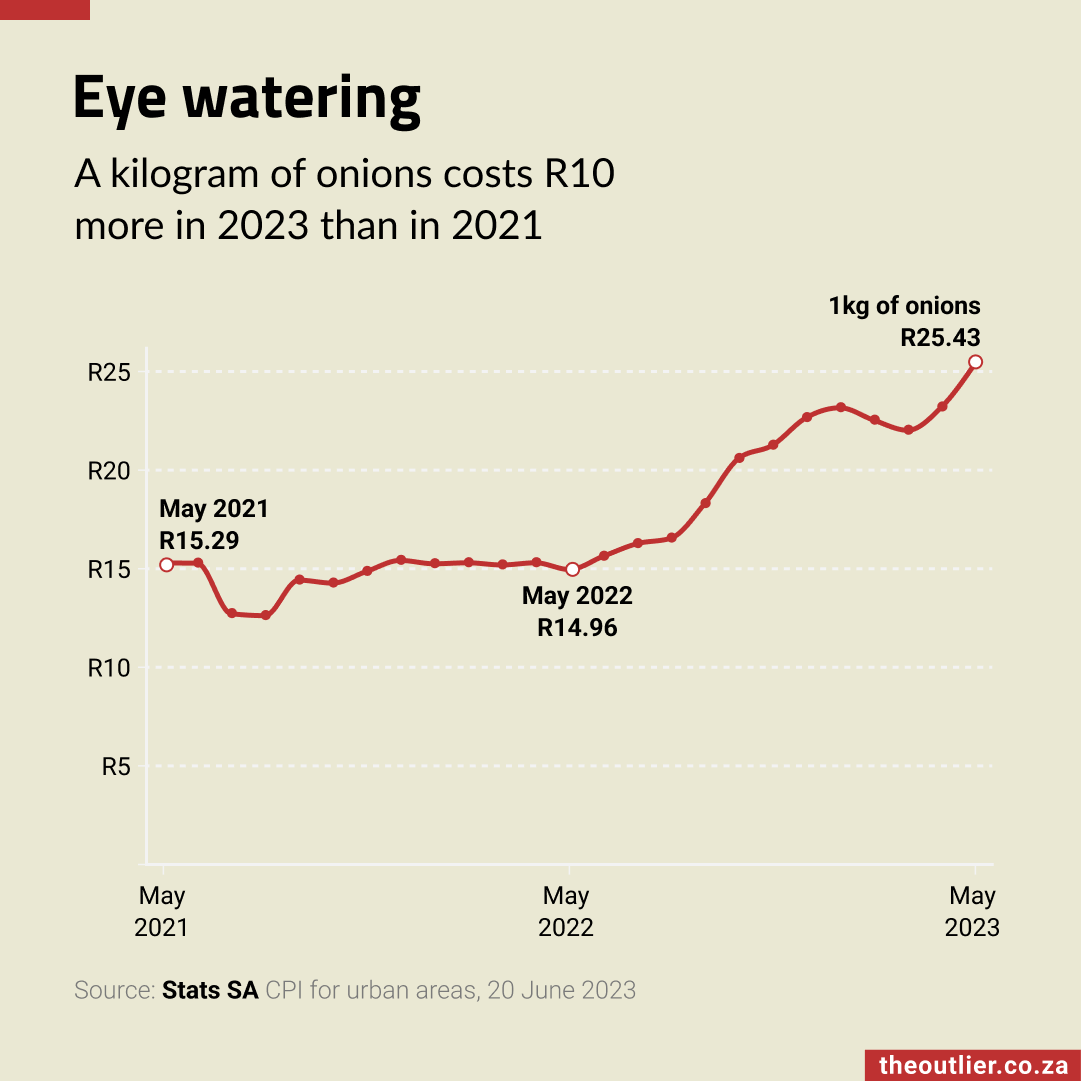

South Africa’s consumer price index (CPI) rose slightly from 2.7% in March to 2.8% in April 2025. The main contributors to the uptick were housing and utilities, food, beverages, tobacco, and restaurant and accommodation services.

The rise in food prices was “mainly due to higher meat prices, particularly for beef products such as stewing beef, mince, and steak,” according to Statistics South Africa.

Over the past year, the prices of several everyday items have increased significantly. A kilogram of apples is up 22.4%, rising from R22.46 in April 2024 to R27.48 in April 2025. Instant coffee increased by almost 18%, from R61.99 for 250g to R73.09. Other hot beverages also saw price hikes: Ceylon tea rose by 13.6%, while rooibos tea was up 6.9%.

Not all prices rose, however. A six-pack of eggs, for example, is now 5.3% cheaper than a year ago, down from R25.25 to R23.92.

The United States is South Africa’s second-largest export market, after China. In 2024, South Africa exported goods worth R157-billion to the US, compared to R220-billion to China. Germany, the third-largest export destination (R154-billion), is steadily closing the gap with the US.

In 2021, South Africa exported a record R193-billion in goods to the US, driven by a surge in platinum group metal prices. Nearly half of South Africa’s exports to the US are precious metals and stones. South Africa’s trade delegation is lobbying the US for more favourable terms ahead of a July deadline when a 90-day freeze on the proposed 31% tariff is set to expire. However, according to Minister of Trade, Industry and Competition Parks Tau, some critical minerals have been exempted from tariffs. The existing 10% tariff applies to vehicles, machinery, and agricultural products.

Precious metals and stones are South Africa’s largest exports to the US, making up nearly half of total exports. Notably, platinum group metals – platinum, palladium, rhodium, ruthenium, iridium, and osmium – account for 25% of exports. In the chart above, these are broken down into smaller subcategories. Vehicles make up 13% of exports, with petrol and diesel cars contributing 10%. Base metals follow at 12%, then chemicals (7%), agriculture (6%), and machinery (3%). Among agricultural exports, citrus fruits are the biggest agricultural exports to the US.

South Africa’s trade delegation is lobbying the US for more favourable terms ahead of a July deadline when a 90-day freeze on the proposed 31% tariff is set to expire. However, according to Minister of Trade, Industry and Competition Parks Tau, some critical minerals have been exempted from these tariffs. The existing 10% tariff applies to vehicles, machinery, and agricultural products.

The data used in this chart can be downloaded from Atlas of Economic Complexity, Harvard Growth Lab.

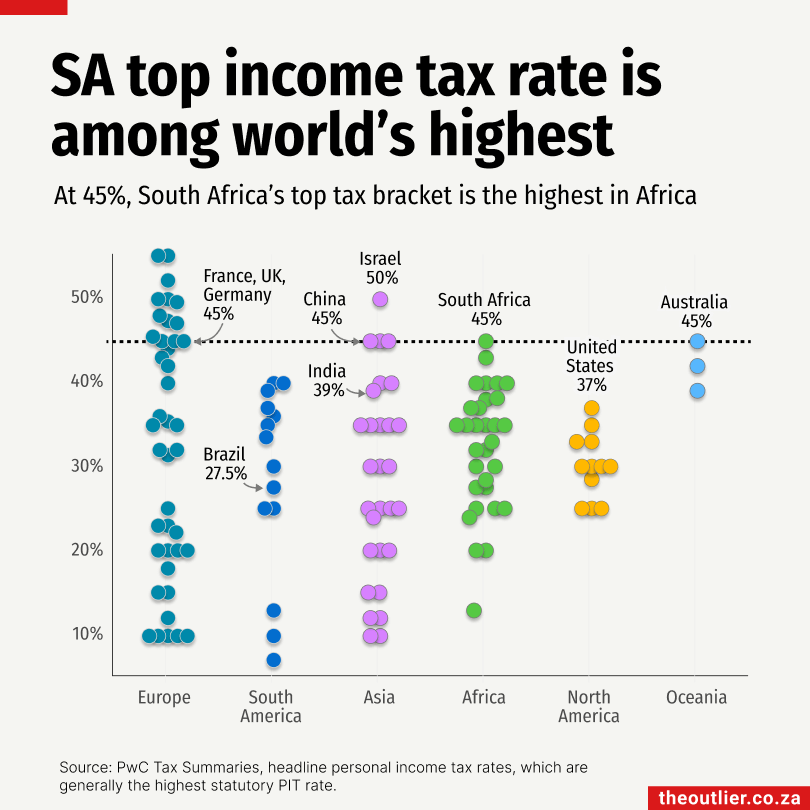

Finance Minister Enoch Godongwana avoided raising the personal income tax rate in his 2025 budget. Personal income tax collections as a percentage of gross domestic product are already higher than most developing countries, he said.

A comparison of the top income tax brackets across 132 countries, shown in the chart, shows that South Africa’s top rate of 45% ranks among the highest in the world. It’s the highest of the African countries, listed by PwC in its tax summaries.

The government introduced the 45% tax bracket in the 2017/18 financial year for individuals with an income of R1.5-million or more. That has since increased to R1.8-million or more.

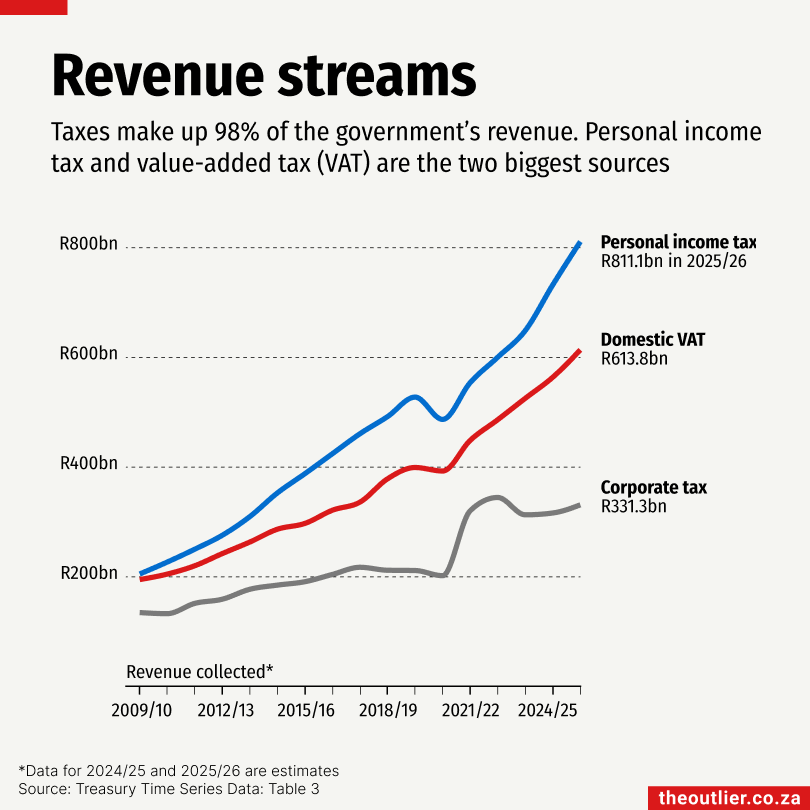

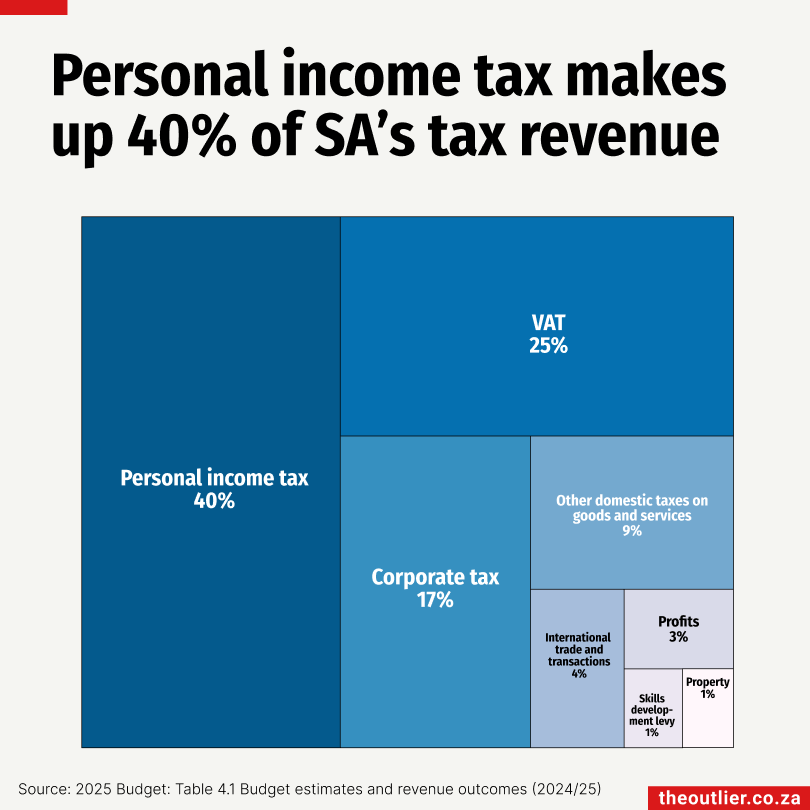

Ninety-eight percent of South Africa’s revenue comes from taxes, with personal income tax accounting for 40% of the total tax collected.

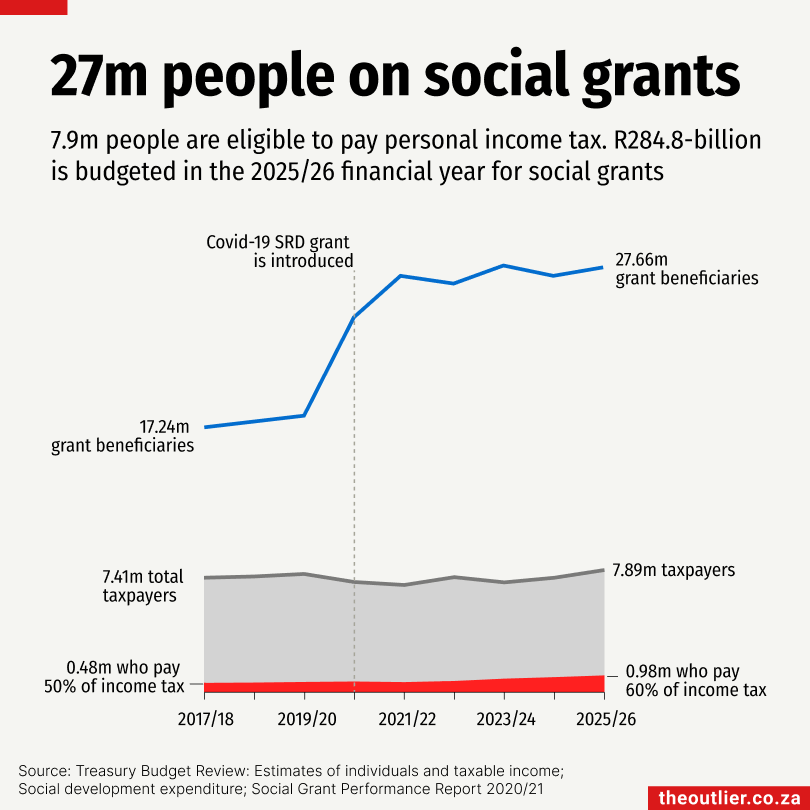

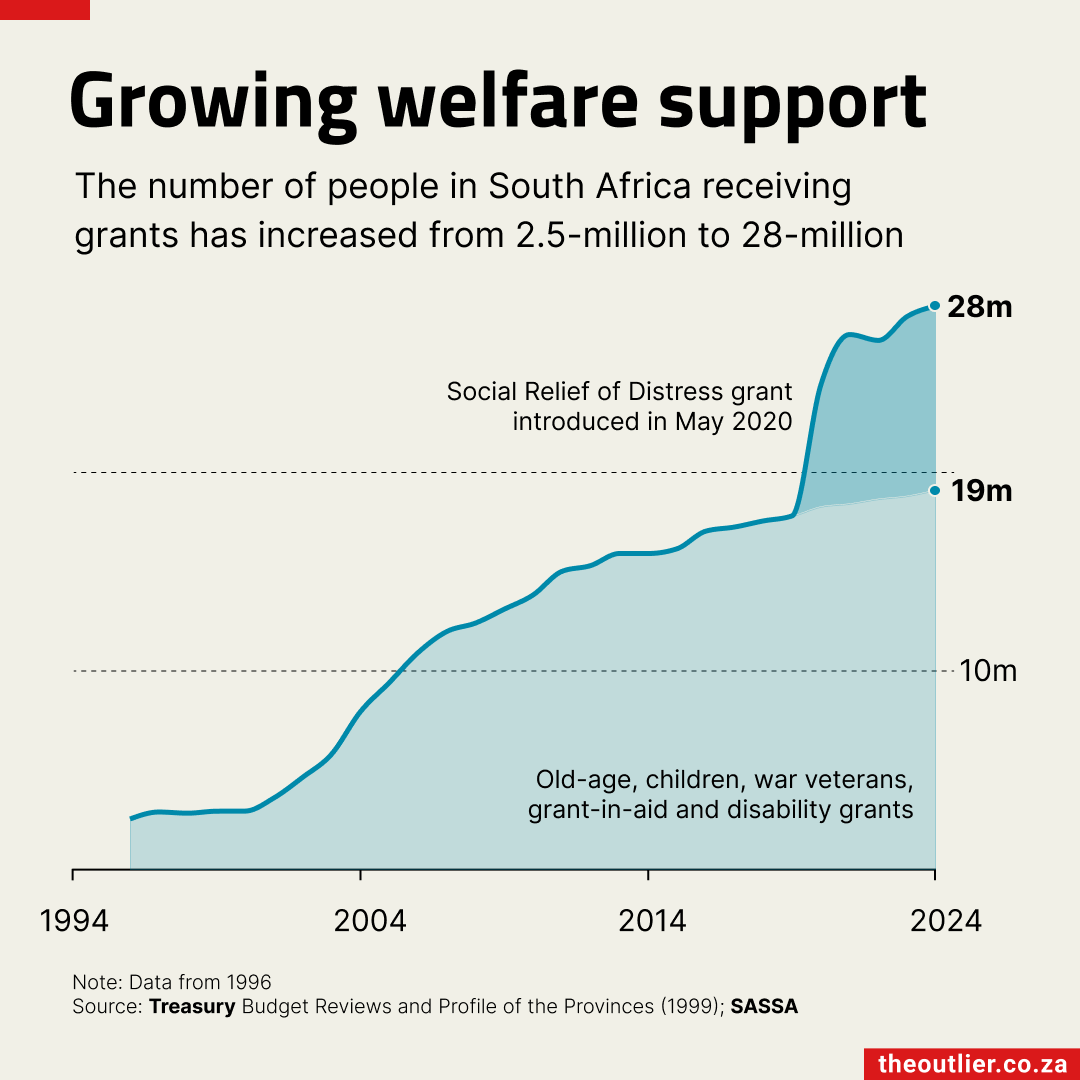

At the end of December 2024, 26-million people received social grants from the South African government, according to the South African Social Security Agency.

Half of them — 13.5-million — were for child support, care dependency and foster care. Another 4.1-million went to pensioners, and 6.9-million were Covid-19 Social Relief of Distress (SRD) grants, which were introduced during the pandemic.

The Treasury estimates there will be 27.7-million grant beneficiaries in the 2025/26 financial year.

Over the past eight years the number of social grant beneficiaries has increased by 60%, largely driven by the Covid-19 SRD grant. The increase in the 2020/21 financial year can be seen in the chart.

Finance Minister Enoch Godongwana said the SRD grant will continue, as it ‘serves as a basis for the introduction of a sustainable form of income support for unemployed people’.

Ninety-eight percent of the government’s revenue comes from taxes, with personal income tax contributing 40% of that.

The number of people eligible to pay tax has remained relatively stable at around 7-million over the eight-year period.

There are now roughly four grant beneficiaries for every taxpayer.

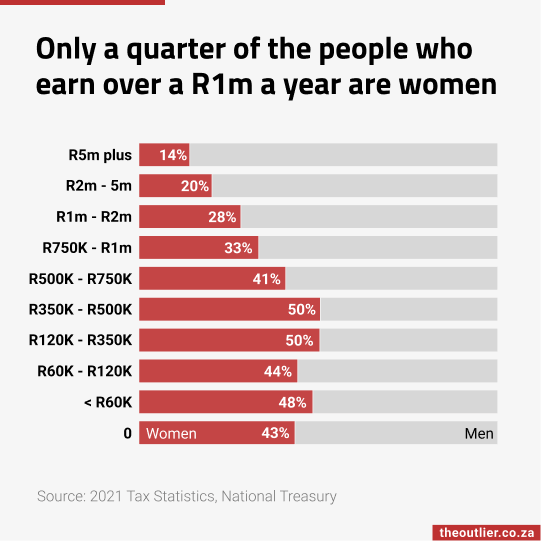

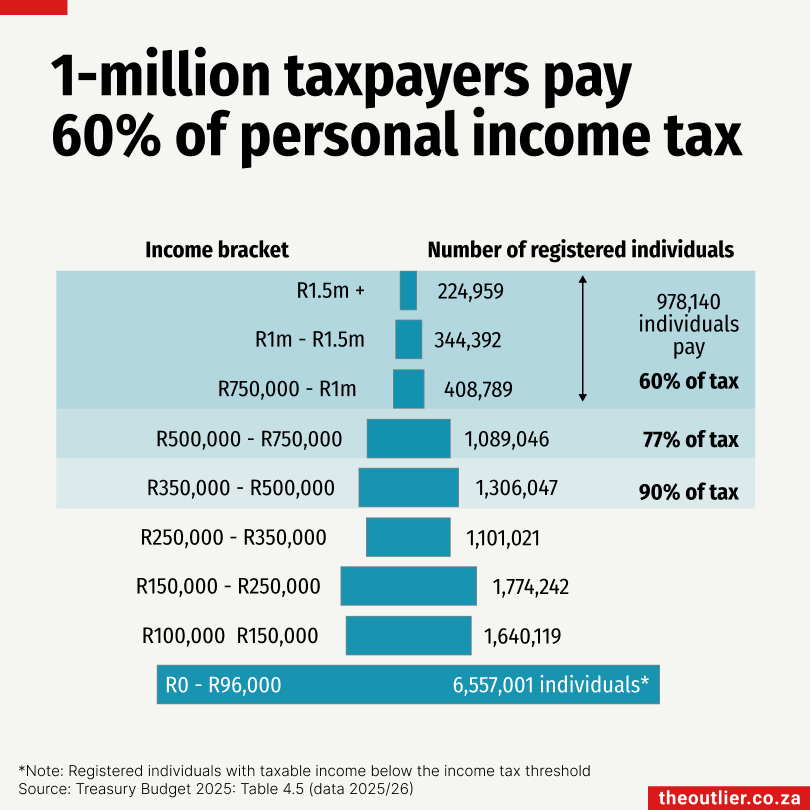

There are 14.45-million registered taxpayers in South Africa. They are divided into nine income categories by the National Treasury.

Only 7.89-million of those registered have income high enough to be eligible to pay personal income tax – on the chart that’s everyone except those in the lowest income category of R0 – R96,000.

The taxpayers in the top three income brackets – which is fewer than 1-million people – contribute 60% of the total personal income tax revenue collected by the government. Those are people with income of R750,000 and above. Among them are 224,959 individuals with incomes of R1.5-million or more, who account for nearly 33% of the personal income tax revenue collected.

Overall, 98% of South Africa’s revenue comes from taxes, with personal income tax contributing 40%.

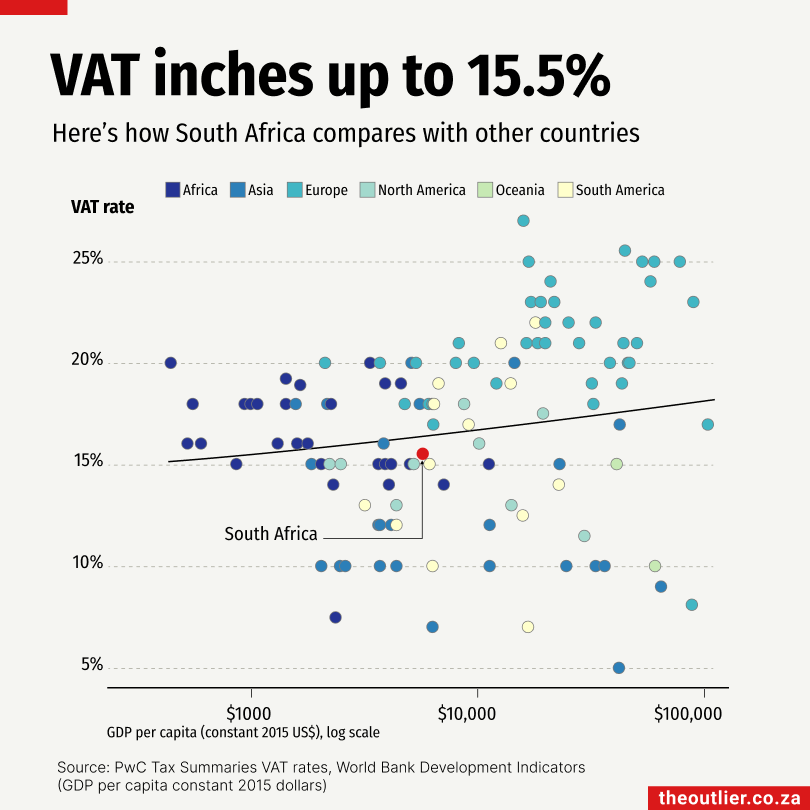

In his 2025 budget, South Africa’s Finance Minister Enoch Godongwana increased the value-added tax rate by 1 percentage point, split over two years, despite widespread criticism that a VAT hike will be hard on poor people.

The minister had little room to manoeuvre with this year’s budget. Corporate tax collections have decreased over the past few years, which he blamed on falling profits and ‘a trading environment worsened by logistics constraints and rising electricity costs’.

South Africa’s top personal income tax rate is already high. ‘Our personal income tax collections as a percentage of gross domestic product (GDP) are far higher than those of most developing countries,’ he said.

The government expects to collect an estimated R811.1-billion in personal income tax revenue and R613.8-billion from domestic VAT in the 2025/26 financial year, according to the Treasury. This is a significant chunk of its total revenue.

Ninety-eight percent of the government’s revenue is from taxes. Personal income tax contributes 40%, VAT accounts for 25%, and corporate income tax 17%.

Almost all of South Africa’s revenue — 98% — comes from taxes. Personal income tax contributes 40%, followed by value-added tax (VAT) at 25% and corporate income tax at 17%.

In his 2025 budget, Finance Minister Enoch Godongwana announced an unpopular increase in the VAT rate. He had to adjust it down from an initial 2 percentage point rise – which would have raised VAT from 15% to 17% – to a compromise 1 percentage point, split over two years.

‘Increasing corporate or personal income tax rates would generate less revenue, while potentially harming investment, job creation and economic growth,’ he explained.

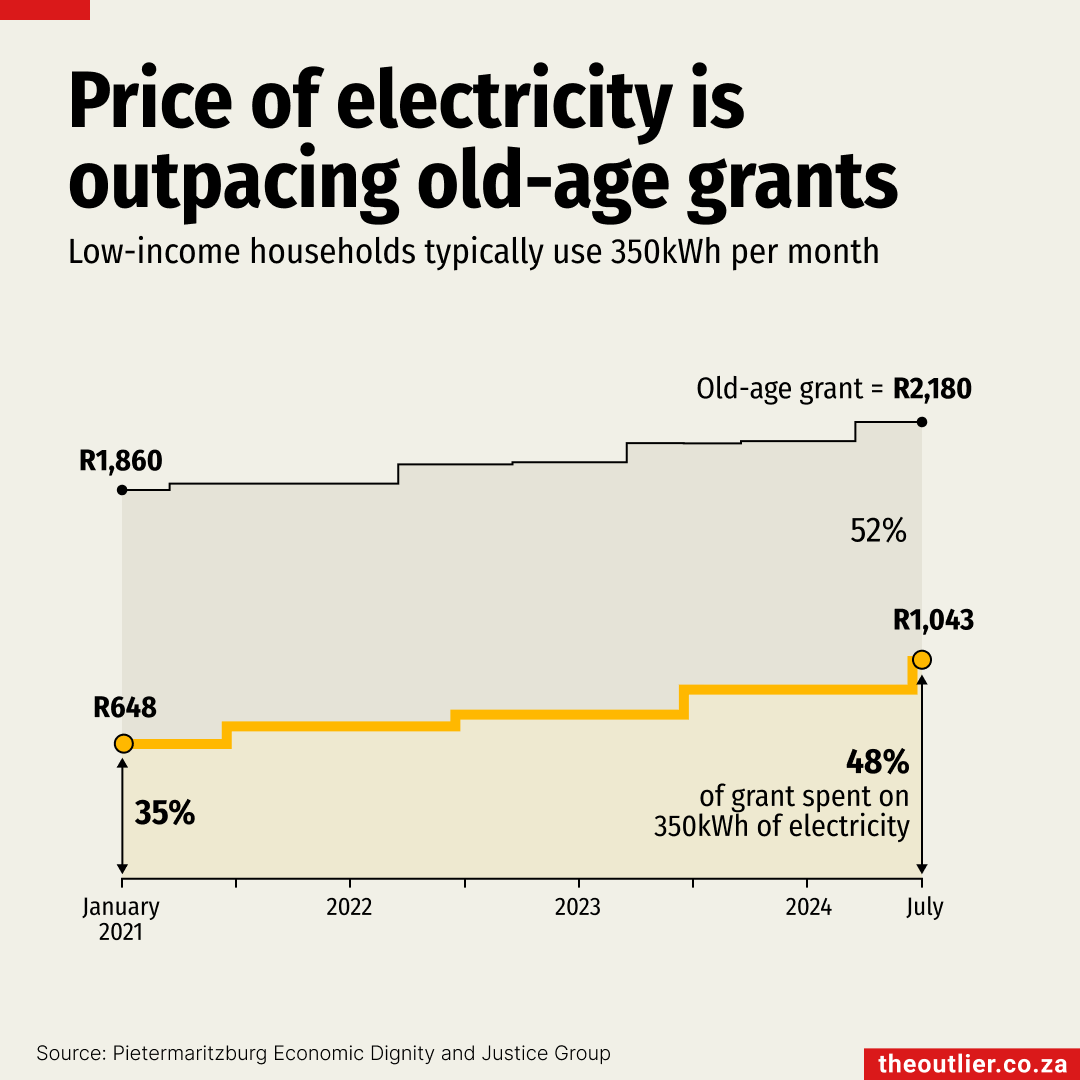

VAT is seen as a tax on the poor. ‘Dropping the proposed VAT-rate increase from 2% to 0.5% [the increase for 2025] still hurts people and still hurts the economy,’ said Mervyn Abrahams of the Pietermaritzburg Economic Justice & Dignity Group, which monitors low-income families’ household expenses.

South Africa’s Finance Minister Enoch Godongwana increased value-added tax (VAT) by 1 percentage point over two years in his 2025 budget — from 15% to 15.5% in 2025 and then to 16% in 2026. It was a controversial move. VAT is seen as a tax on the poor.

He had initially proposed a 2 percentage point VAT increase, which was rejected. The lower compromise amount is still unpopular.

‘Dropping the proposed VAT rate increase from 2% to 0.5% still hurts people and still hurts the economy,’ said Mervyn Abrahams of the Pietermaritzburg Economic Justice & Dignity Group, which monitors the household expenses of low-income families.

South Africa’s VAT rate is not particularly high in comparison with countries with economies of a similar size, the chart shows.

Although VAT is generally higher in richer European countries, there are a number of African countries with higher VAT rates that South Africa. For example, Rwanda, Uganda, Tanzania, Côte d’Ivoire and Senegal have VAT of 18%, according to PwC data. Nigeria’s is a relatively low 7.5%.

VAT contributes 25% to the South African government’s revenue, according to the National Treasury.

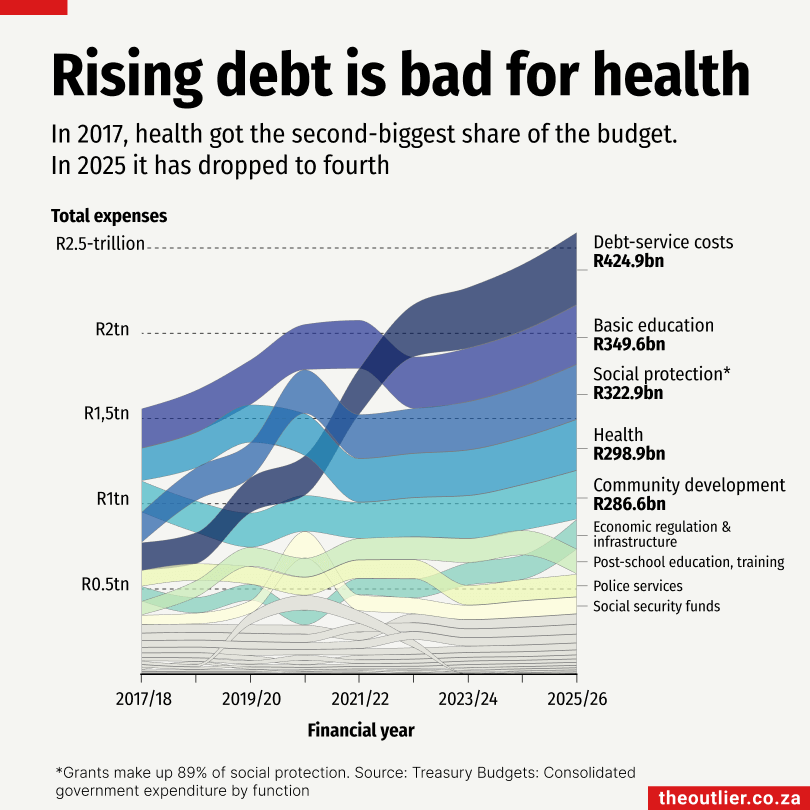

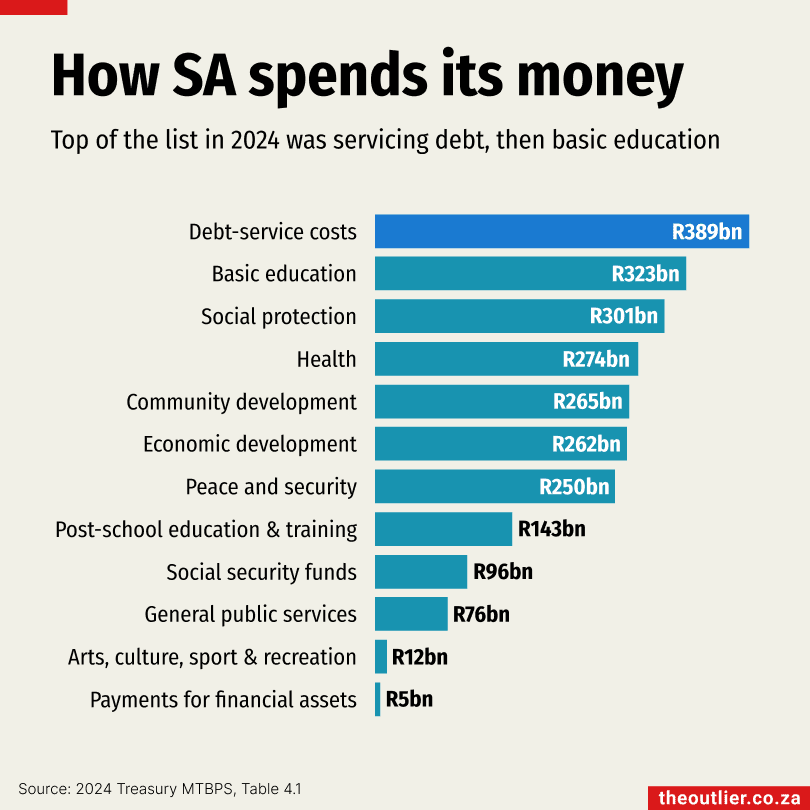

The biggest chunk of South Africa’s 2025/26 budget is going towards servicing debt — no surprise there; it’s been that way since the 2022/23 budget.

As Finance Minister Enoch Godongwana noted in his budget speech, 22 cents of every rand raised in revenue is spent on debt repayments. ‘It is more than what we spend on health, the police, and basic education,’ he said.

Back in 2017, health received the second-biggest share of the national budget. Now, it’s slipped to fourth place. This year, health received a 7.8% increase on last year’s allocation — slightly more than basic education (7.6%).

A ‘significant portion’ of the health budget goes towards salaries and wages. Yet over the past year, the public health system lost nearly 9,000 health workers. ‘We did not have the money to retain or replace them, even after reprioritising funds budgeted for consumables and medicines,’ Godongwana said.

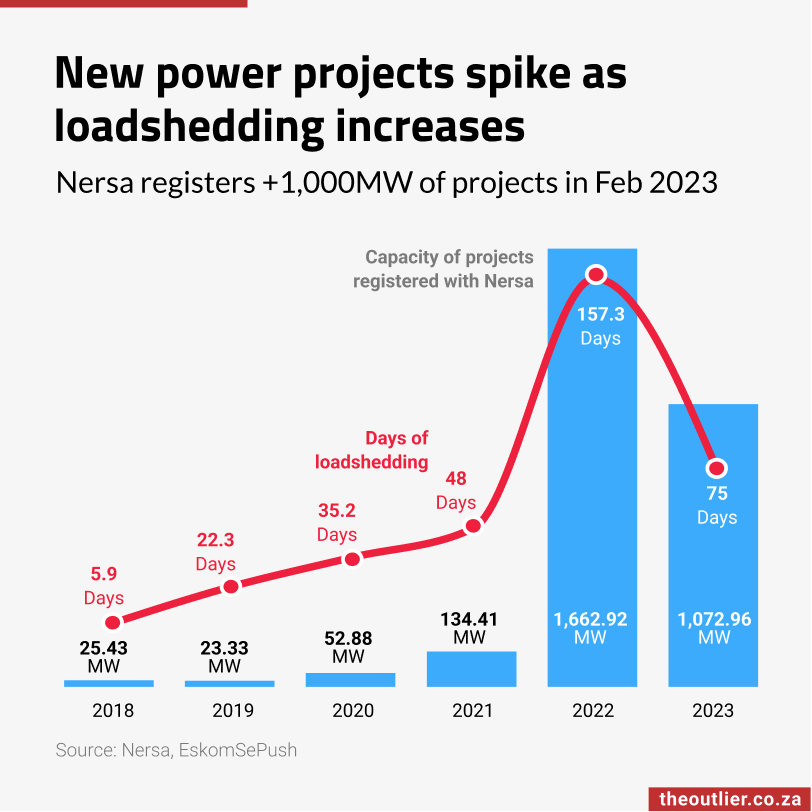

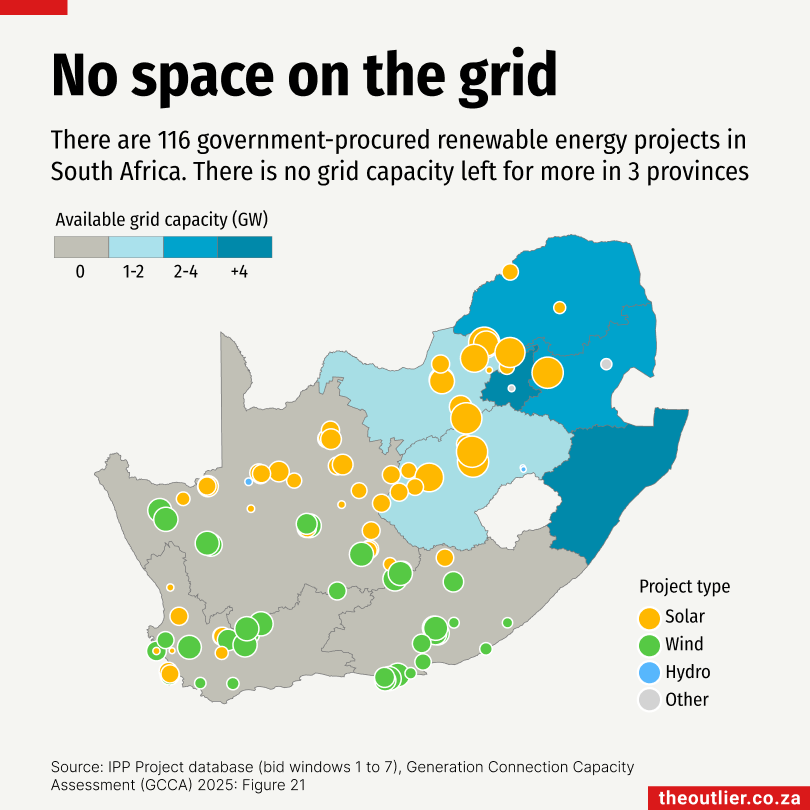

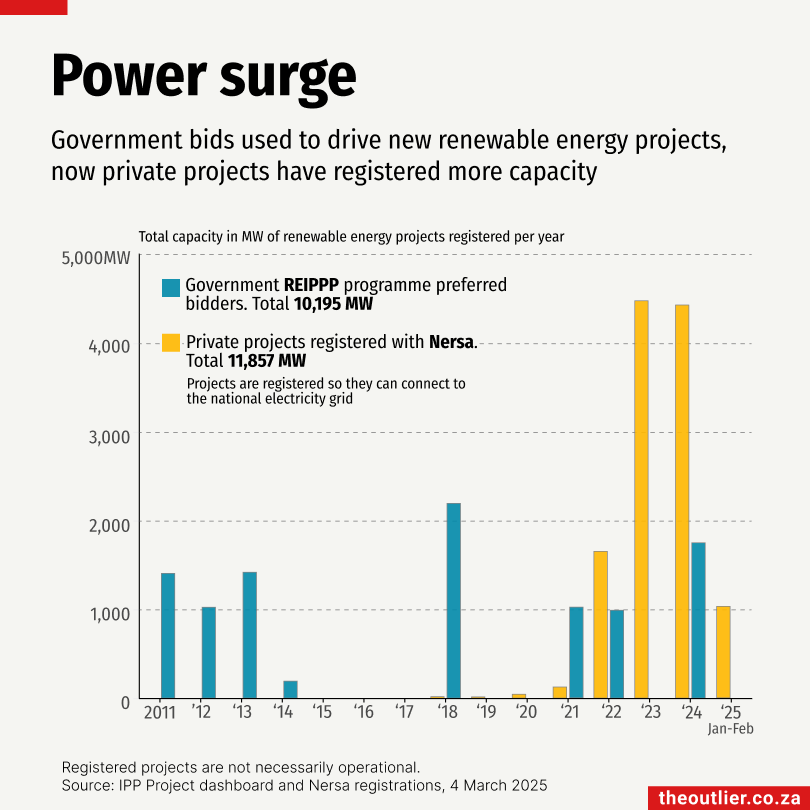

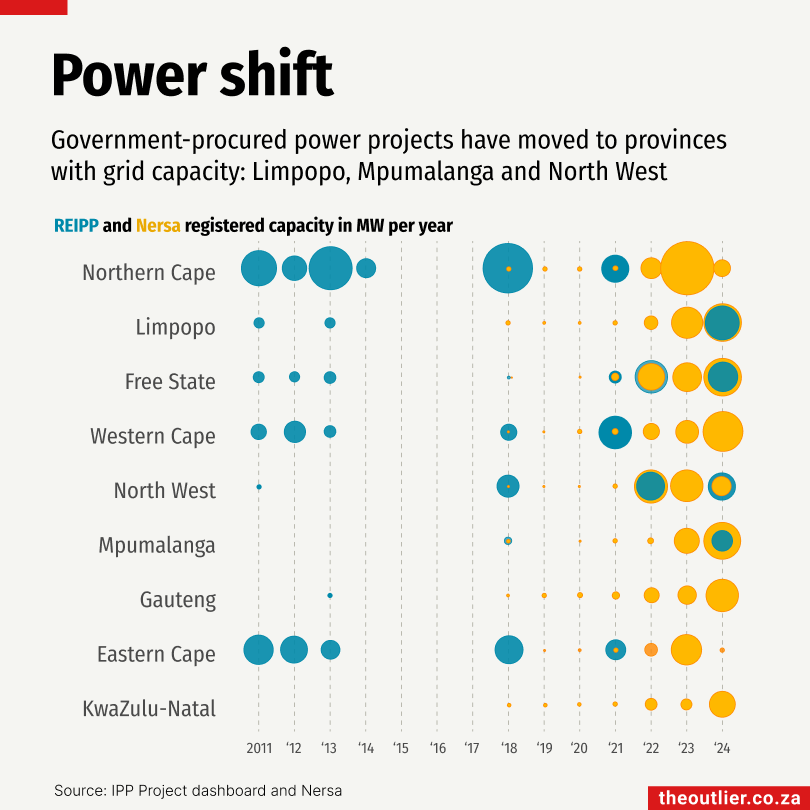

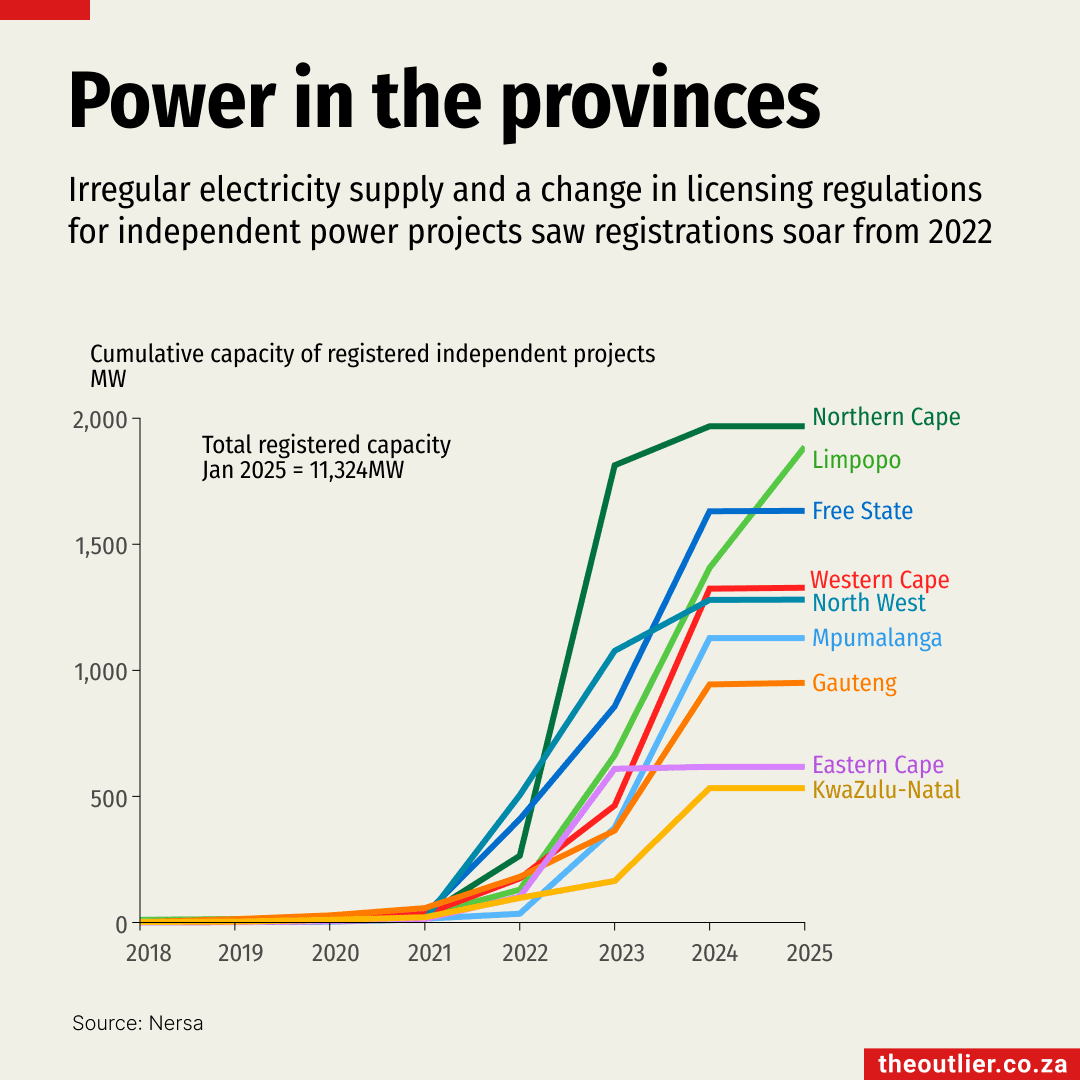

South Africa has 6,505MW of installed renewable energy capacity that generates power for the national electricity grid, according to [Eskom](https://www.ntcsa.co.za/wp-content/uploads/2025/03/Weekly_System_Status_Report_2025_w09.pdf). A key driver of renewable energy capacity has been the government’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). Launched in 2011, it was designed to facilitate private sector investment in renewable energy projects that connect to the national grid through a competitive tender process. Since its inception, 116 projects have been approved, in seven bid windows. Ninety-one of these projects are operational.Forty REIPPPP projects are wind farms. Although there are more solar projects than wind projects, at present the wind farms are generating more electricity for the grid.But there’s a snag. The areas that are rich in solar and wind resources – the Northern Cape, Eastern Cape and Western Cape – have run out of grid capacity, according to Eskom’s Generation Connection Capacity Assessment: 2025.Get the data used in this chart on DataDesk

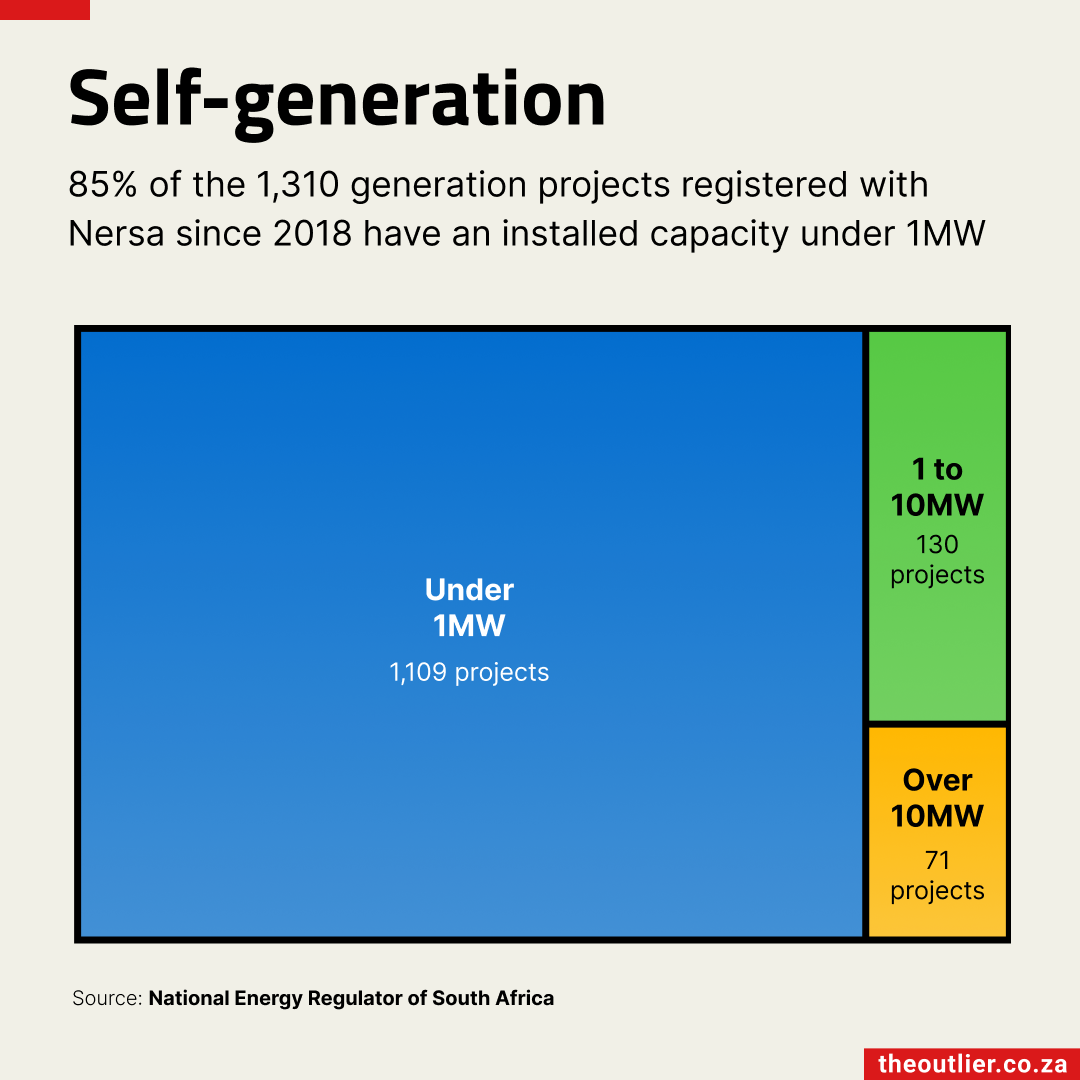

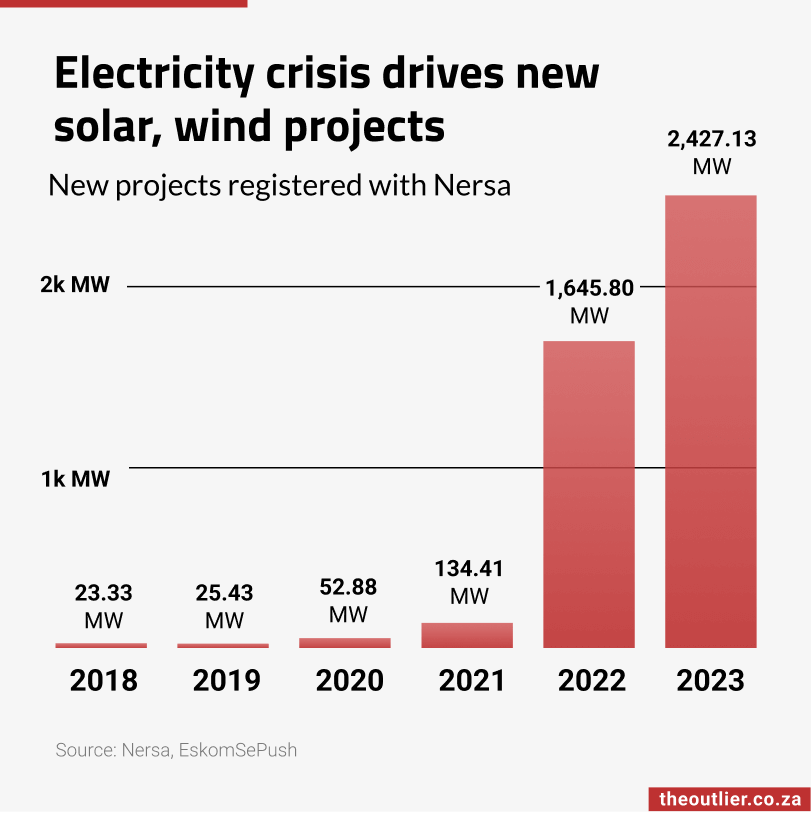

Since 2011, renewable energy projects with an installed capacity of 22,000MW have been registered as part of either the government’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) or with the National Energy Regulator of SA (Nersa) by private operators. The REIPPP programme, launched in 2011, was designed to facilitate private sector investment in renewable energy projects that connect to the national electricity grid through a competitive tender process. Since its inception, 116 projects have been approved, in seven bid windows. Ninety-one projects are operational.Thanks to years of loadshedding, private businesses and residents have invested in solar and other energy alternatives, to compensate for the unreliable electricity supply. By February 2025, Nersa had registered projects with a total installed capacity of 11,857MW – most of it solar. Nersa doesn’t provide information about whether these projects are operational.Get the data used in this chart on DataDesk

The South African government’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) has been a key driver of the growth of renewable electricity projects in South Africa. It was designed to facilitate private sector investment in renewable energy projects that connect to the national electricity grid through a competitive tender process. Since its inception, 116 projects have been approved, in seven bid windows (blue circles on the chart). The Northern Cape and Eastern Cape are rich in solar and wind energy potential and are the site of many of the earlier REIPPPP projects, but there’s been a big drop in registrations of government projects in those provinces because of the shortage of grid capacity. The bigger energy projects are now being registered in Limpopo and the Free State, where there is still grid capacity.Thanks to years of loadshedding, private businesses and residents have also started to invest in solar and other energy generation alternatives. A project must be registered with the National Energy Regulator of SA (Nersa) if it is to be connected to the electricity grid. By February 2025, Nersa had registrations with a total installed capacity of 11,857MW (see yellow circles) – most of it is solar.

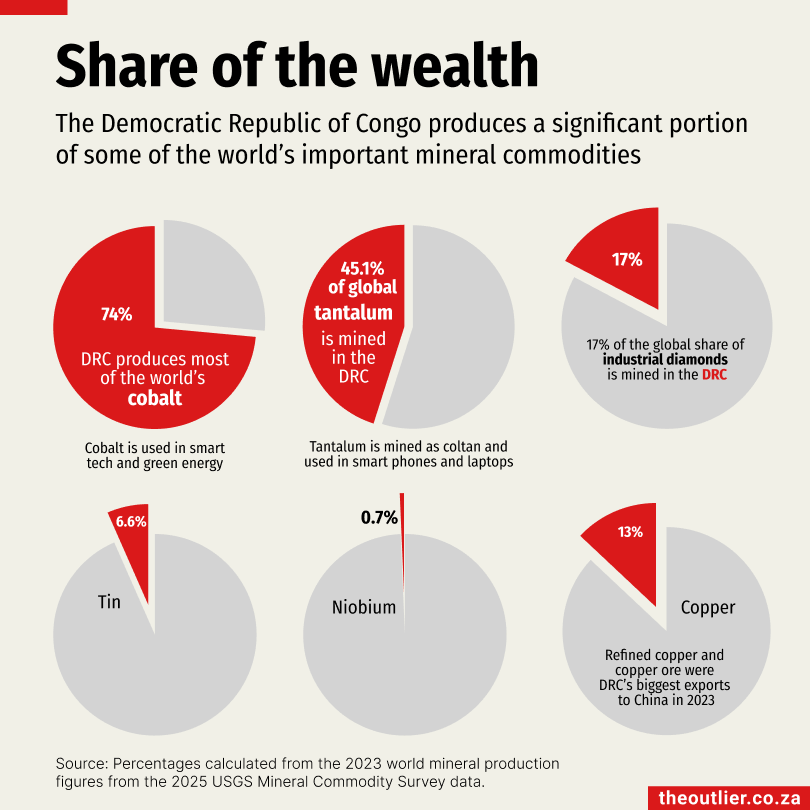

The Democratic Republic of Congo (DRC) produces substantial slices of critical minerals used in clean energy and other tech, particularly cobalt and coltan. It produces three-quarters of the world’s cobalt, according to data from the United States Geological Survey (USGS).

‘Coltan’ is the term used to describe columbite-tantalite, which contains tantalum and niobium. Small amounts of tantalum powder are used to make the heat-resistant capacitors in almost all smart technology that we use, like cellphones and laptops. Nearly half of global tantalum is mined in the DRC, USGS data shows.

Despite its mineral wealth, millions of people in the DRC live in extreme poverty. Artisanal mining (small scale, subsistence) is still predominant and much of the conflict in the DRC reportedly relates to control and movement of these resources.

China is the DRC’s biggest mineral export partner. It refines most of the DRC’s cobalt, which is used in lithium-ion batteries.

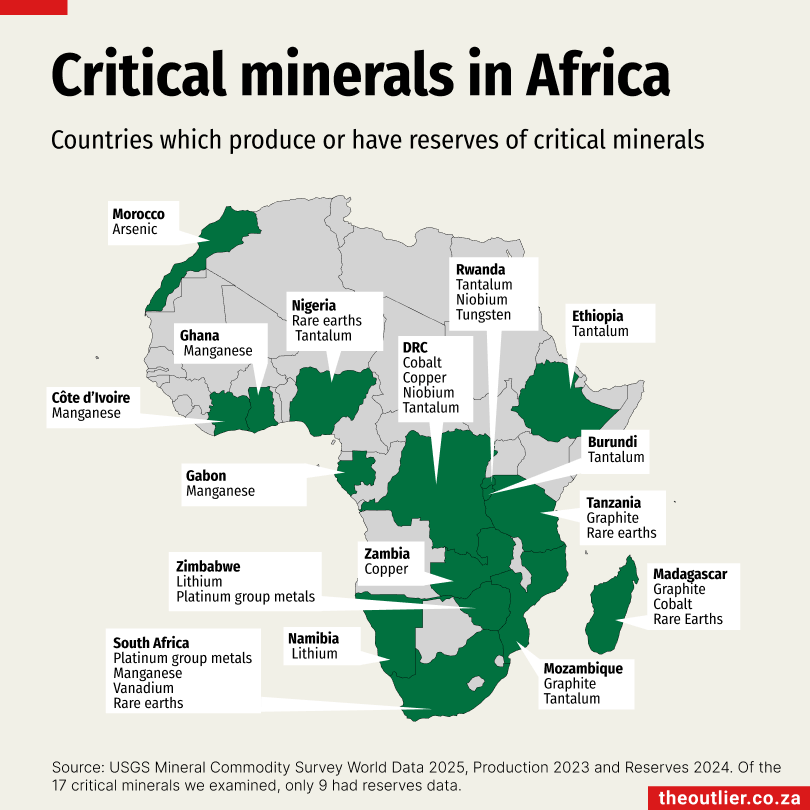

African countries are rich in critical minerals required for clean energy and tech. The map above shows the countries that produce or have reserves of 18 critical minerals, according to the United States Geological Survey (USGS) Mineral Commodity Survey World Data 2025.

The Democratic Republic of Congo (DRC) produces three-quarters of the world’s cobalt. It also has copper, niobium and tantalum.

Eighty percent of the world’s tantalum, which is used in capacitors in cellphones and computers, is produced in three African countries: the DRC, Nigeria and Rwanda. Ethiopia, Burundi and Mozambique have reserves of the mineral.

South Africa produces 70% of the platinum group metals (PGMs) and a third of manganese globally. It also produces vanadium and has reserves of rare earths.

Zimbabwe produces 7% of the world’s lithium, used in rechargeable batteries.

Clean energy systems require critical minerals. There are five core critical minerals, according to the International Energy Agency (IEA): copper, cobalt, lithium, nickel, graphite and rare earths. But there are many others, such as arsenic, bismuth, gallium, germanium, hafnium, magnesium, manganese, niobium, platinum group metals, tantalum, tungsten and vanadium, all of which play different roles in energy tech.

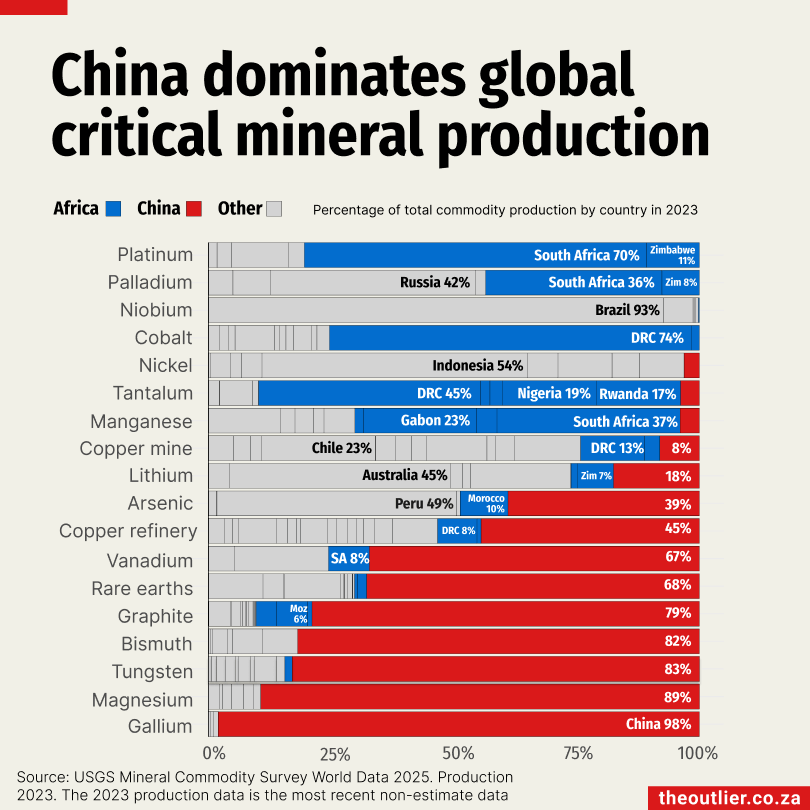

The places on Earth where there are mineral-rich ore deposits that are ‘economically viable’ to mine are becoming increasingly important as countries move away from fossil fuels towards renewable energy, and increasingly advanced tech is created. As the chart above shows, China is a dominant player in the production of critical minerals, producing more than half of the world’s gallium, magnesium, tungsten, bismuth, graphite, rare earths and vanadium. Of the 18 minerals in the chart, South Africa is a major producer of platinum and palladium as well as manganese.

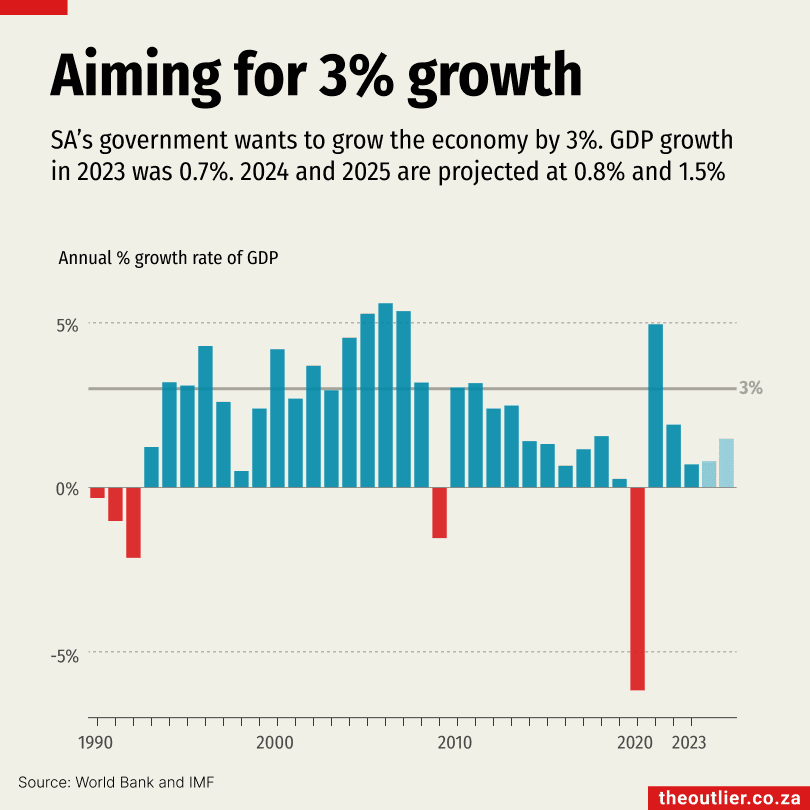

South Africa’s key focus areas for 2025 include energy, transport and logistics, youth unemployment as well as crime and corruption, according to president Cyril Ramaphosa.

These sectors, he said in his state of the nation address in February, have the potential to lift the county’s economic growth to above 3%, helping to create jobs and lift people out of poverty.

The government has set a target to grow GDP by 3%, a level not achieved in recent years. While challenges like energy shortages and inefficiencies in transport and logistics continue to affect economic progress, the outlook for 2025 is more positive.

In 2023, growth was just 0.7%, and the International Monetary Fund has projected a modest 0.8% for 2024. Growth for 2025 is expected to pick up to 1.5%, driven by improvements in electricity generation, relaxed monetary policies and renewed investor and consumer confidence after the 2024 national election.

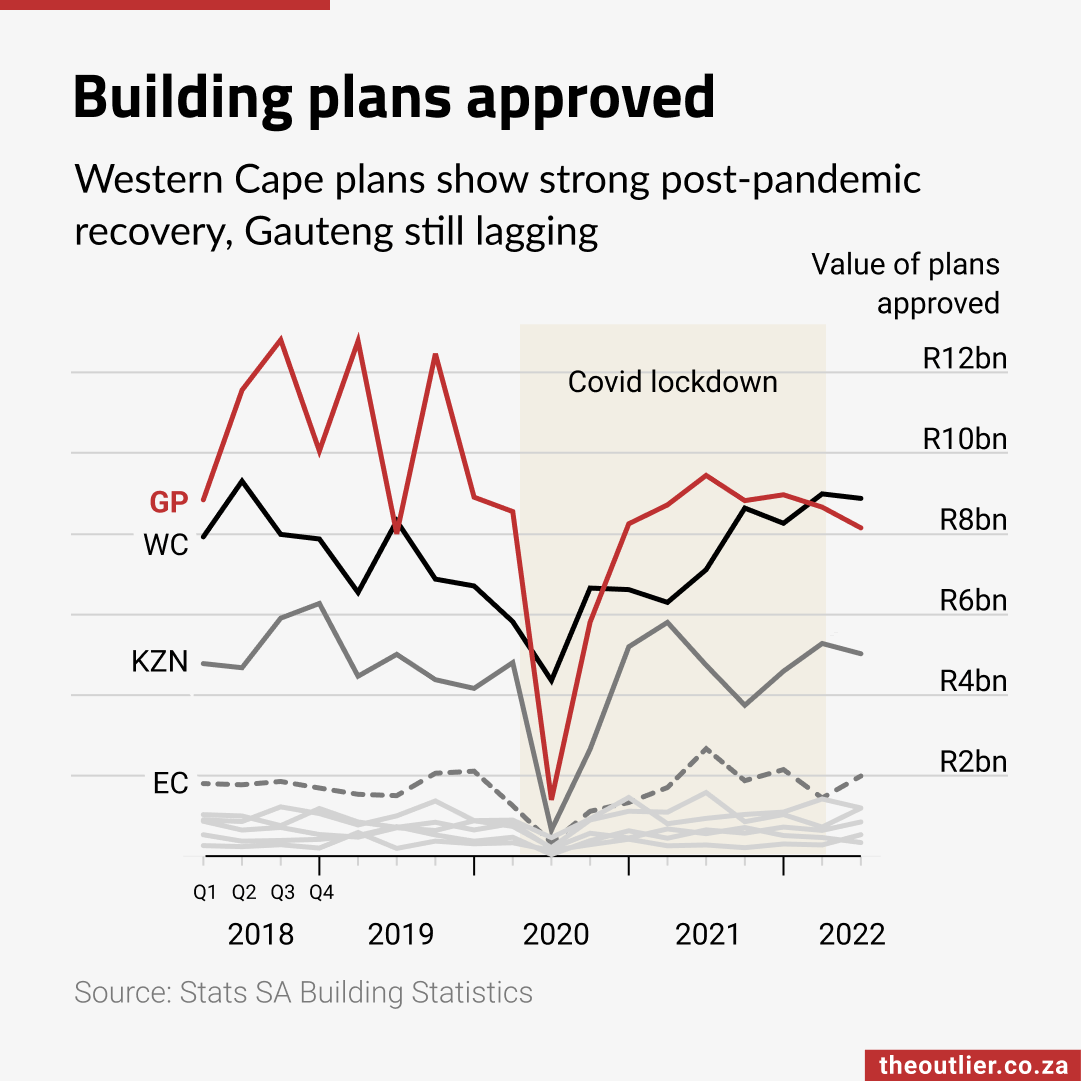

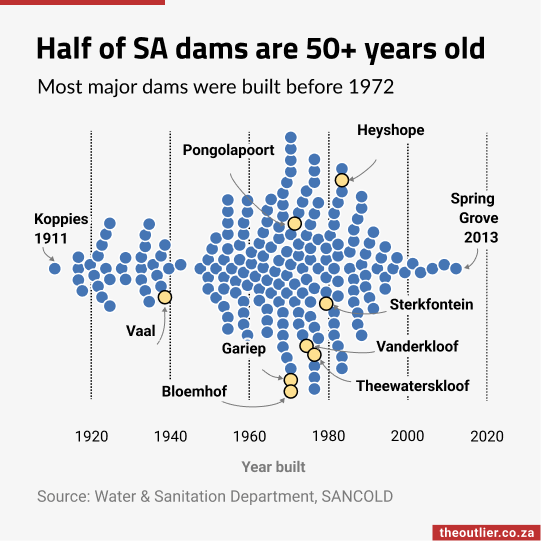

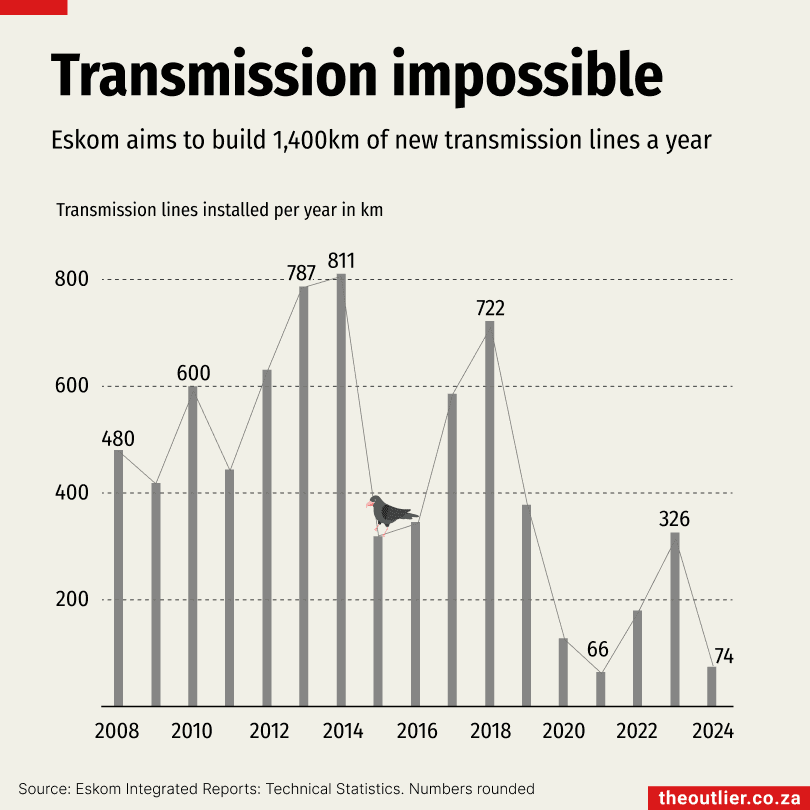

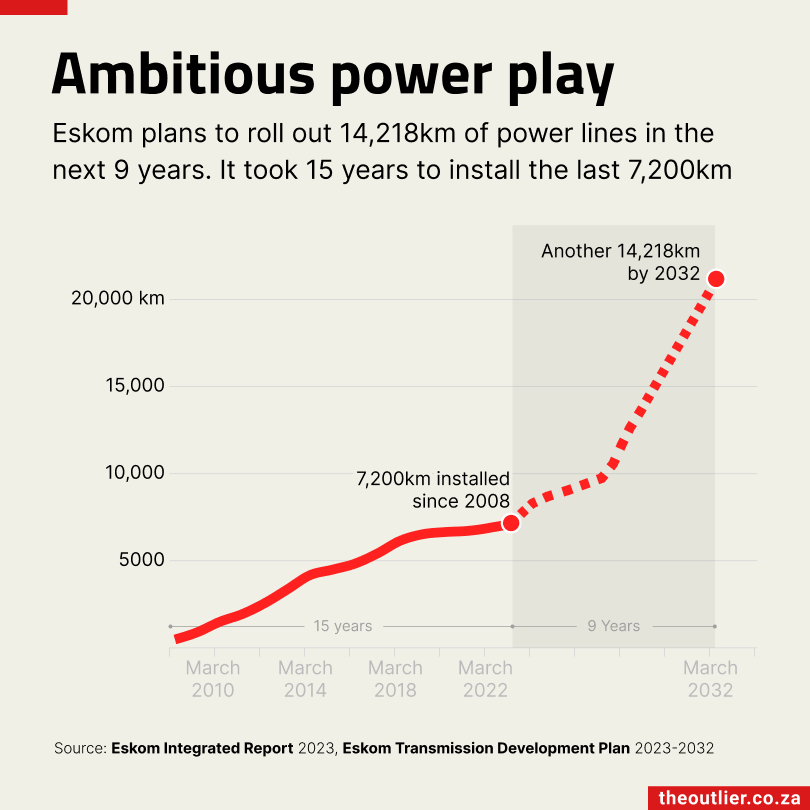

South Africa has a pressing need to increase energy capacity. However, some of the country’s best solar and wind resource areas – the Eastern Cape, Western Cape and Northern Cape – have run out of grid capacity.

To address this, Eskom must expand capacity and build more transmission lines, which transport electricity from where it is generated to where it is needed.

In its 2024 annual report, the power utility stated that it wants to accelerate its transmission line construction rate to 1,400km a year. However, reaching this target will require a significant increase in efforts. In 2024, for instance, only 74km of lines were built.

Eskom’s Transmission Development Plan aims to install more than 14,000km of transmission lines over the next decade. However, the utility acknowledges that this will have to be done at an ‘unprecedented pace.’

The highest installation since 2008 was in 2014, when 811km of lines were added.

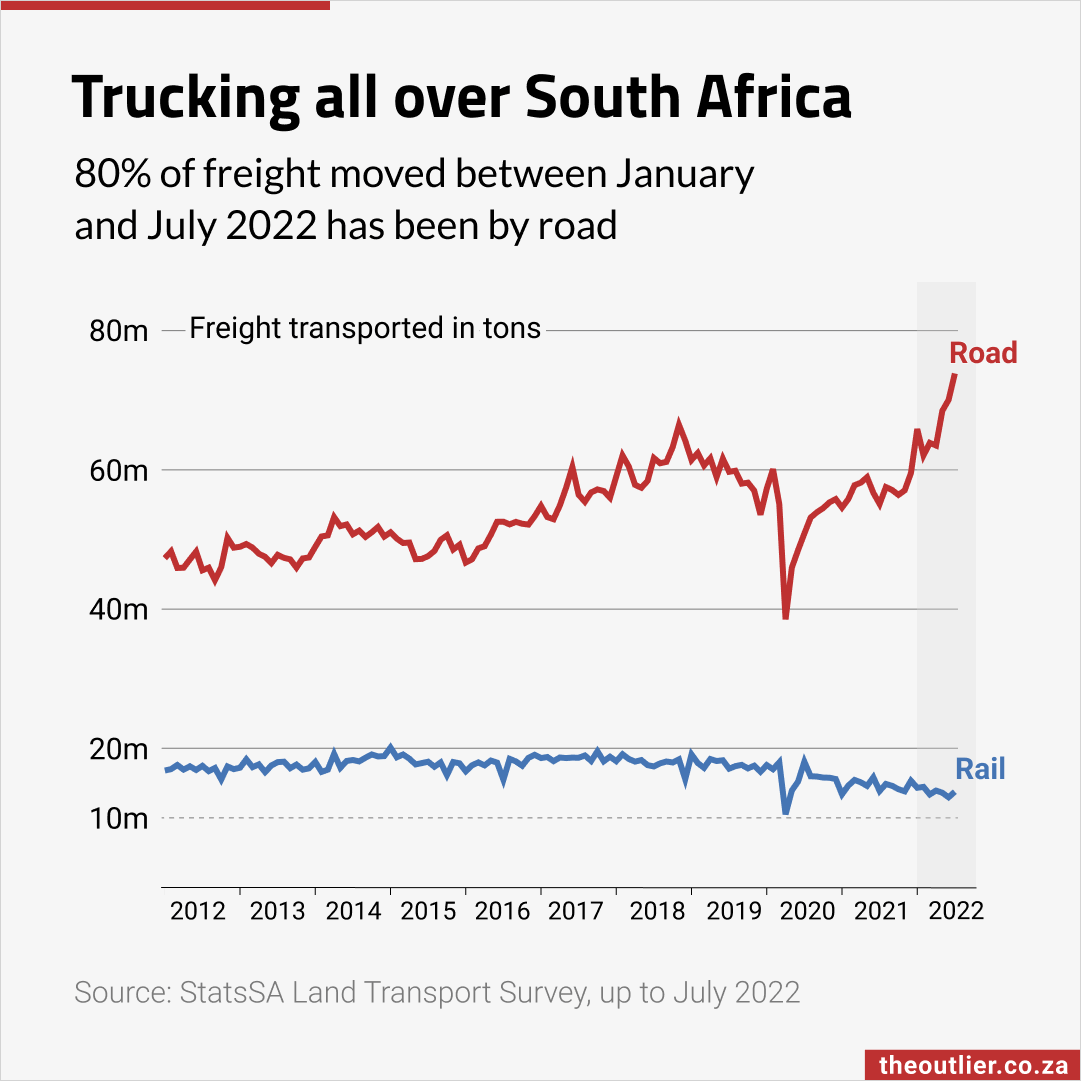

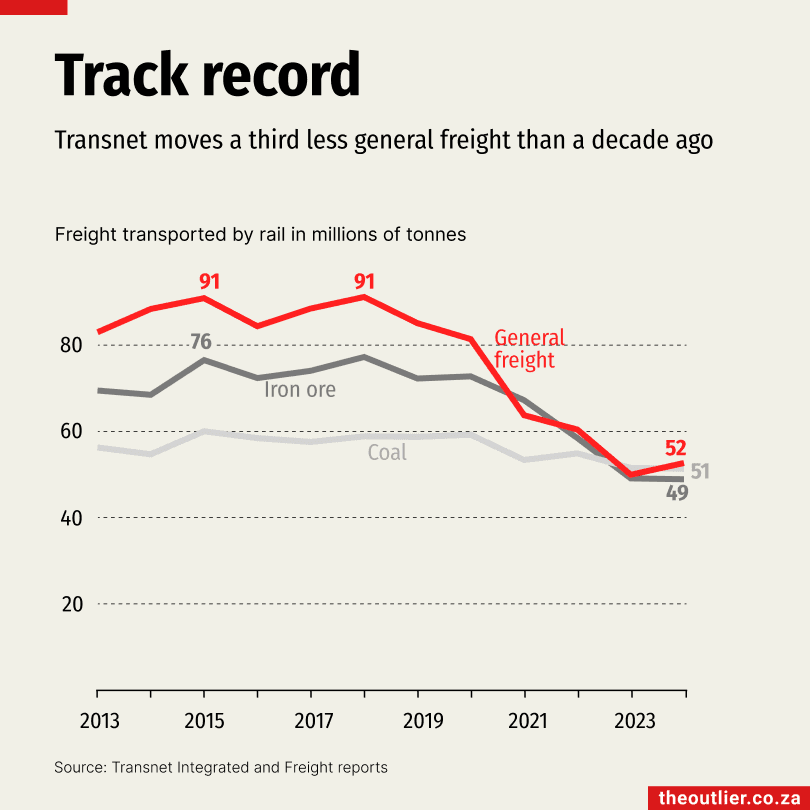

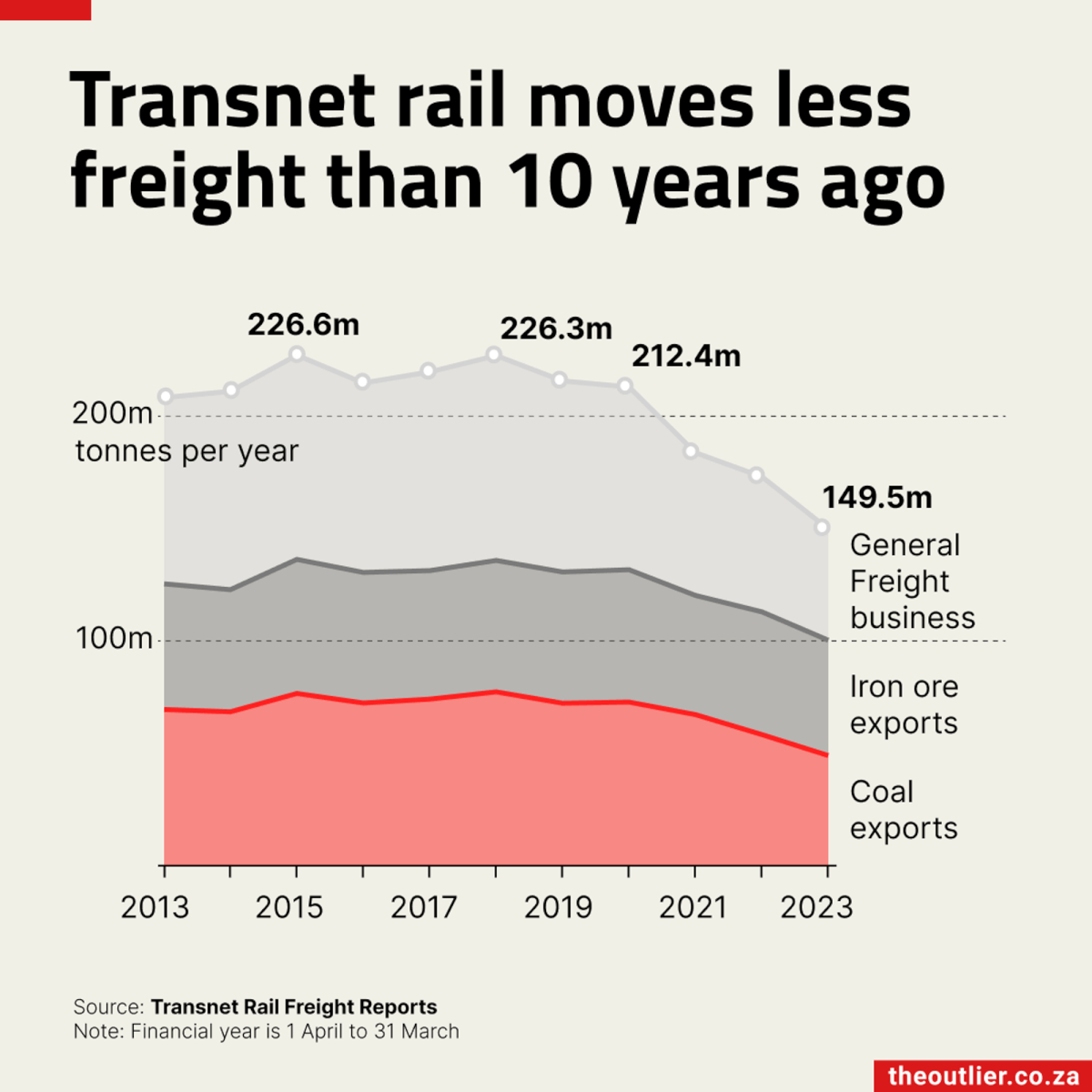

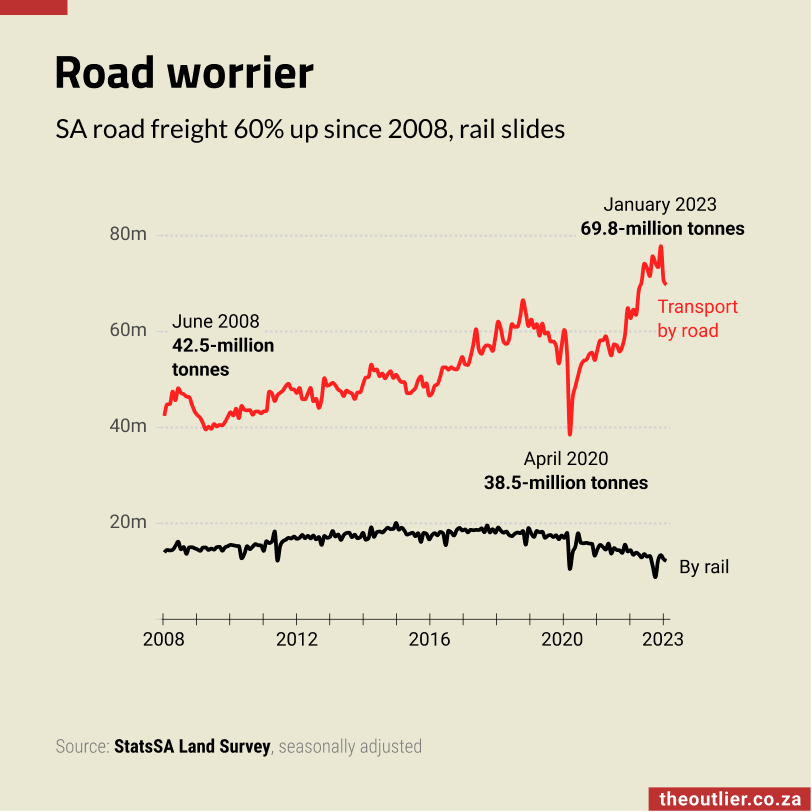

The collapse of South Africa’s freight rail network has placed a significant strain on the economy. In 2013, Transnet moved 208-million tonnes of freight, but by 2024, this had dropped to 152-million tonnes.

General freight, which includes all goods except iron ore and coal, has been hardest hit, declining by one-third over the past decade from 83-million tonnes to 52-million tonnes.

Coal transport has also suffered, with Transnet moving 30% less coal in 2024 than in 2013.

In his 2025 state of the nation address, president Cyril Ramaphosa highlighted a key reform: private rail operators are now allowed access to the freight rail network, which allows them to increase the volume of goods transported by train.

While the infrastructure remains state-owned, Ramaphosa said wider access will help ensure that South African ‘minerals, vehicles and agricultural produce reach international markets, securing jobs and generating much-needed revenue for our fiscus’.

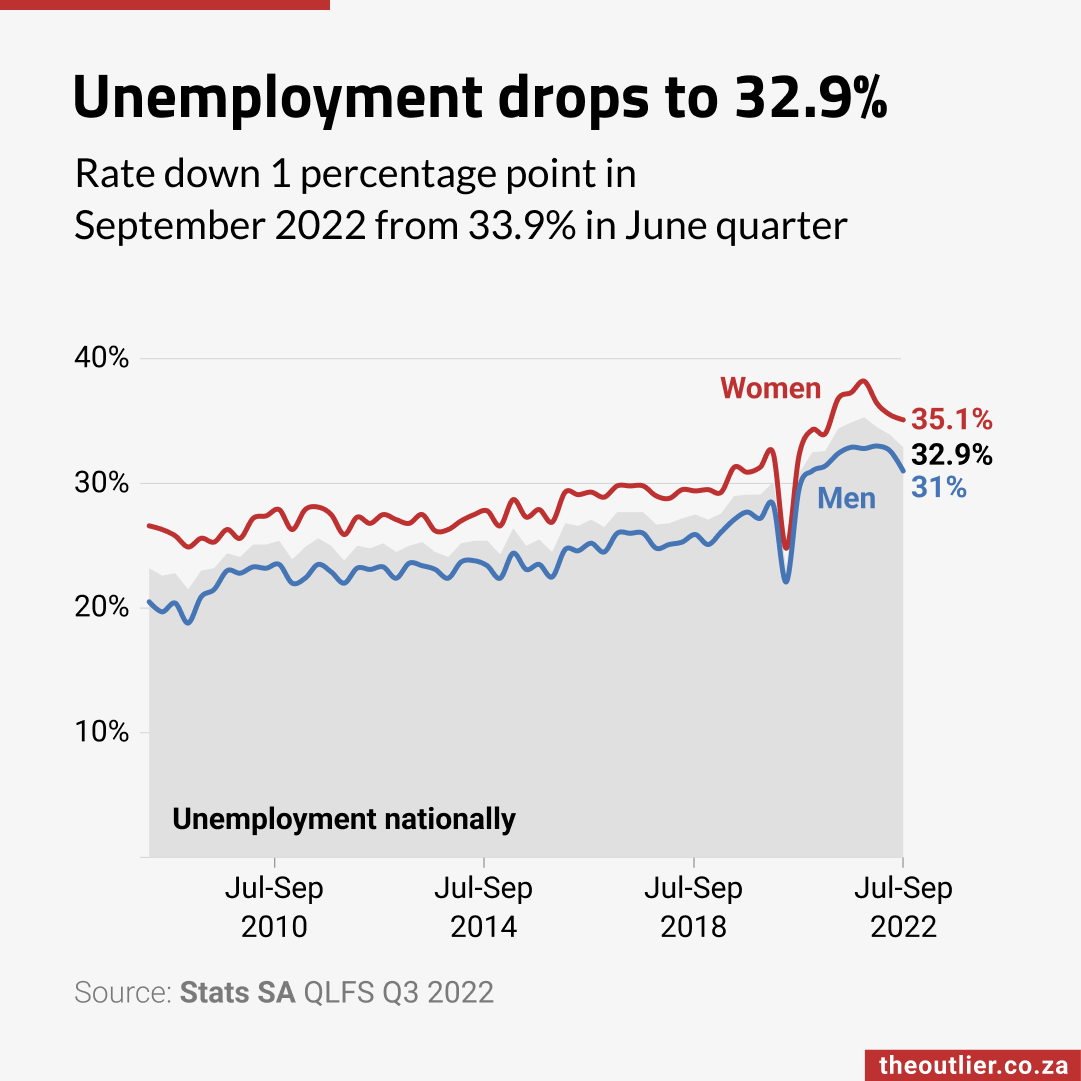

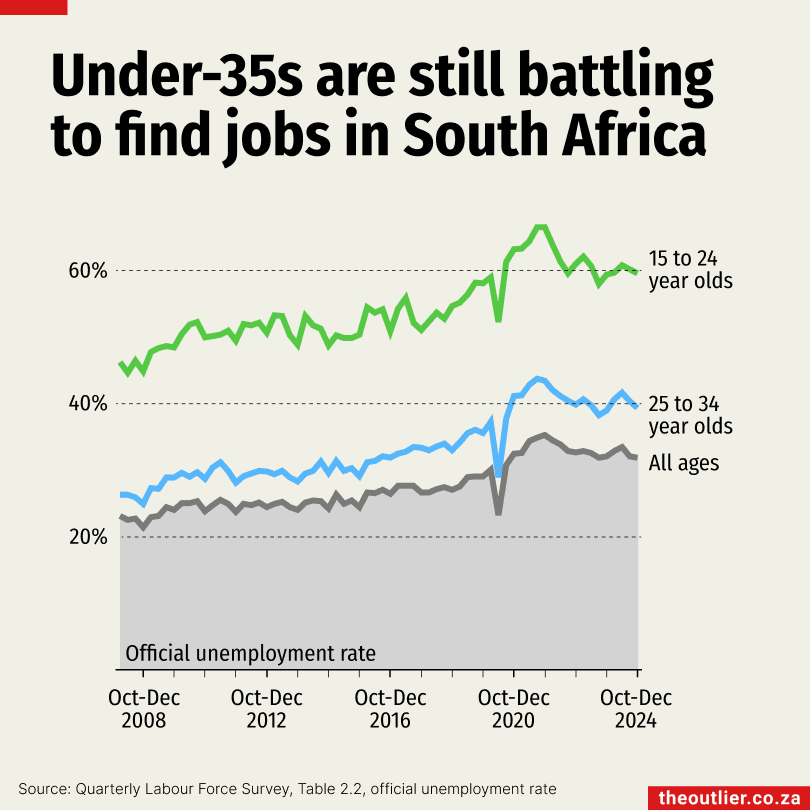

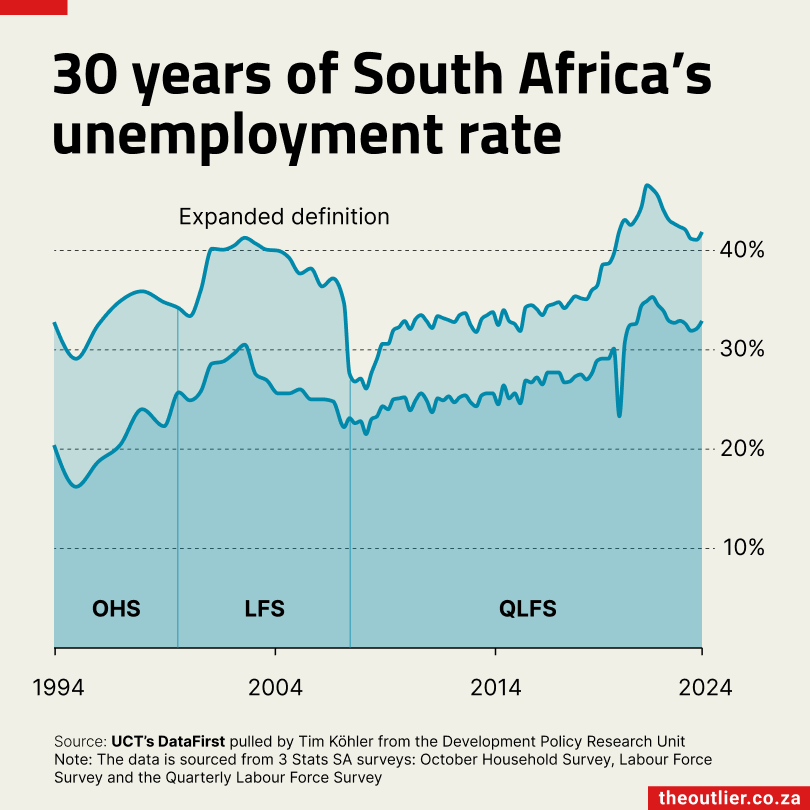

South Africa’s unemployment rate in the last quarter of 2024 stood at 31.9%, slightly lower than the 32.1% recorded in the same period in 2023. However, it remains alarmingly high, particularly among young people.

Youth unemployment is particularly severe, with 59.6% of the labour force aged 15 to 24 unemployed. Many in this group are likely searching for their first job but struggling to find one. Among those aged 25 to 34, the unemployment rate is also high at 39.4%. Recognising this crisis, the Presidency has launched several initiatives to provide unemployed young people with work experience. Statistics South Africa noted last year that ‘initiatives such as experiential learning, apprenticeships, or other forms of exposure to the workplace have far-reaching implications in addressing the scourge of youth unemployment.’

President Cyril Ramaphosa has also called on the private sector to create opportunities for young people to gain work experience.

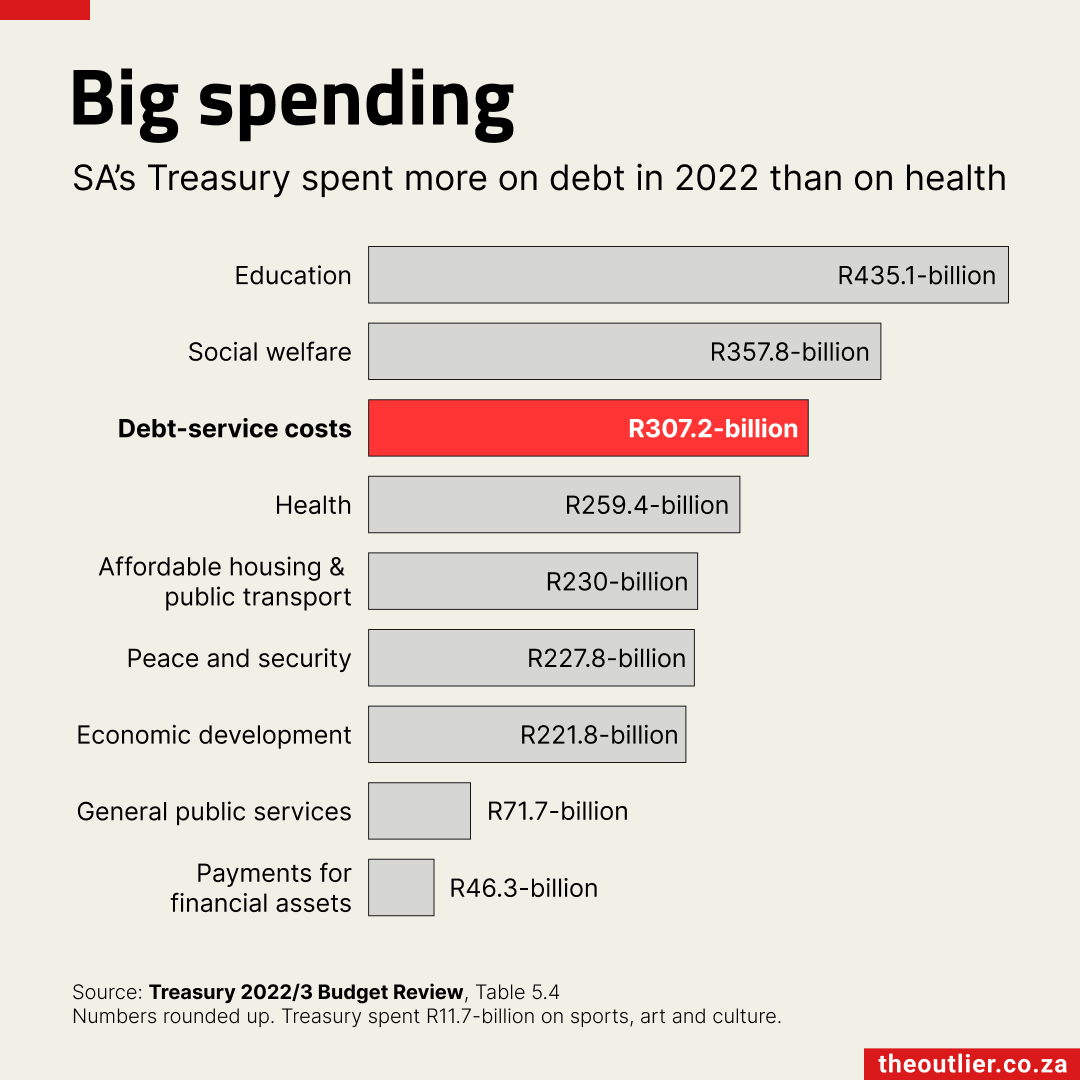

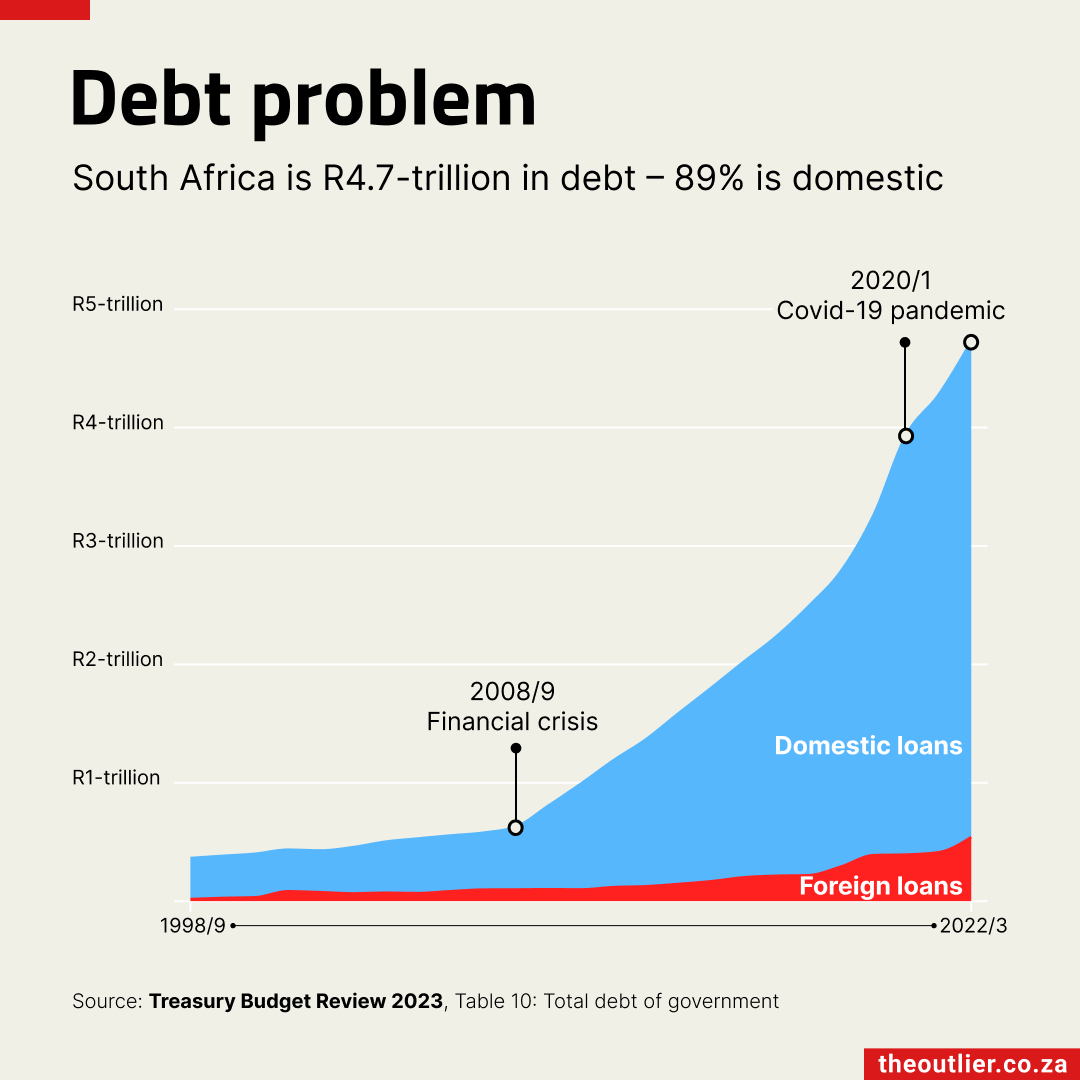

A significant portion of South Africa’s budget is spent on servicing debt – R389-billion in 2024, according to the National Treasury. This exceeds allocations for basic education (R323-billion), health (R274-billion) and peace and security (R250-billion).

Debt service costs surpassed basic education spending after the 2021/22 financial year. The year before, debt repayment was the government’s fourth biggest expense after basic education, social protection and health.

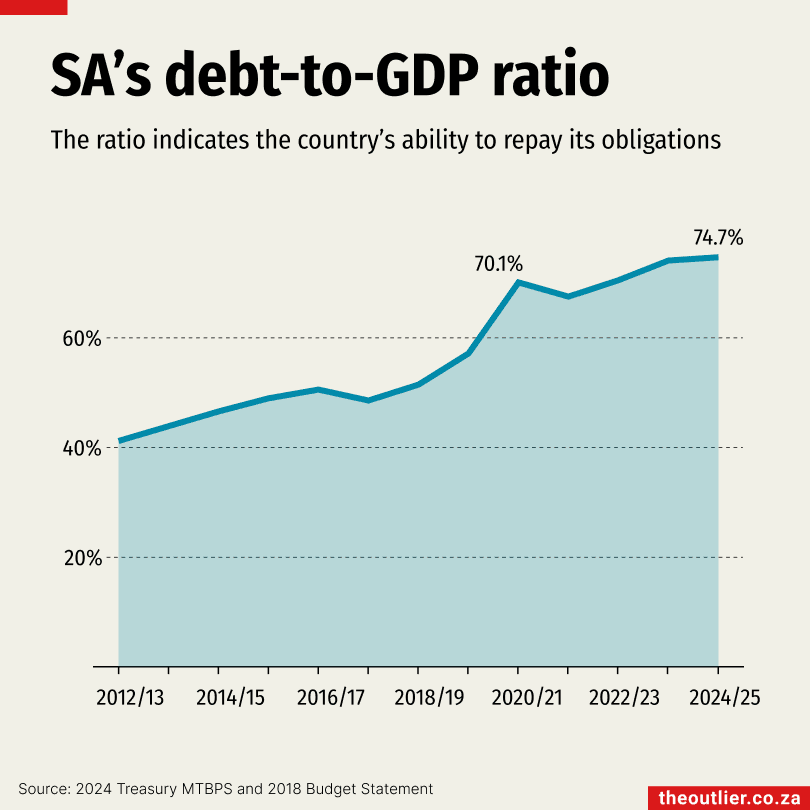

South Africa’s debt-to-GDP ratio stood at 74.7% in 2024/25, far above the government’s original goal set in 2014 of keeping it below 40%. This ratio, which measures total debt as a percentage of GDP, reflects a country’s ability to meet its obligations.

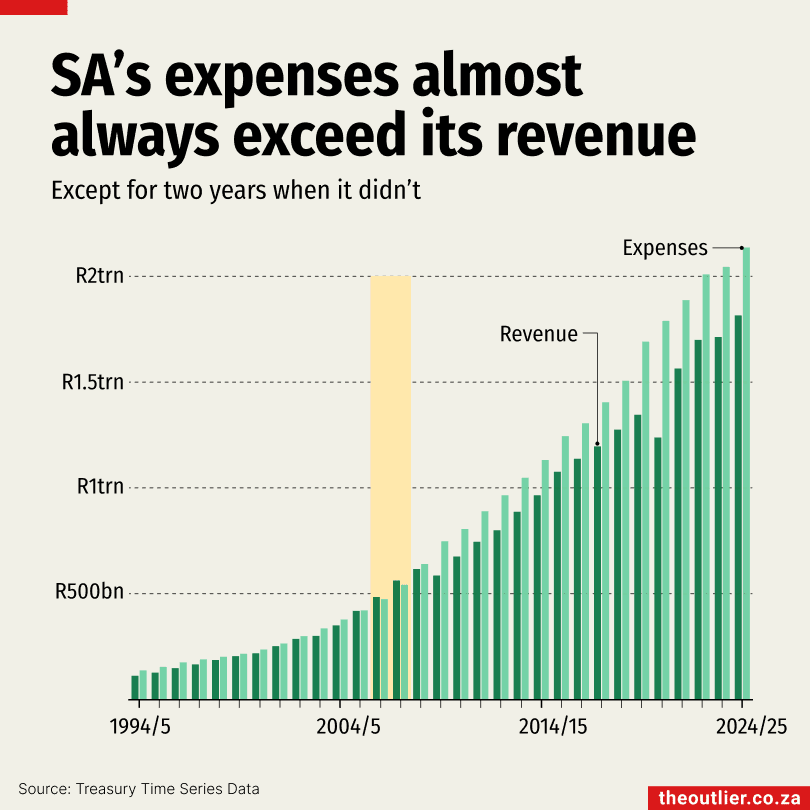

Since democracy, government spending has exceeded revenue every year except for two (2006/07 and 2007/08). With slow economic growth and ongoing budget deficits, fiscal pressure is high, raising concerns about the South Africa’s ability to manage its debt in the long term.

A significant portion of South Africa’s budget is spent on servicing debt – R389-billion in 2024, according to the National Treasury. This exceeds allocations for basic education (R323-billion), health (R274-billion) and peace and security (R250-billion).

Debt service costs surpassed basic education spending after the 2021/22 financial year. The year before, debt repayment was the government’s fourth biggest expense after basic education, social protection and health.

South Africa’s debt-to-GDP ratio stood at 74.7% in 2024/25, far above the government’s original goal set in 2014 of keeping it below 40%. This ratio, which measures total debt as a percentage of GDP, reflects a country’s ability to meet its obligations.

Since democracy, government spending has exceeded revenue every year except for two (2006/07 and 2007/08). With slow economic growth and ongoing budget deficits, fiscal pressure is high, raising concerns about the South Africa’s ability to manage its debt in the long term.

A significant portion of South Africa’s budget is spent on servicing debt – R389-billion in 2024, according to the National Treasury. This exceeds allocations for basic education (R323-billion), health (R274-billion) and peace and security (R250-billion).

Debt service costs surpassed basic education spending after the 2021/22 financial year. The year before, debt repayment was the government’s fourth biggest expense after basic education, social protection and health.

South Africa’s debt-to-GDP ratio stood at 74.7% in 2024/25, far above the government’s original goal set in 2014 of keeping it below 40%. This ratio, which measures total debt as a percentage of GDP, reflects a country’s ability to meet its obligations.

Since democracy, government spending has exceeded revenue every year except for two (2006/07 and 2007/08). With slow economic growth and ongoing budget deficits, fiscal pressure is high, raising concerns about the South Africa’s ability to manage its debt in the long term.

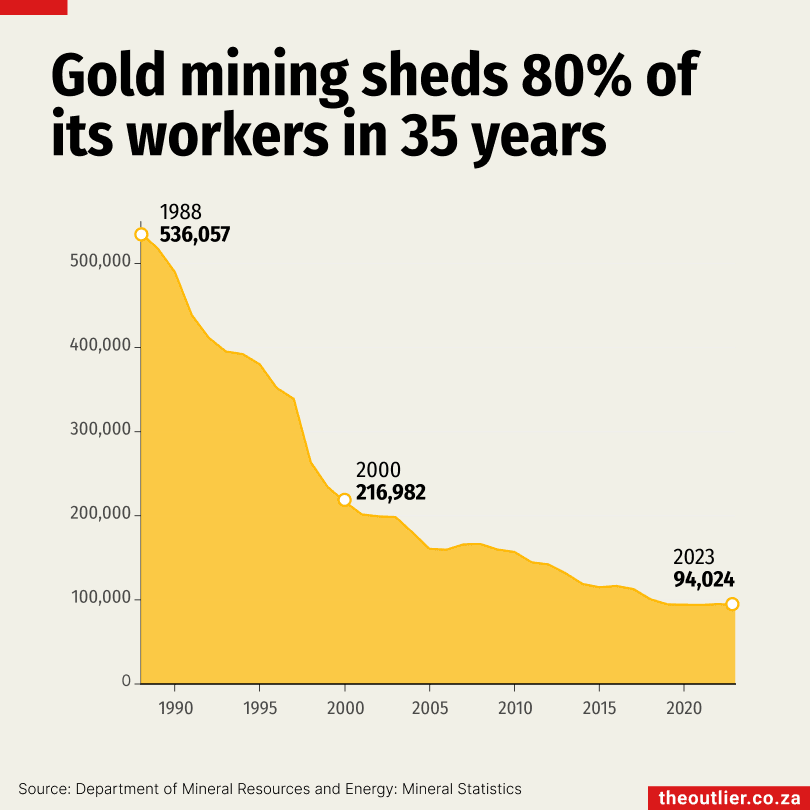

South Africa’s gold mining industry has shed 80% of its workforce over the past three-and-a-half decades. In 1988, more than 536,000 people worked in the sector. By 2000, that number had more than halved to 217,000; by 2023, it had fallen to 94,000.

Several factors have driven this decline. Many gold mines have closed as accessible reserves became depleted, forcing miners to dig ever deeper and at greater costs. Global economic shifts and competition from other gold-producing nations have put pressure on South African mines.

Gold has been overtaken by platinum and coal in terms of employment numbers. The number of people working in platinum mining has doubled from 85,000 in 1988 to 183,000 in 2023. Just over 96,000 people were employed in coal mining in 2023.

Mining was once a pillar of SA’s economy. In the early 1980s, it contributed about 20% to the GDP; by 2023, its contribution had dropped to 6.3%.

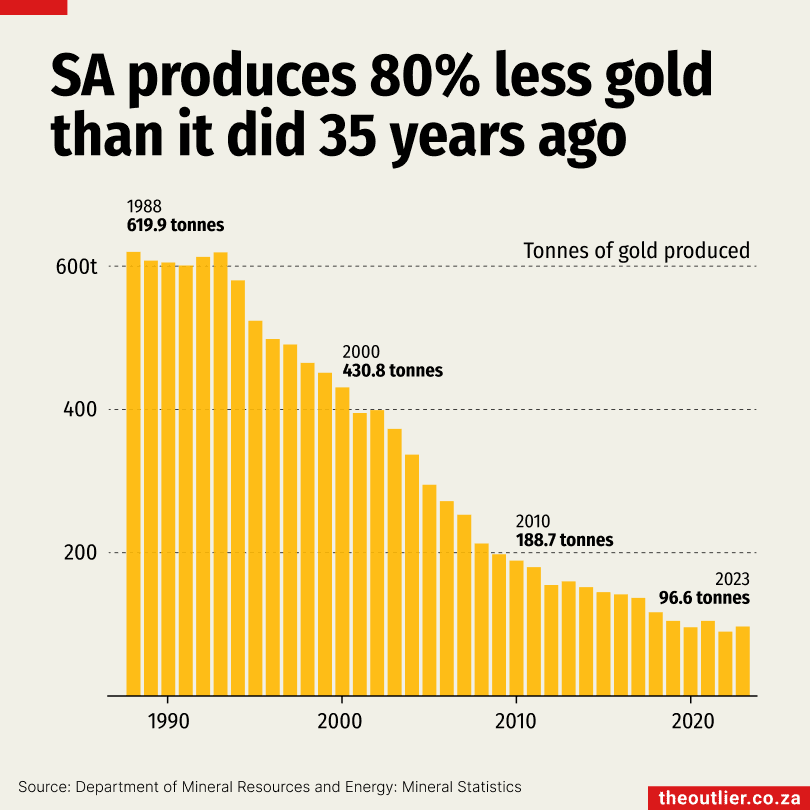

The amount of gold produced by South Africa has fallen by 80%, plunging from 620 tonnes in 1988 to 97 tonnes in 2023.

This doesn’t mean there’s no gold left in the ground. PwC reported in 2023 that South Africa still had 68-million troy ounces of gold reserves, the equivalent of 27 years of production.

However, extraction has become punishingly expensive as mines have become deeper to reach remaining deposits.

As a result, hundreds of gold mines have been closed. The Auditor-General said in 2022 that of the estimated 6,100 closed mines in SA, at least 700 were old gold mines.

Although the mines are supposed to be sealed, many are not. An informal economy has grown around them, with former miners and other workers extracting residual gold under hazardous conditions. Many of these miners, known as zama zamas, operate without permits.

Mining minister Gwede Mantashe said in January that SA lost R60-billion to illicit trade in 2024.

Platinum and coal have outpaced gold in terms of people employed in South Africa. The country has more than 80% of the world’s platinum group metal deposits and the number of people working in platinum mining has doubled from 85,000 in 1988 to 183,000 in 2023. Just over 96,000 people were employed in coal mining in 2023.

Gold is now the third largest employer in South Africa’s mining sector, having shed 80% of its workforce over the past 35 years. In 1988, more than half-a-million people worked in gold mining. By 2000, that number had plunged to less than half at 217,000. By 2023, it had fallen to 94,000 employees.

Chrome and manganese mining have seen significant growth in their employee numbers, with both industries tripling their workforce over the past three decades. These two minerals will continue to grow in importance as they are critical for renewable energy-related products.

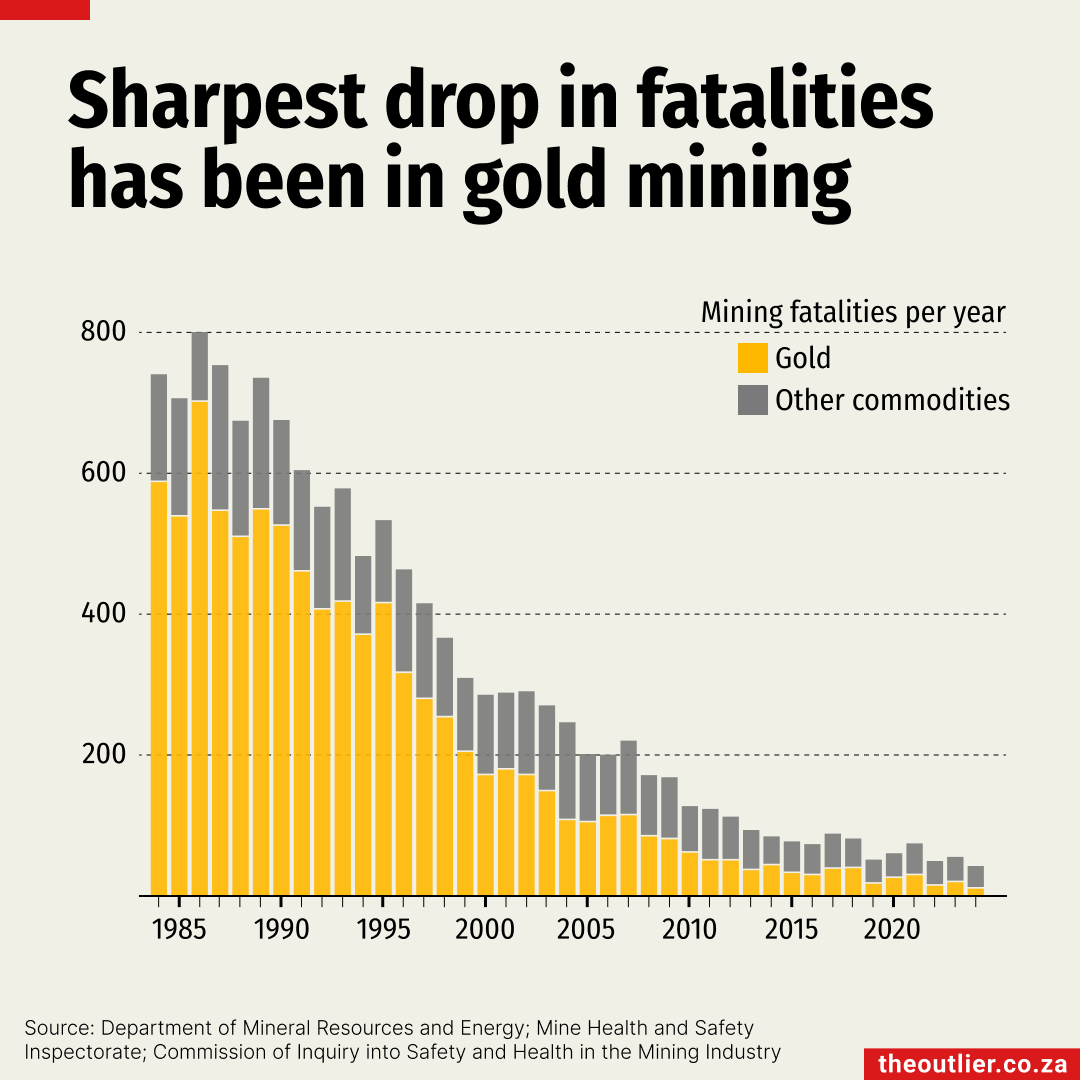

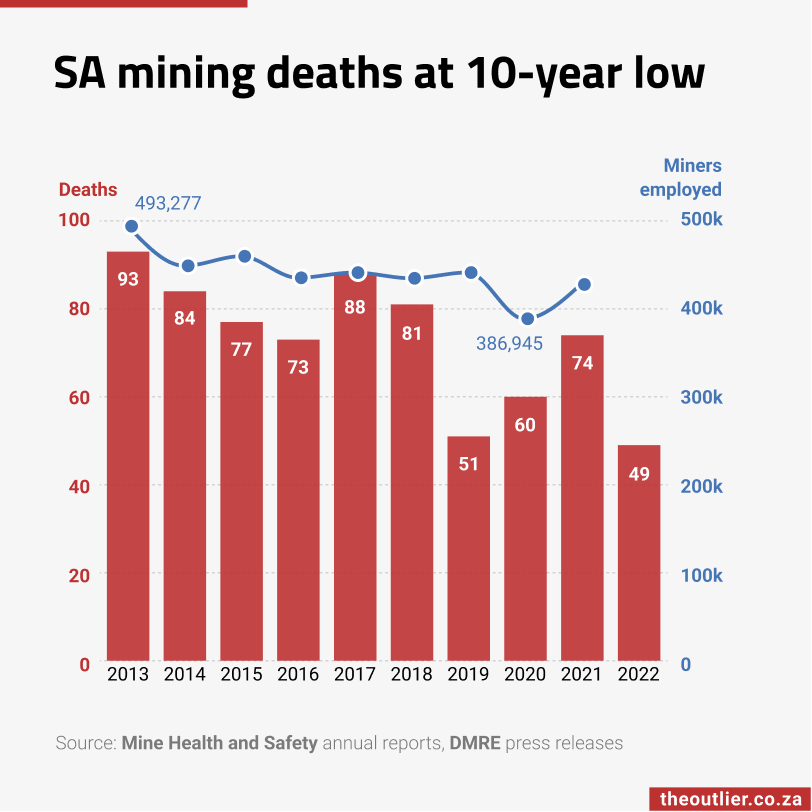

In 2024, South Africa recorded its lowest-ever number of mining fatalities: 42 deaths. That’s a significant improvement on previous decades.

During the 1980s, when mining contributed about 20% to South Africa’s economy, more than 700 deaths were recorded by the industry a year.

At that time, about 80% of the fatalities were in the gold sector, according to statistics from the department of mineral resources and energy. By 2024, only 26% of mining fatalities were linked to gold mining.

Mining’s contribution to the country’s GDP has fallen to around 6% and gold is no longer the country’s biggest employer in the mining sector. In fact, the sharp drop in gold mining fatalities mirrors the decrease in the number of people employed by the sector. In 1988, gold mining employed just over 536,000 people. By 2000, that number had more than halved to 217,000; by 2023, it had fallen to 94,000.

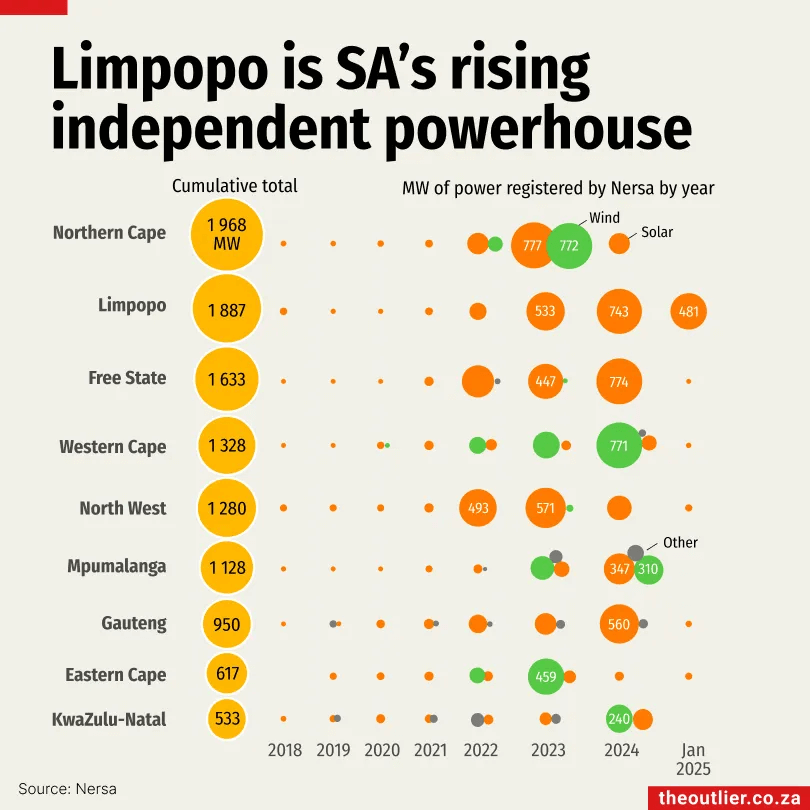

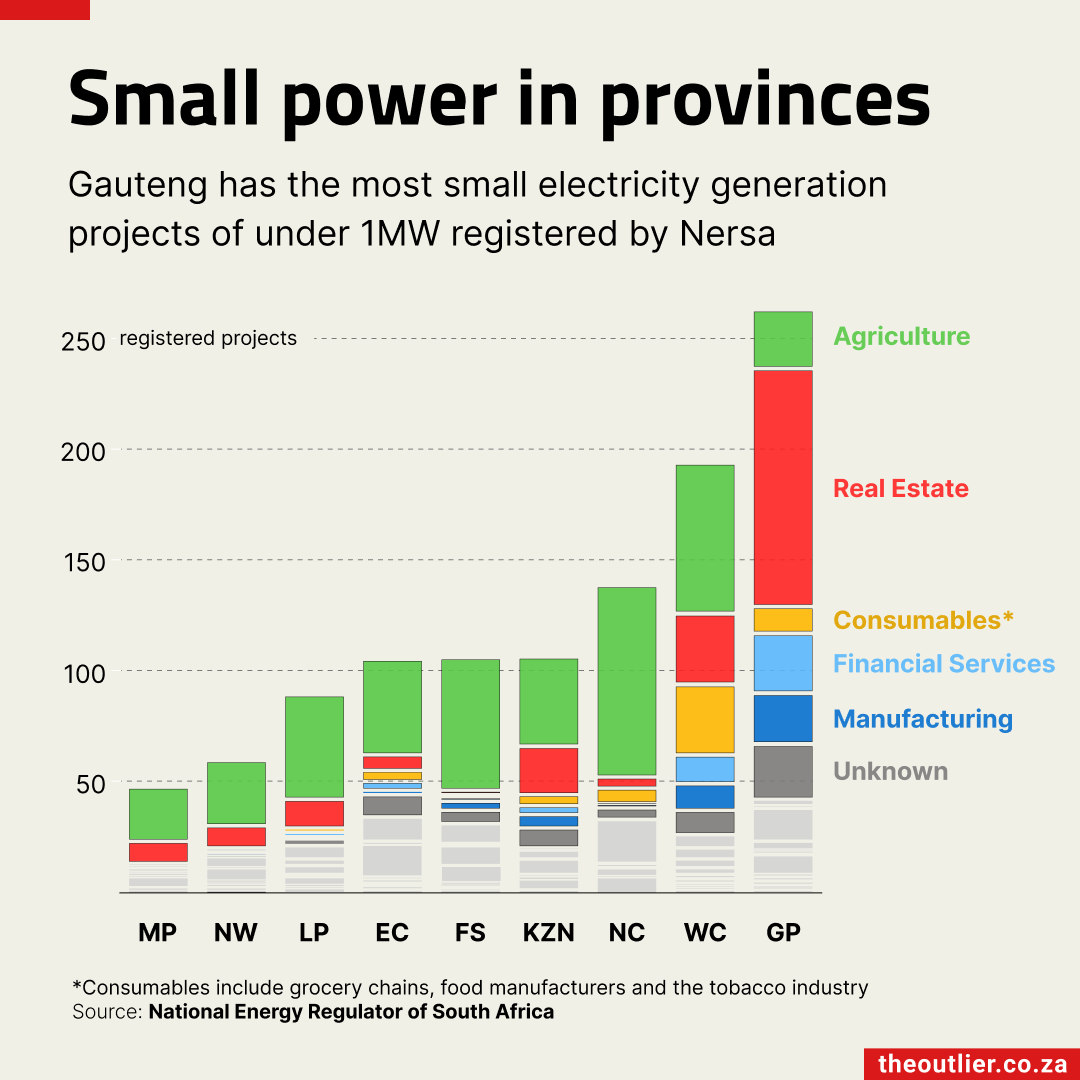

The number of private electricity generation projects in Limpopo is growing rapidly, making the province second only to the Northern Cape in capacity registered with Nersa, South Africa’s energy regulator. Two major solar projects added in January brought Limpopo’s total to 1,887MW, overtaking the Free State.

Three large solar projects were registered in Limpopo in 2024, including a 475MW facility. It is one of the two largest private solar projects on Nersa’s list, with the other located in the Free State.

The Western Cape registered three large wind projects last year, including the 380MW FE Overberg wind farm. No new wind registrations have been added since August.

Large private projects (100MW or more) began registering with Nersa in 2022 after licensing regulations were relaxed. These projects are independent of the government’s Renewable Energy Independent Power Producer Procurement Programme. Registration doesn’t mean they are operational.

Two-thirds of the 11,324MW registered by Nersa since 2018 is solar.

The number of private electricity generation projects in Limpopo is growing rapidly, making the province second only to the Northern Cape in capacity registered with Nersa, South Africa’s energy regulator. Two major solar projects added in January brought Limpopo’s total to 1,887MW, overtaking the Free State.

Three large solar projects were registered in Limpopo in 2024, including a 475MW facility. It is one of the two largest private solar projects on Nersa’s list, with the other located in the Free State.

The Western Cape registered three large wind projects last year, including the 380MW FE Overberg wind farm. No new wind registrations have been added since August.

Large private projects (100MW or more) began registering with Nersa in 2022 after licensing regulations were relaxed. These projects are independent of the government’s Renewable Energy Independent Power Producer Procurement Programme. Registration doesn’t mean they are operational.

Two-thirds of the 11,324MW registered by Nersa since 2018 is solar.

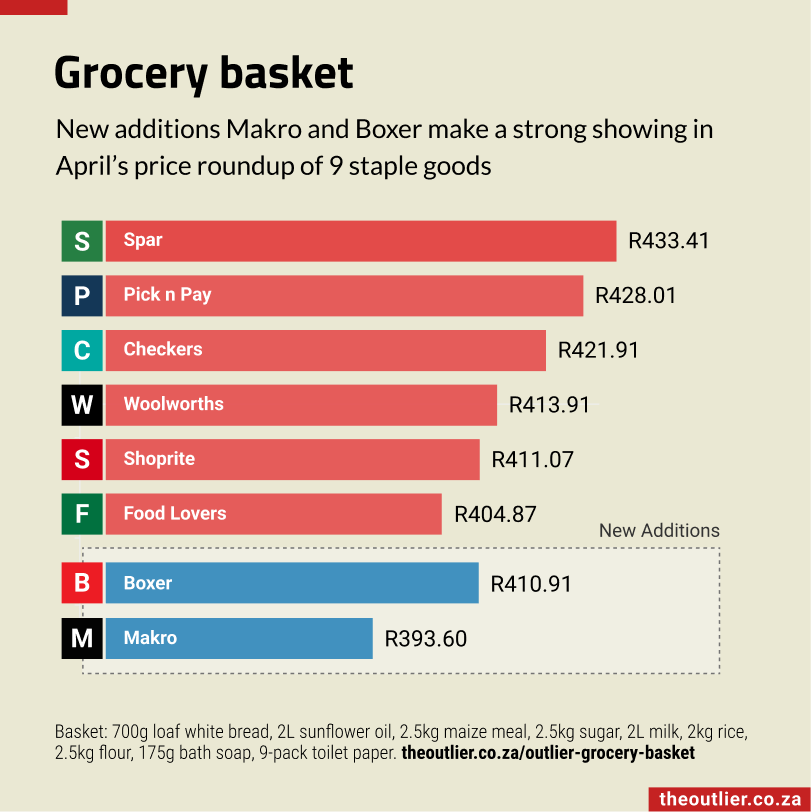

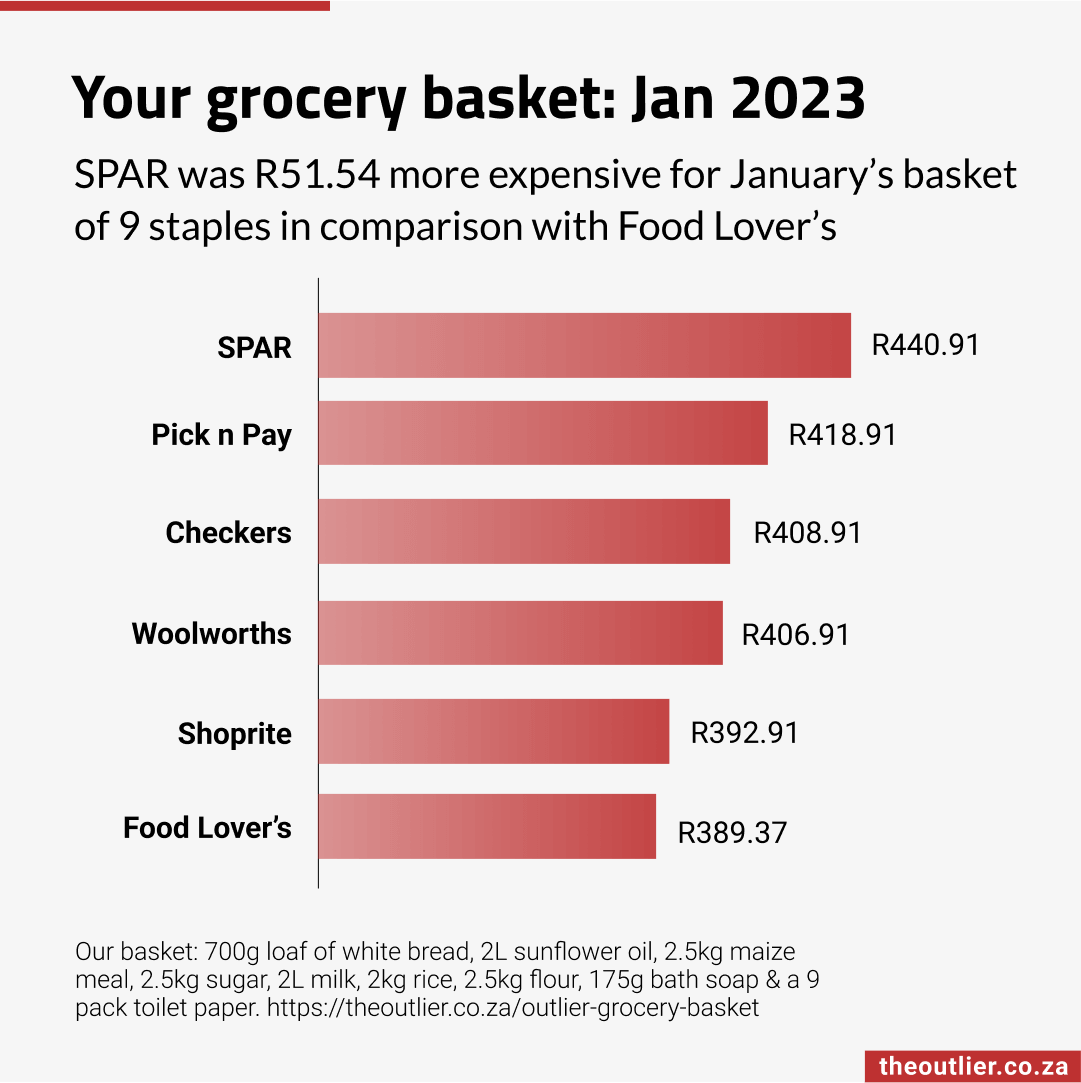

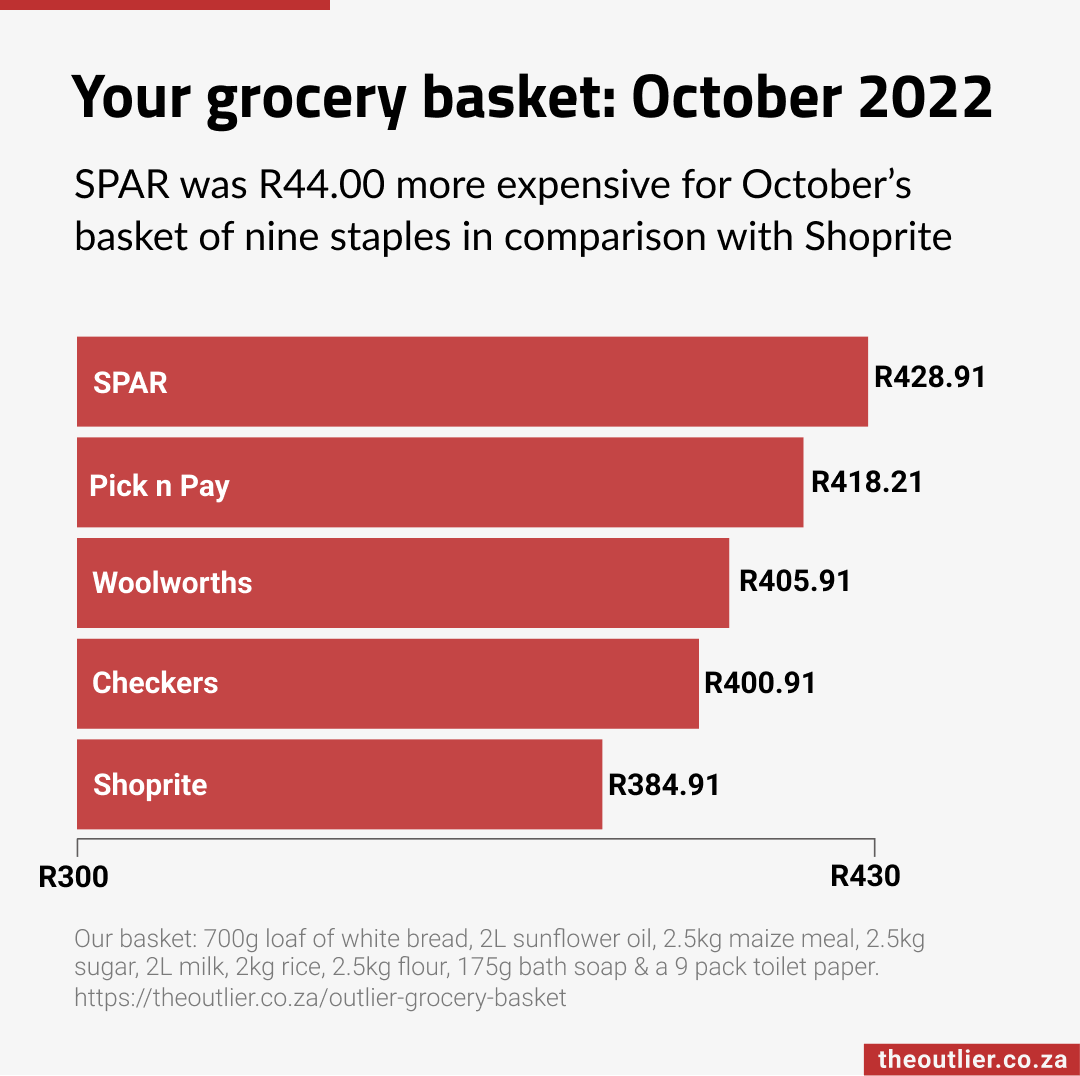

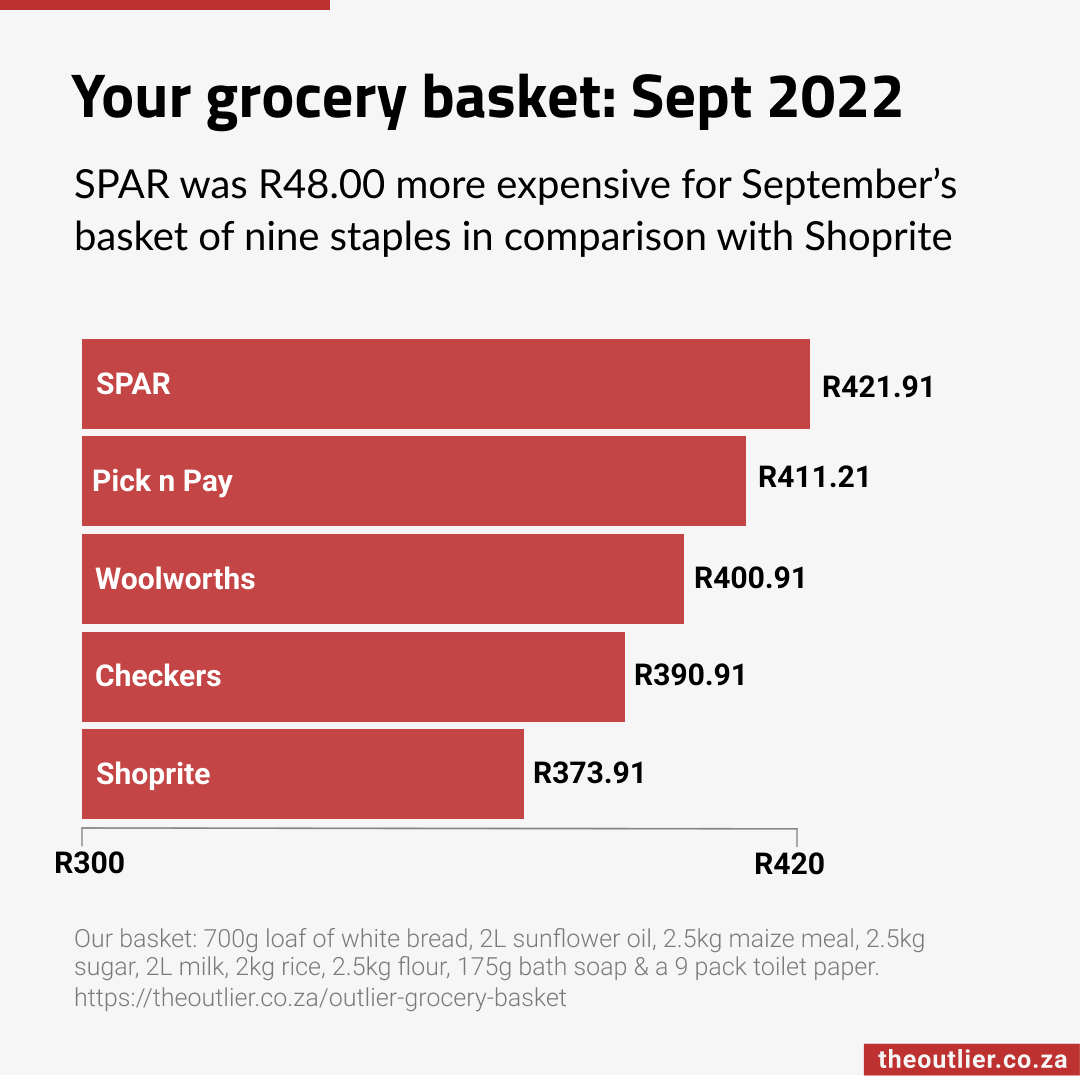

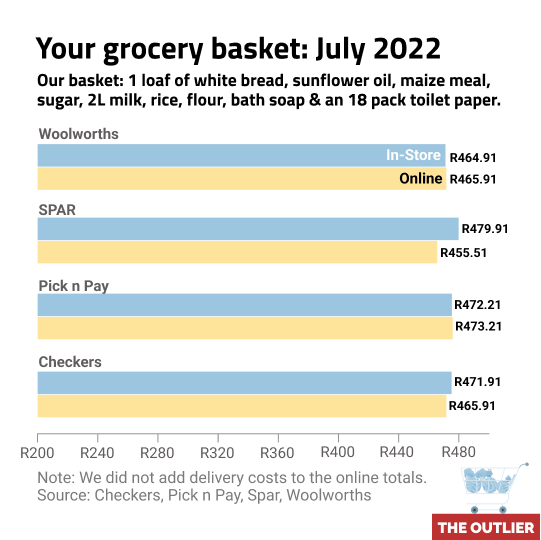

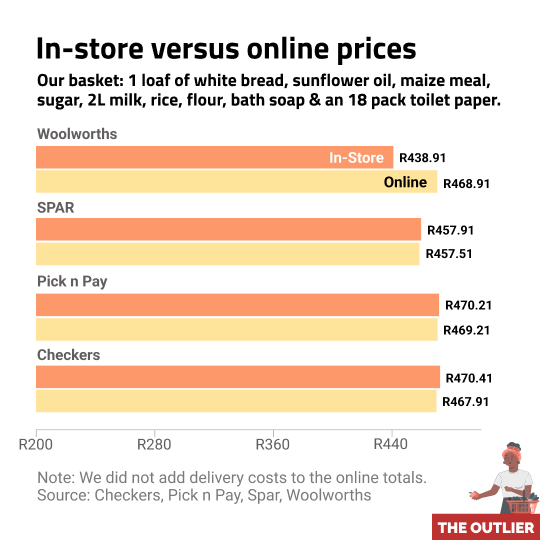

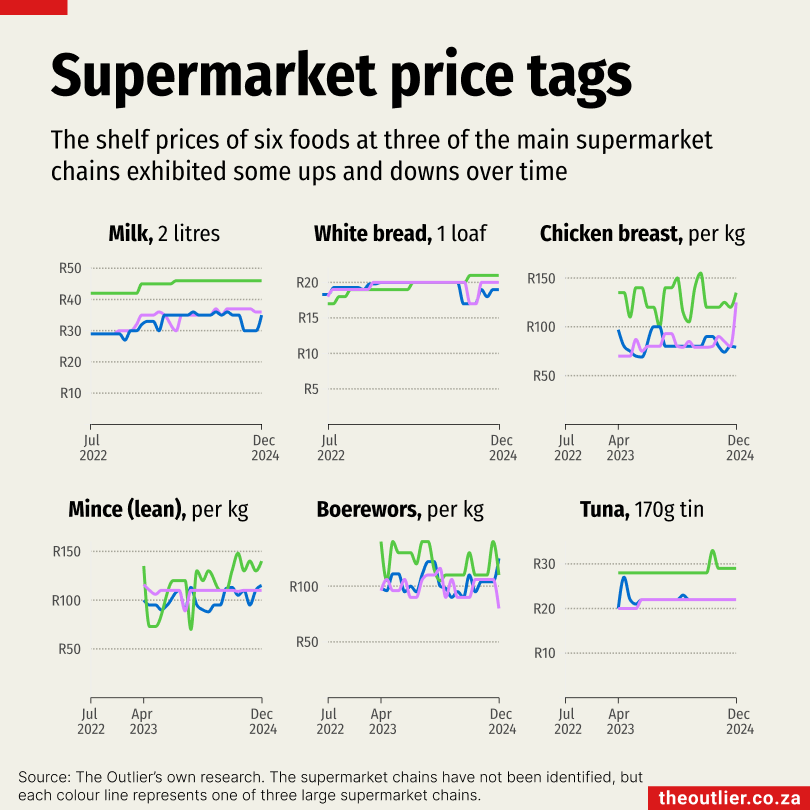

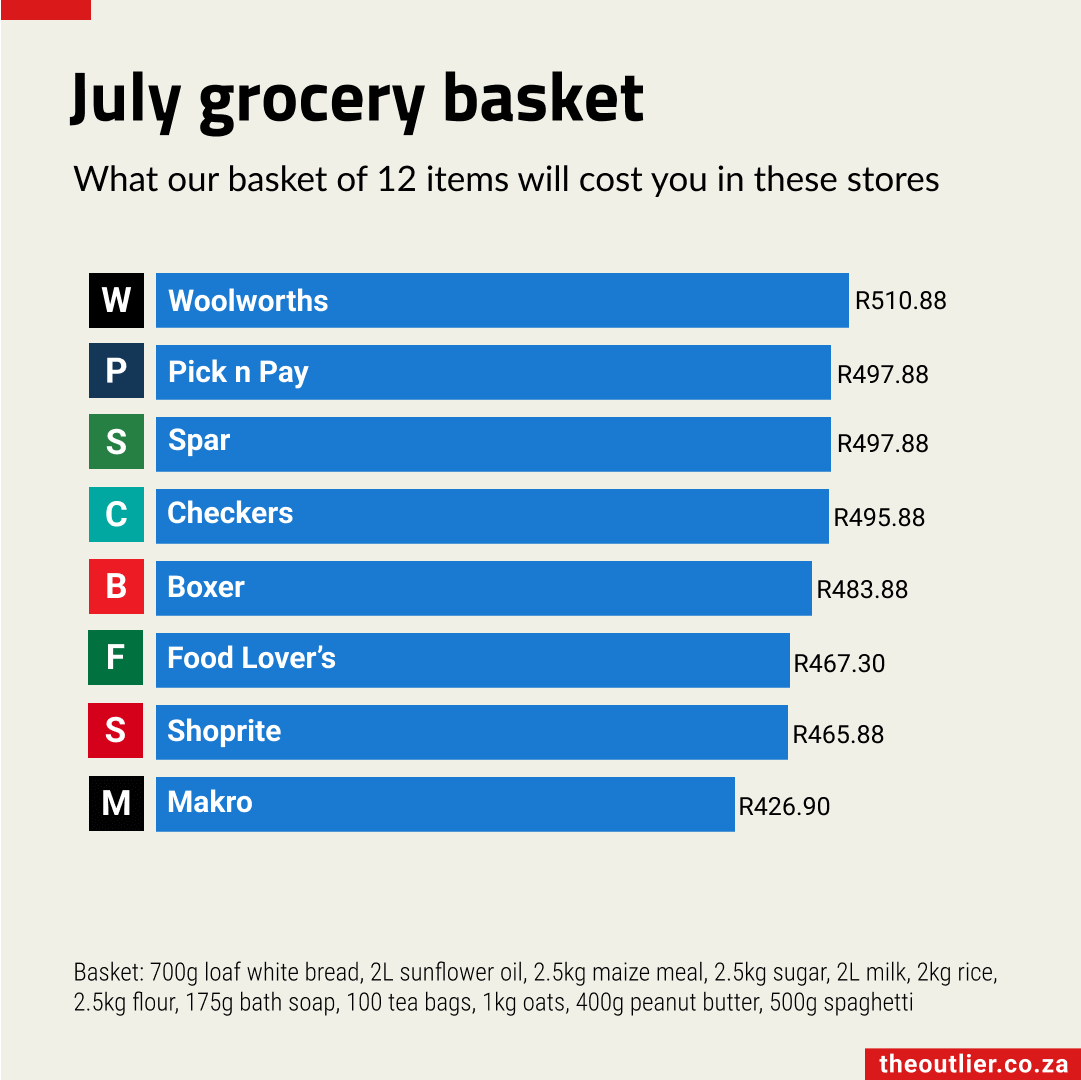

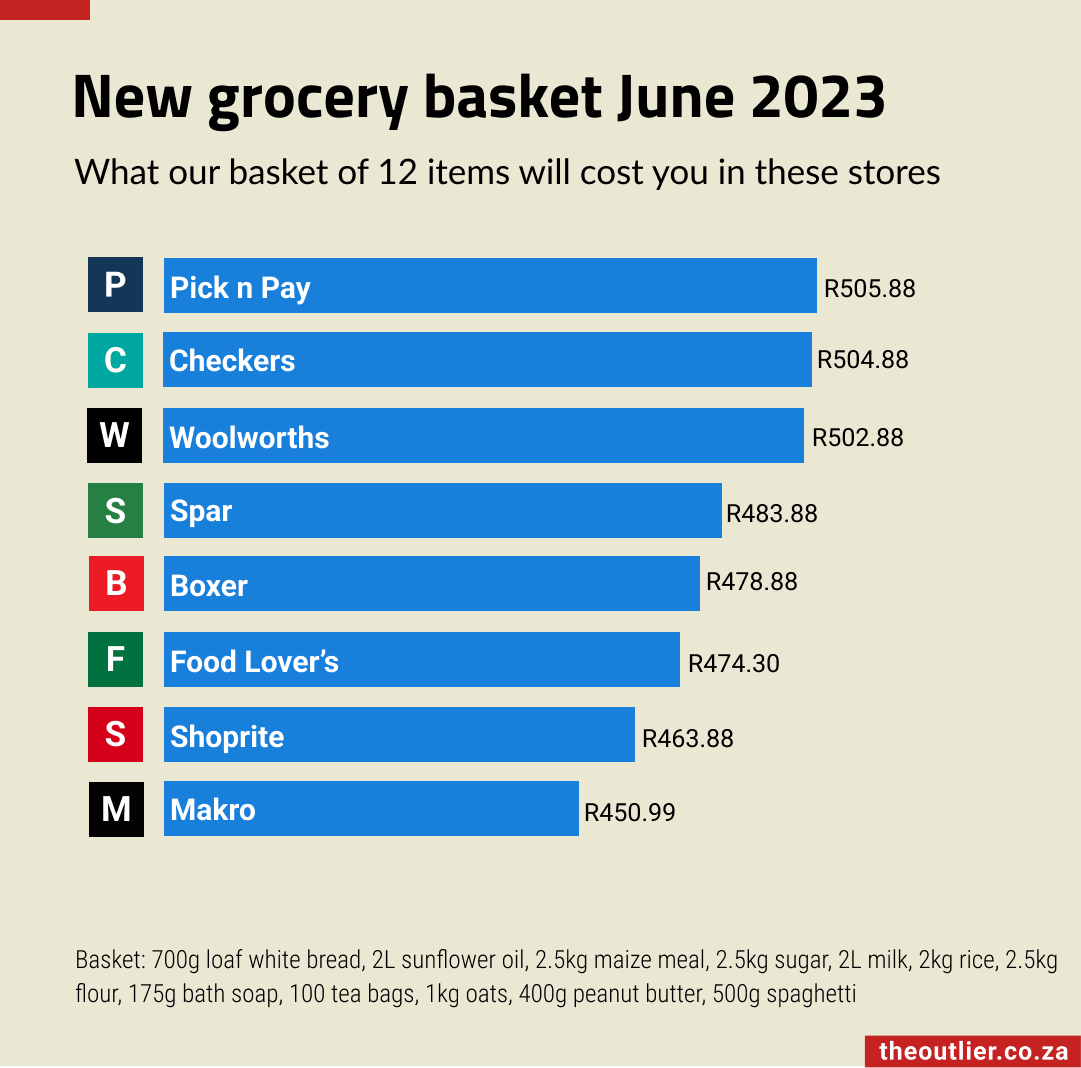

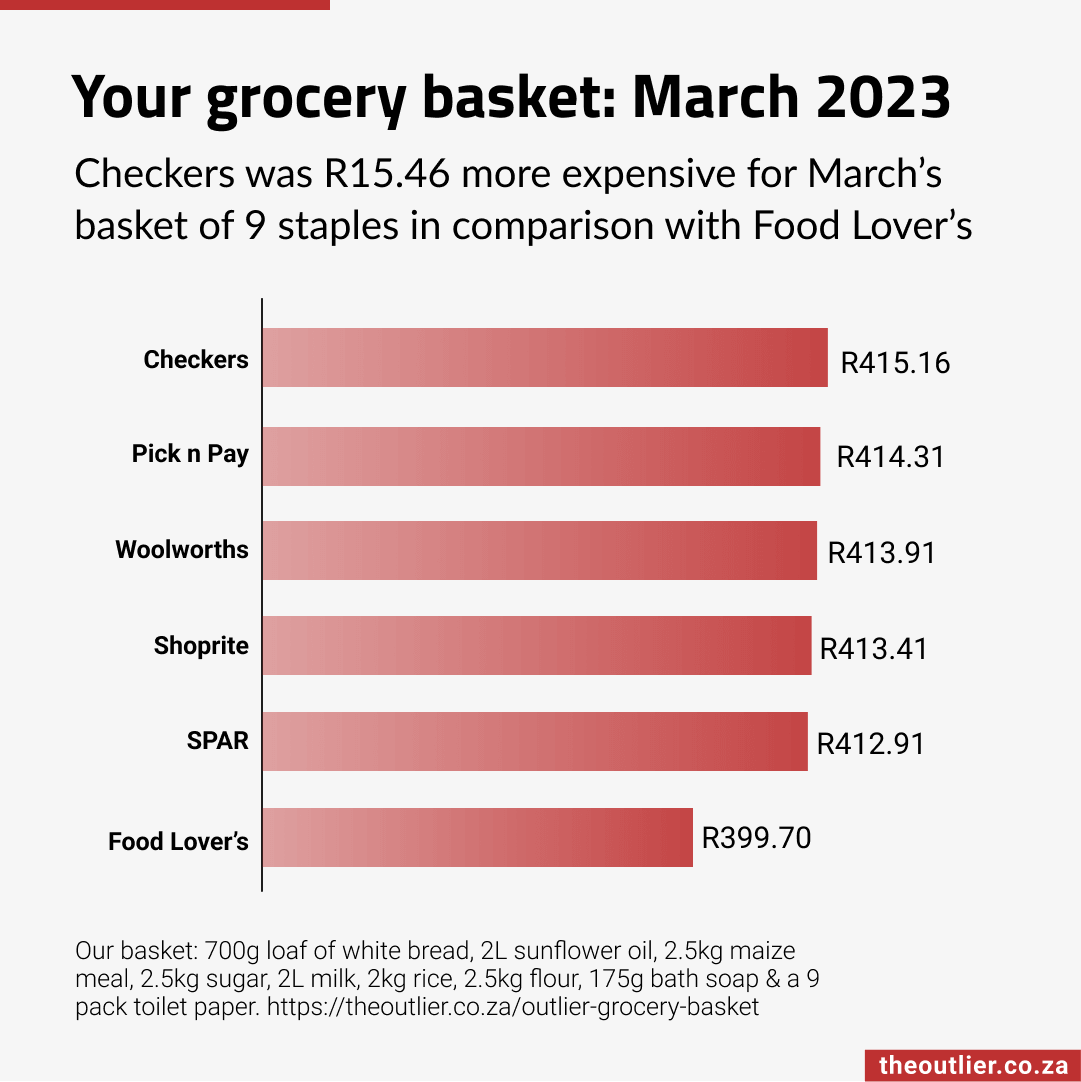

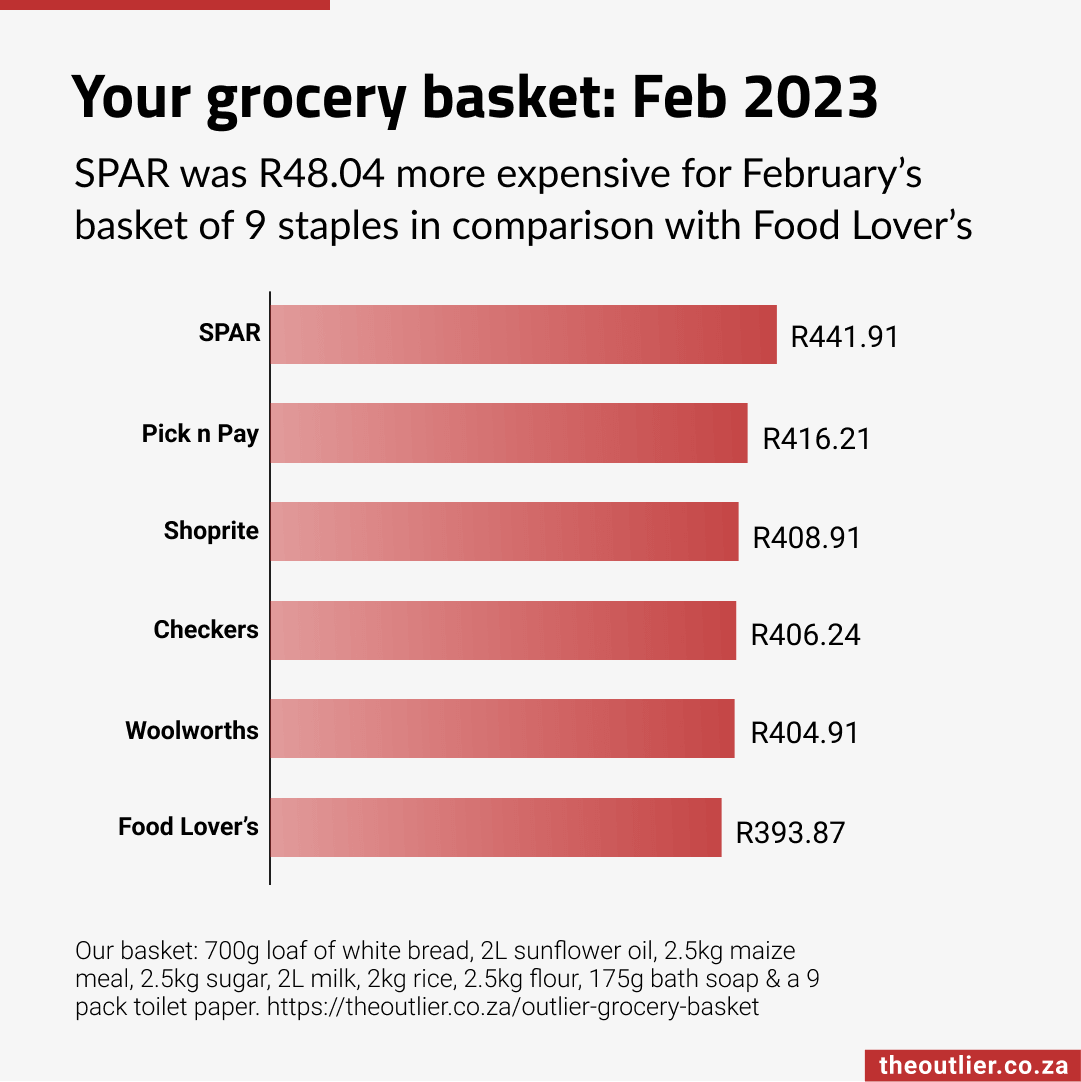

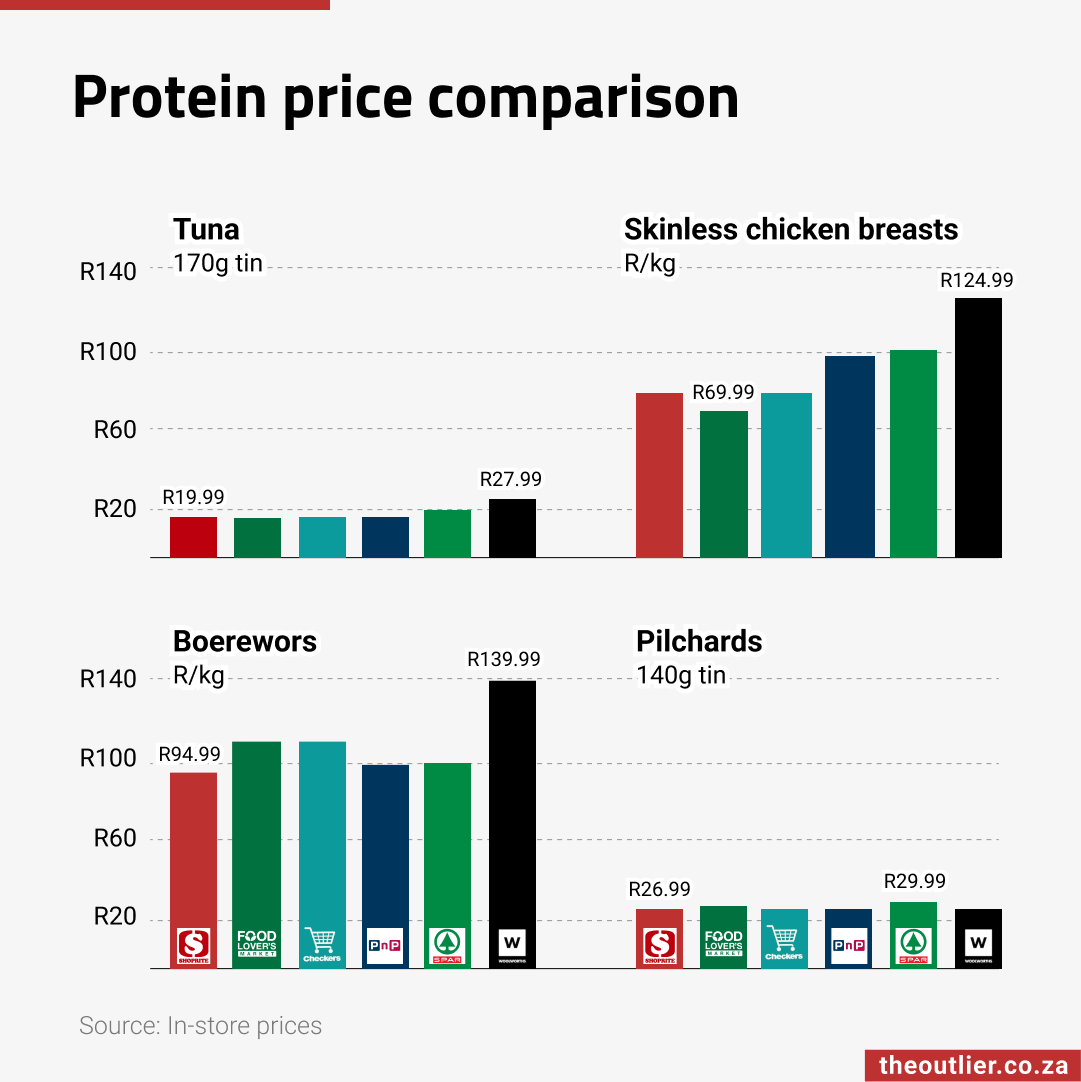

Since July 2022, The Outlier has tracked the prices of goods at six of South Africa’s major supermarket chains. We have collected the shelf prices of a set list of goods every month from Checkers, Pick n Pay, Food Lovers Market, Spar and Woolworths.

This chart highlights the prices of six food items commonly bought by middle-class shoppers: milk, white bread, chicken breast, mince, boerewors and tinned tuna. Each coloured line represents one of three unnamed national retailers, highlighting the fluctuating nature of prices over time.

While supermarket pricing often depends on seasonality and supply chains, it is also affected by brand-specific promotions, loyalty programmes and bulk discounts. These pricing strategies have complicated efforts to capture consistent data over time.

The Outlier’s data does not extend back far enough to show the pandemic-related price jumps over 2020 and 2021, but it does underscore how supermarket pricing can vary widely for the same item.

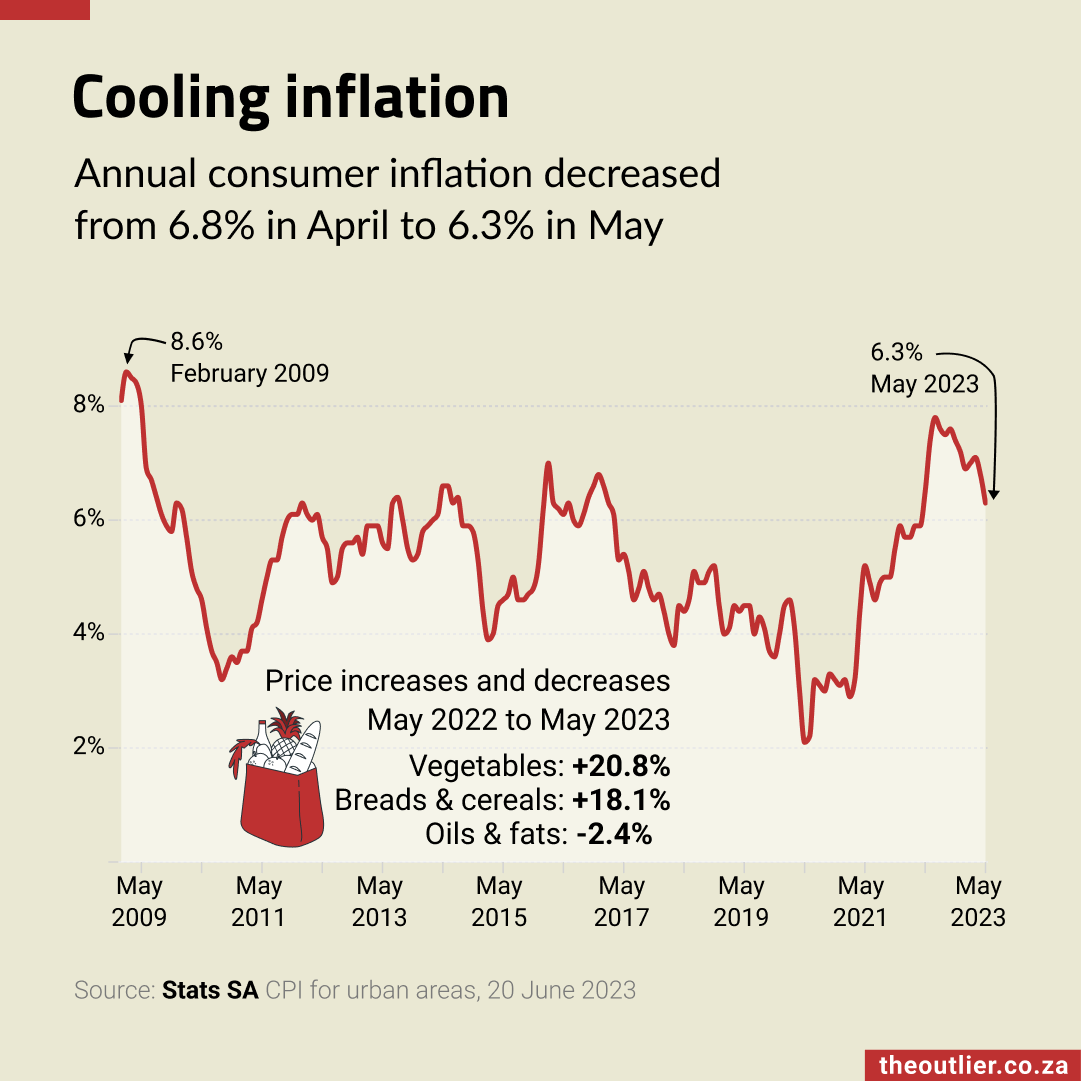

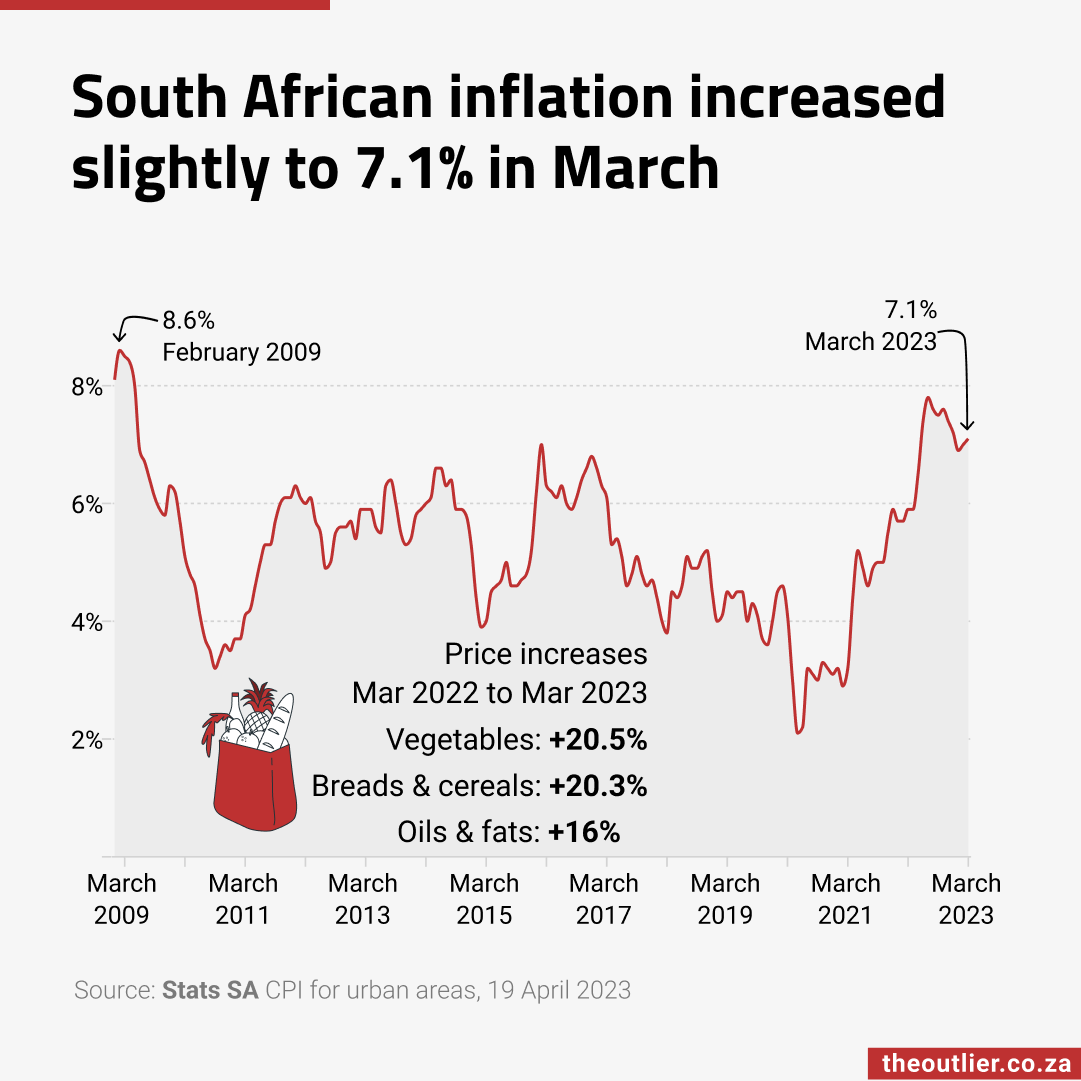

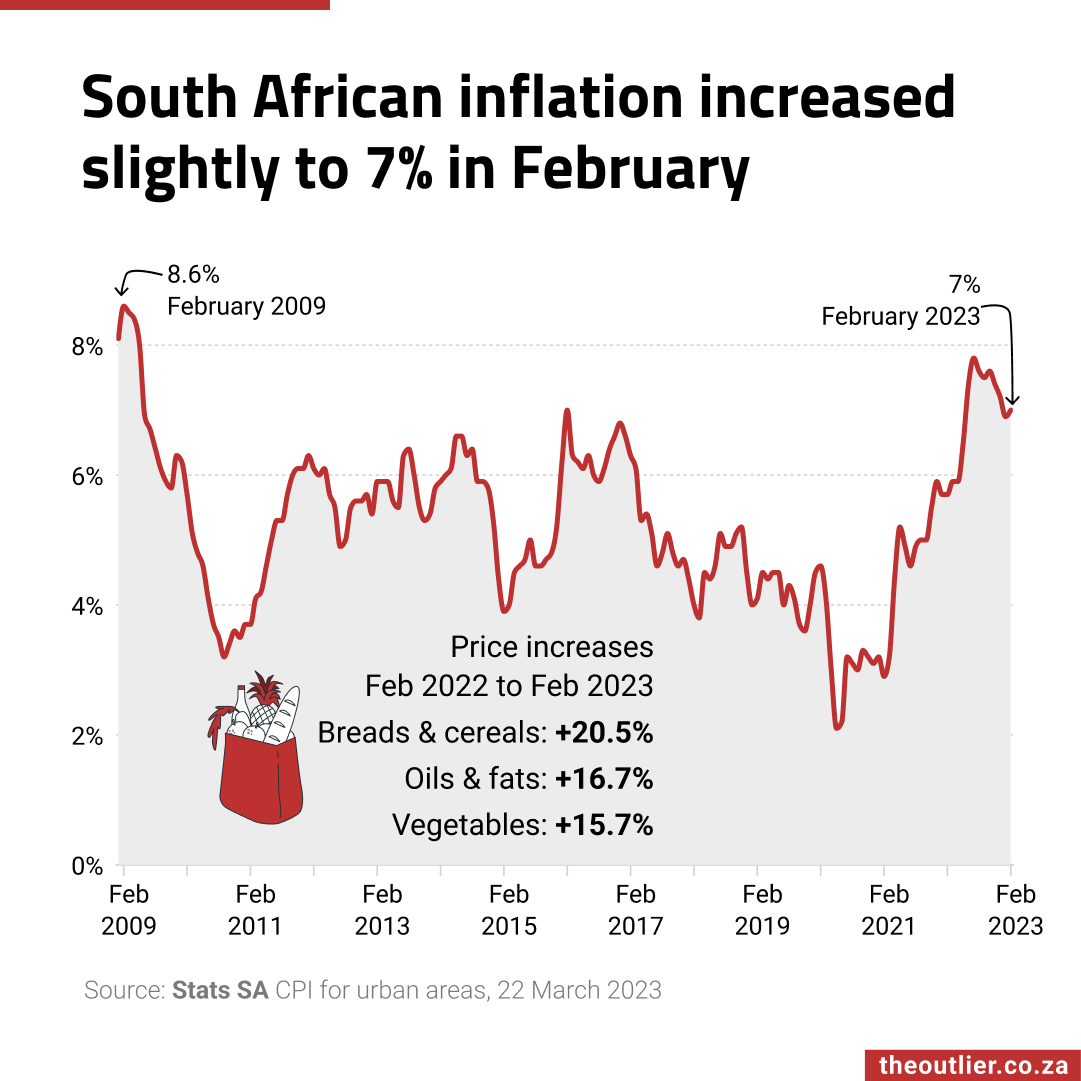

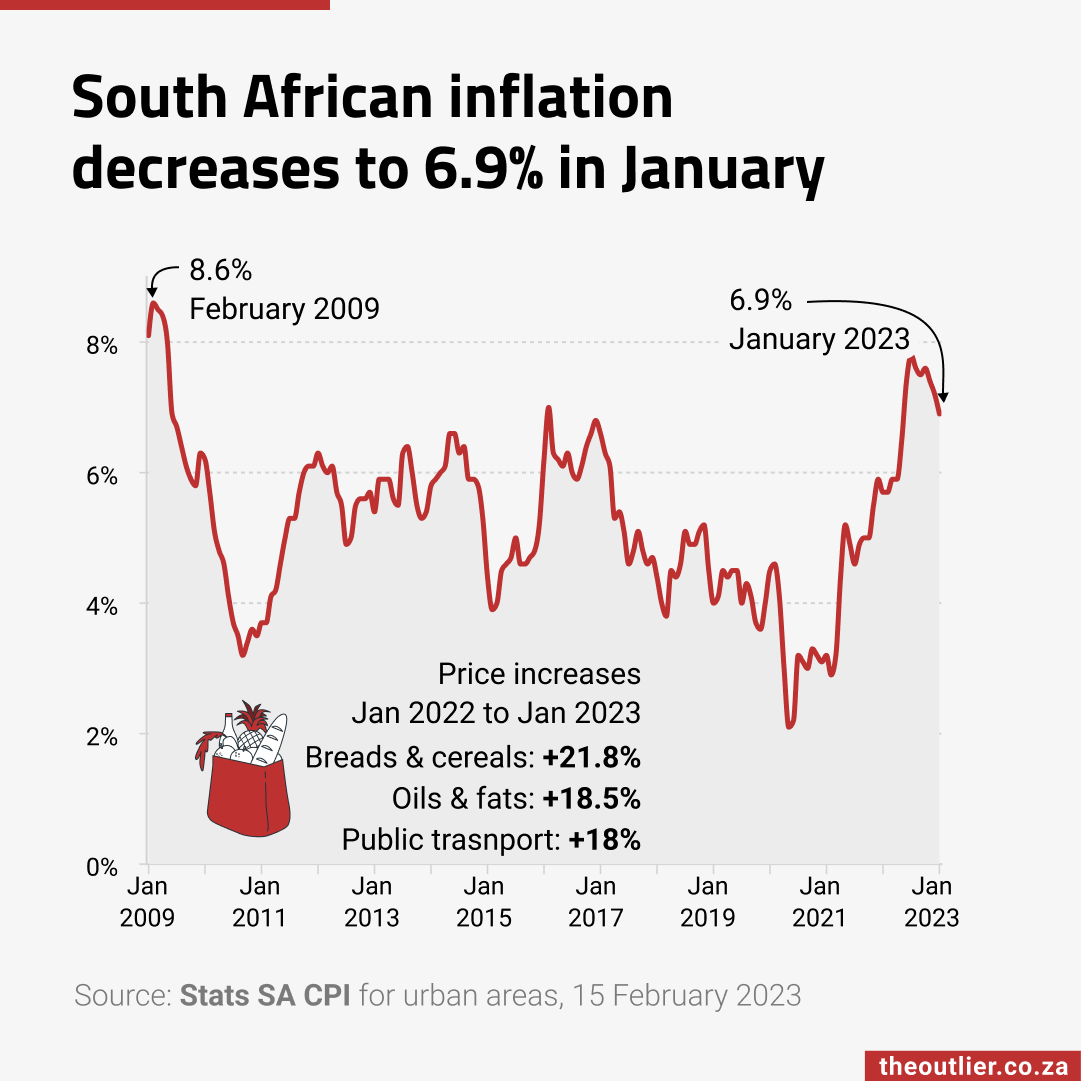

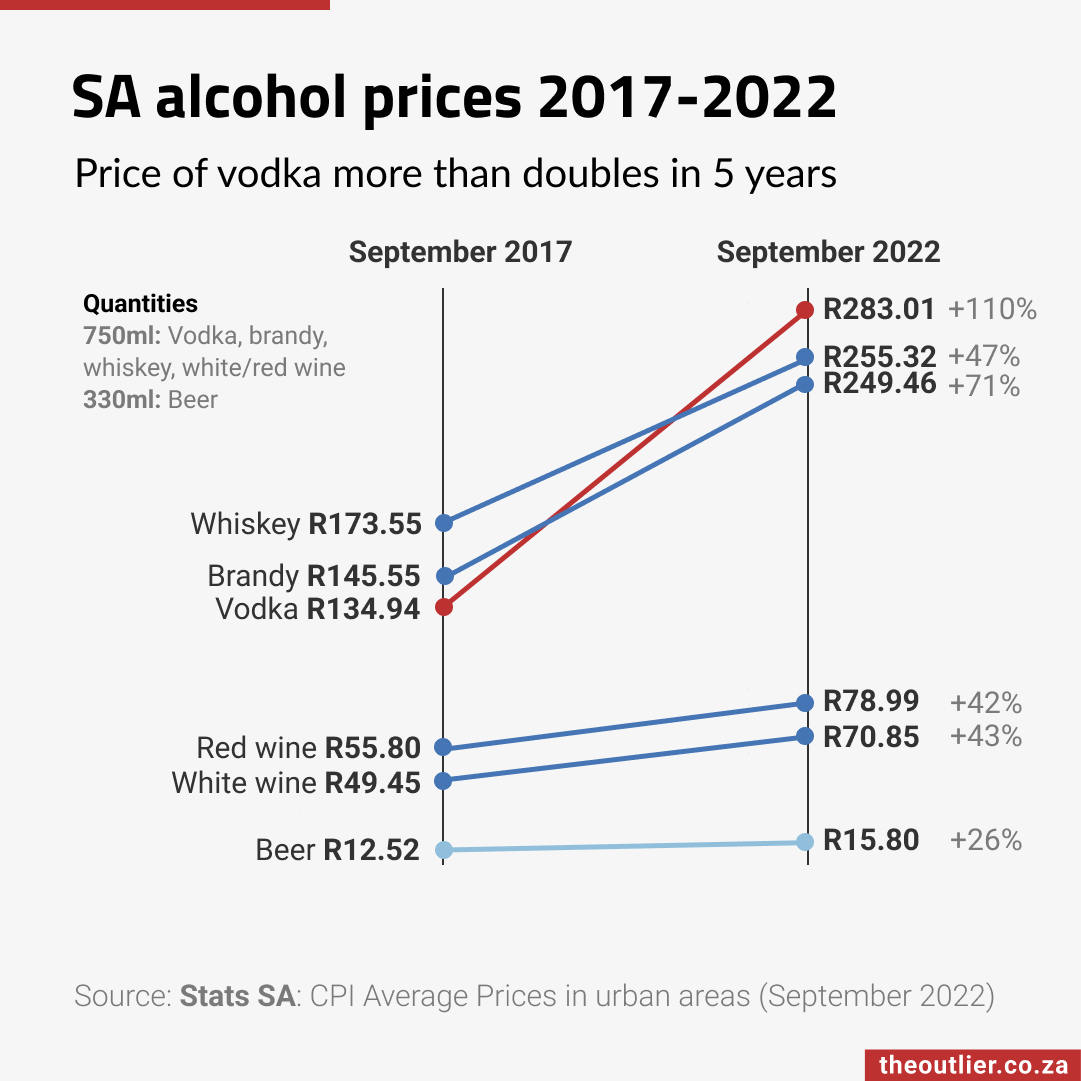

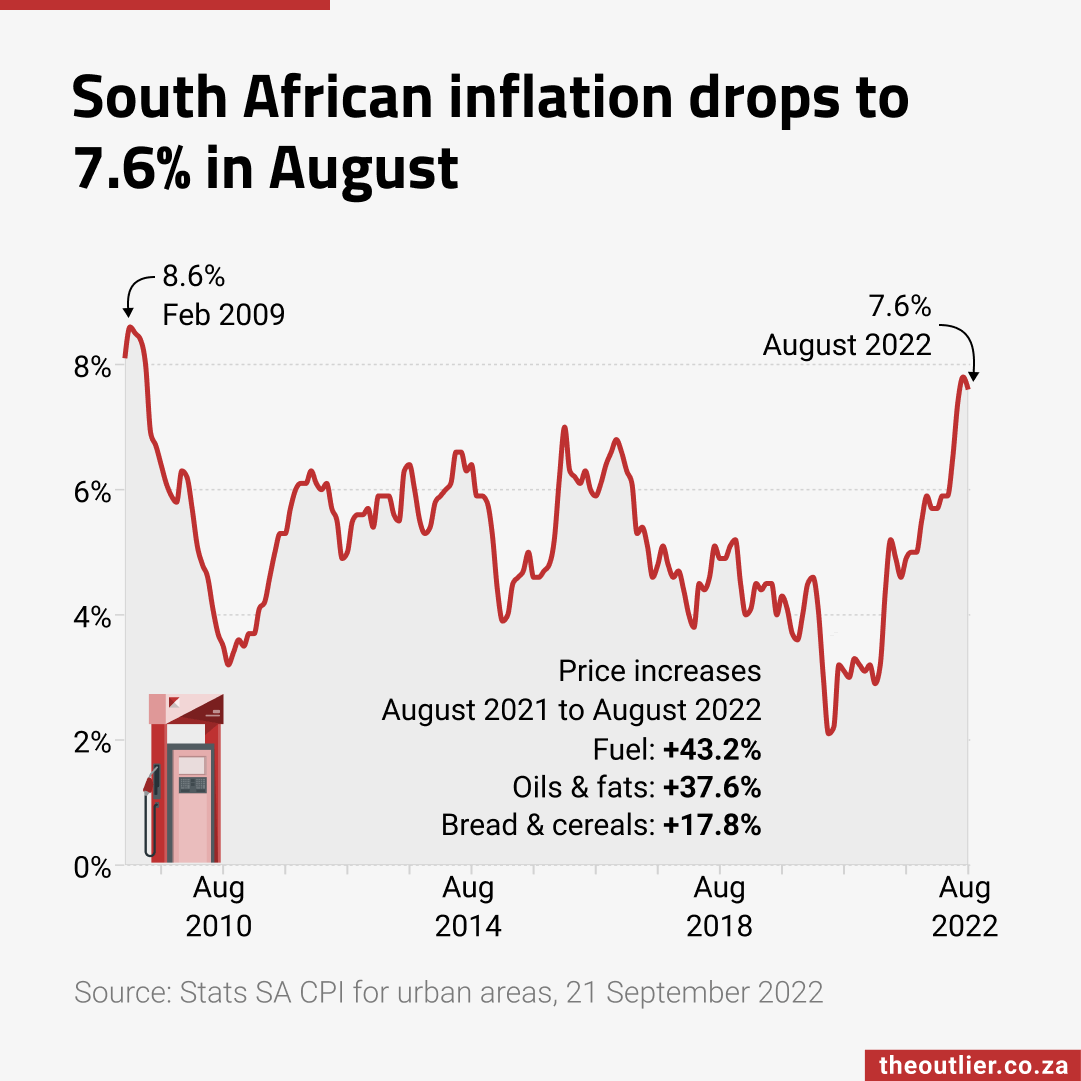

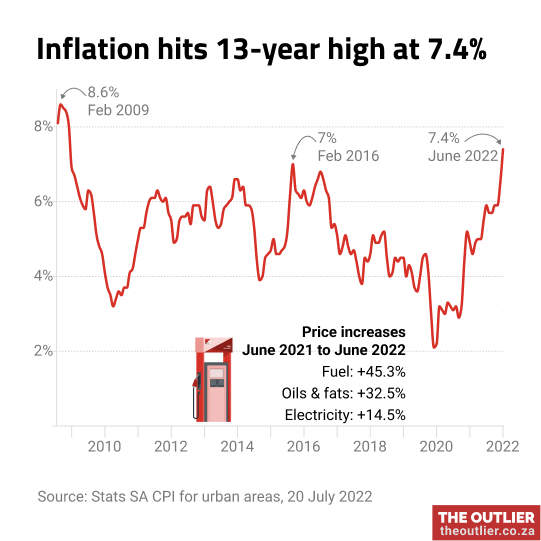

South Africa’s inflation rate is easing, with 2024 recording an average inflation of 4.4%, down from 2023’s average of 6%, according to Statistics SA.

However, inflation measures the change in the cost of goods, not their actual cost. Prices always rise over time, but when inflation cools, price hikes slow down.

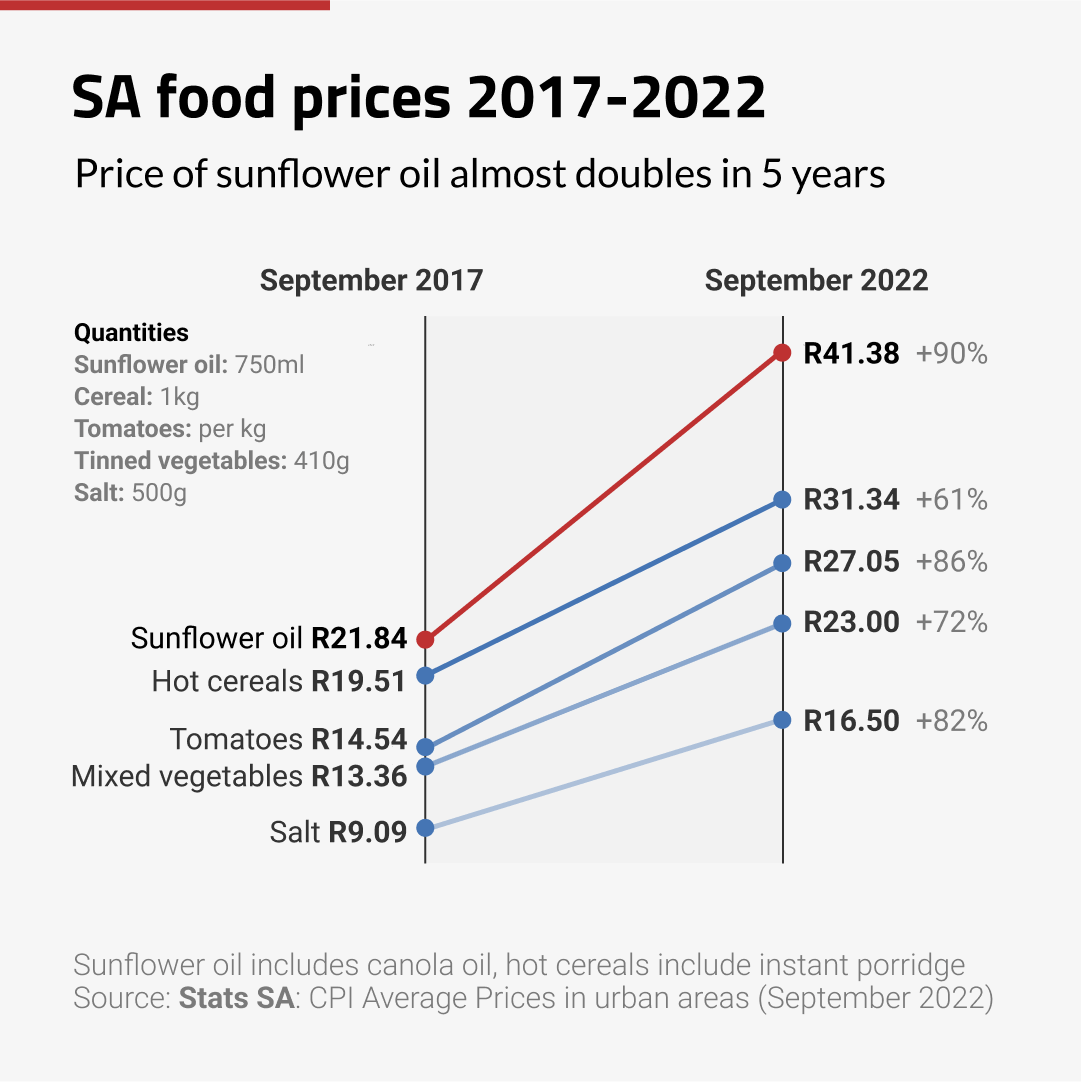

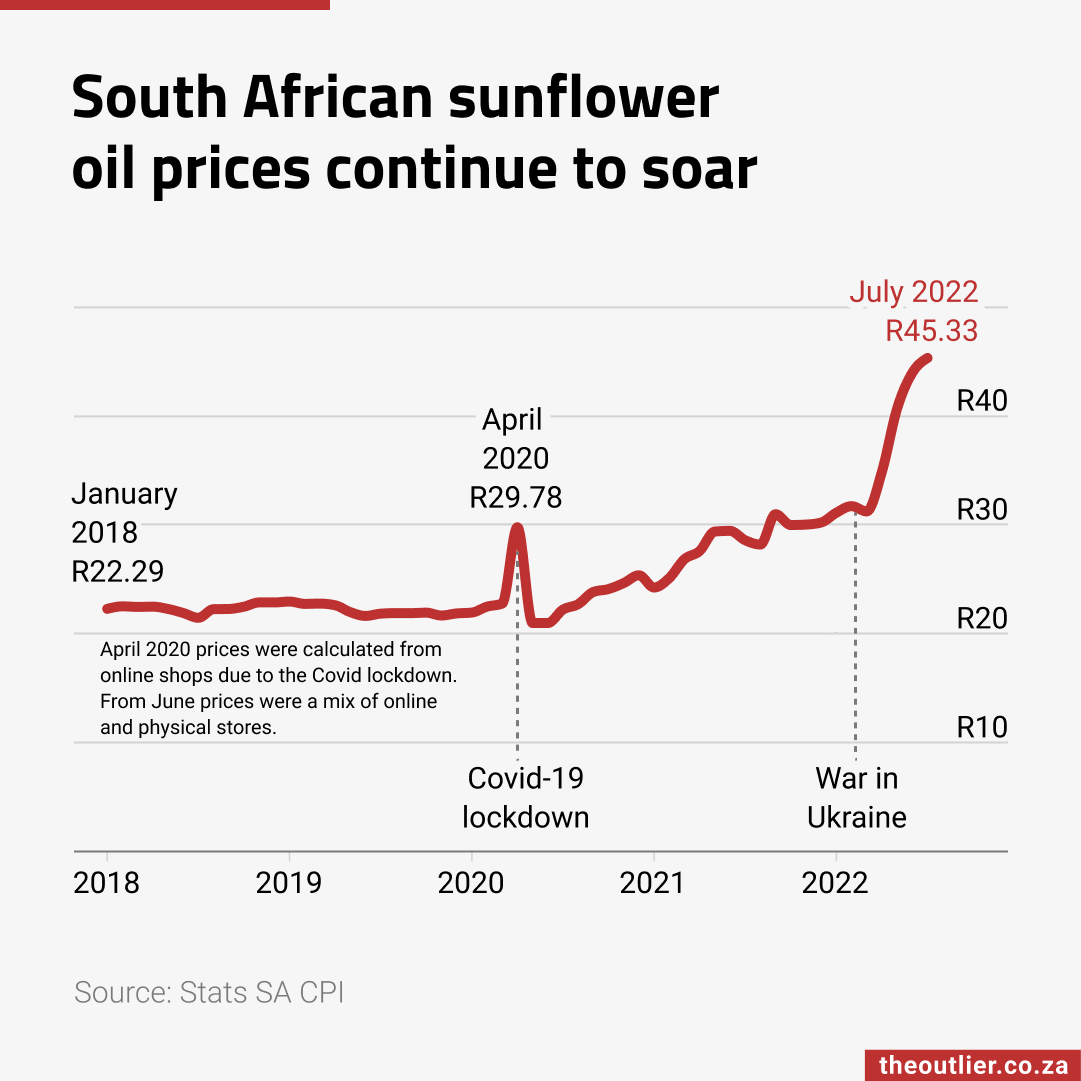

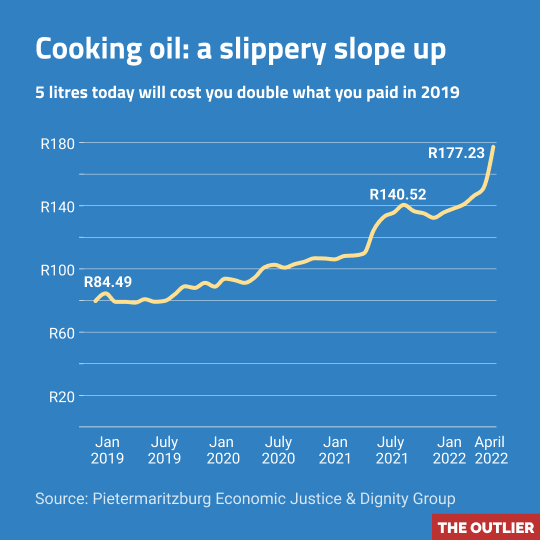

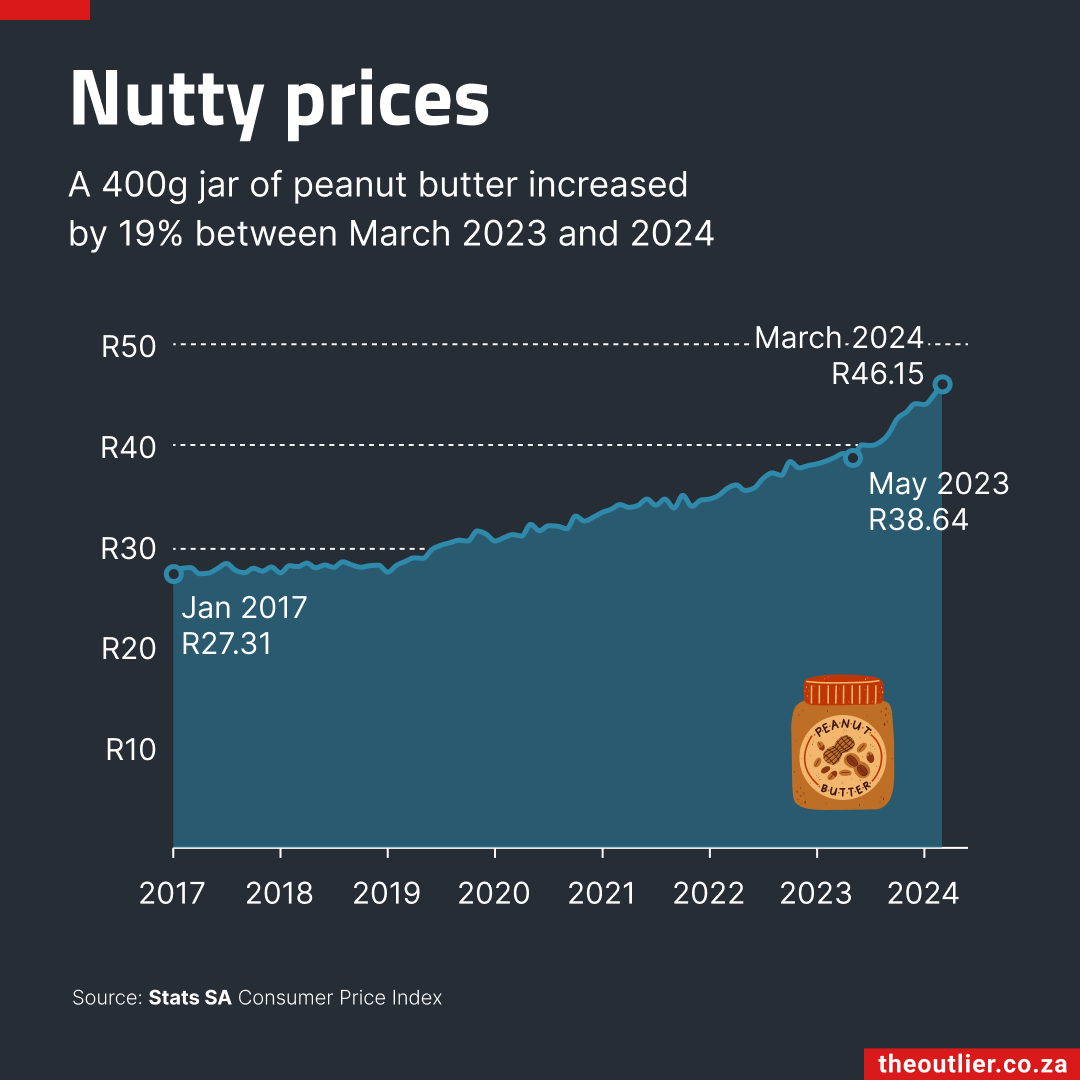

Stats SA data show that in the past five years the price of bread has increased by 41%, milk by 29%, cooking oil by 62%, peanut butter by 54% and sugar by 56%.

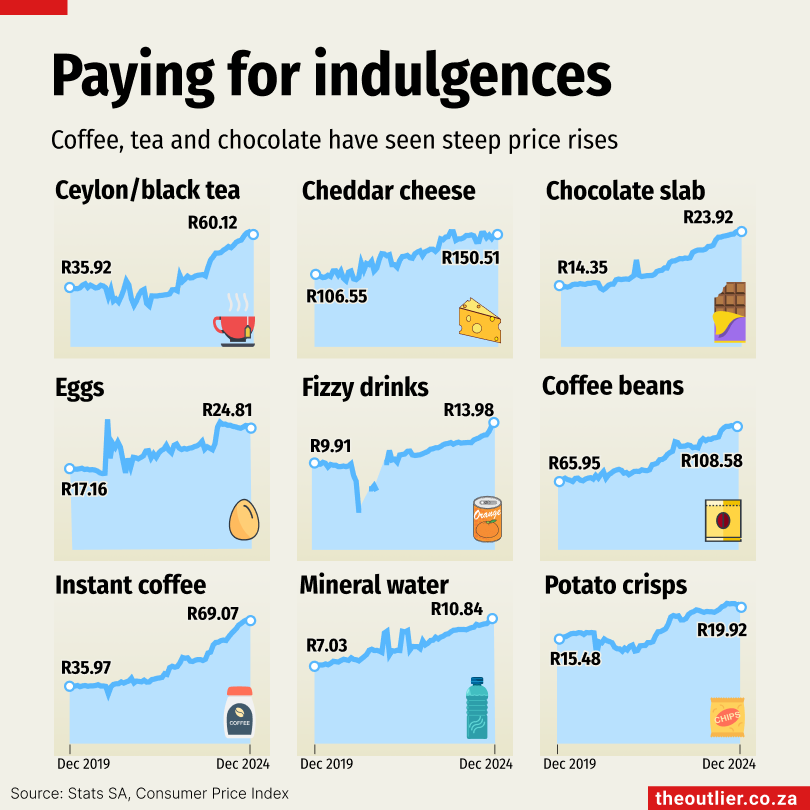

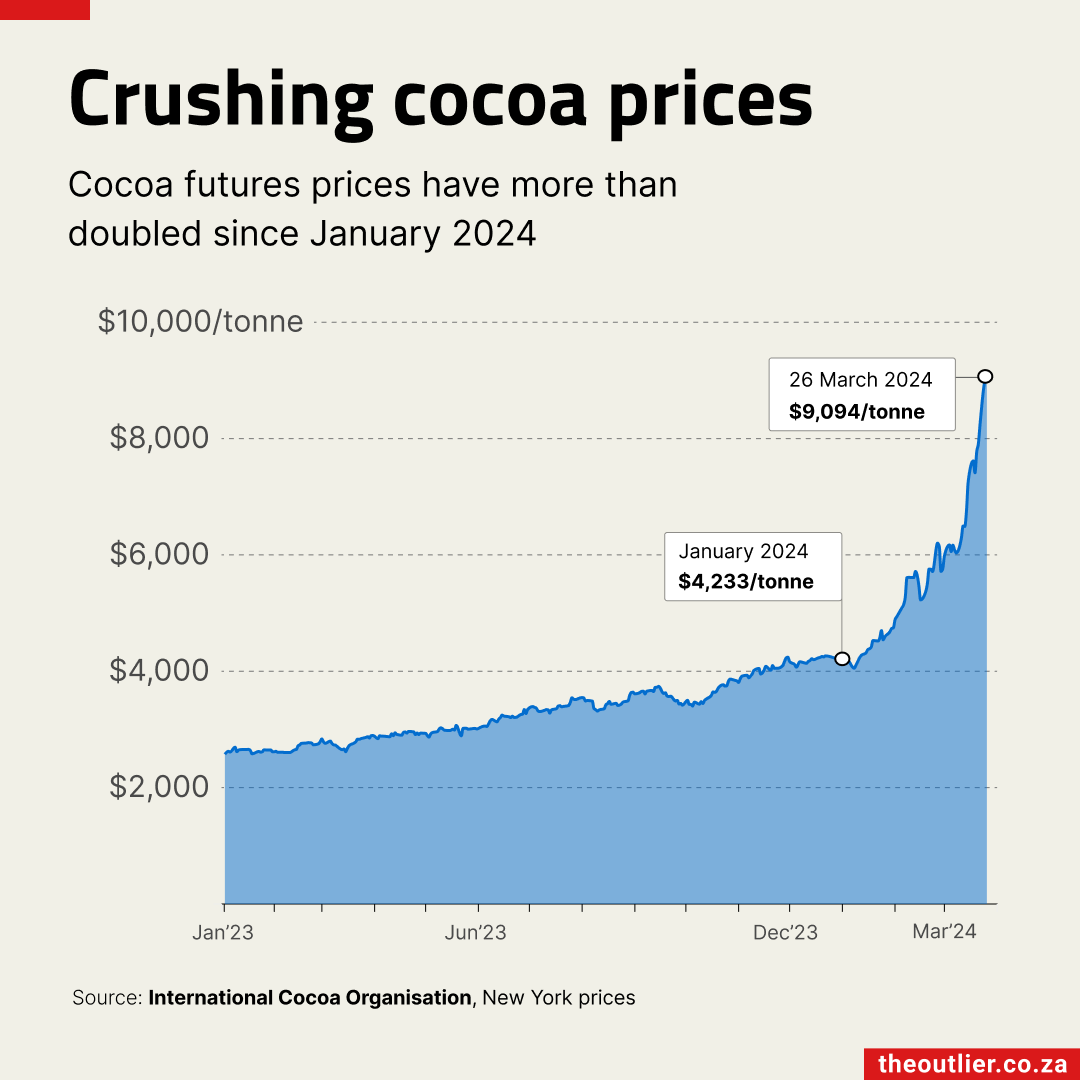

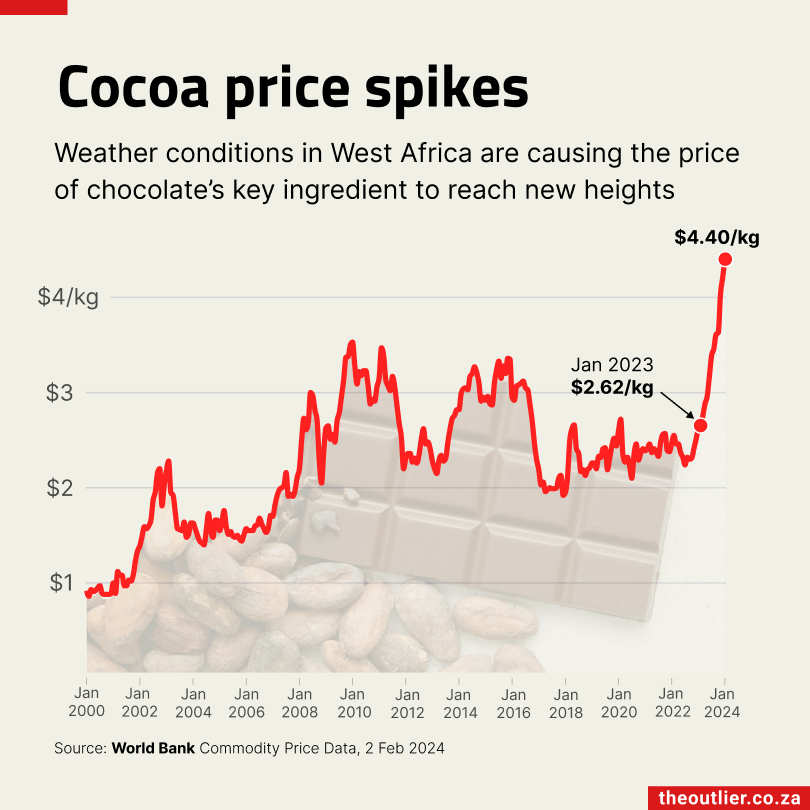

Indulgent treats have also seen steep increases. The price of Ceylon tea nearly doubled between December 2019 and December 2024. And a global shortage of cocoa beans has driven up the price of chocolate (+66.7%) and instant coffee (+92%).

To calculate the Consumer Price Index, Stats SA uses the cost of services and goods, including food items and non-alcoholic beverages bought by the average household each month.

- Check out The Outlier’s Consumer Price Dashboard for more

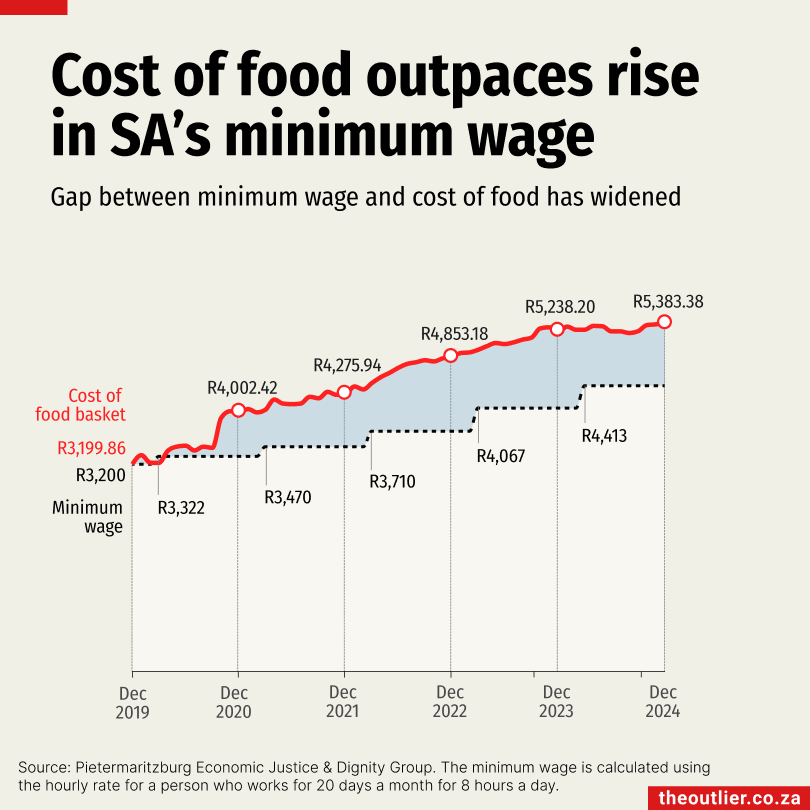

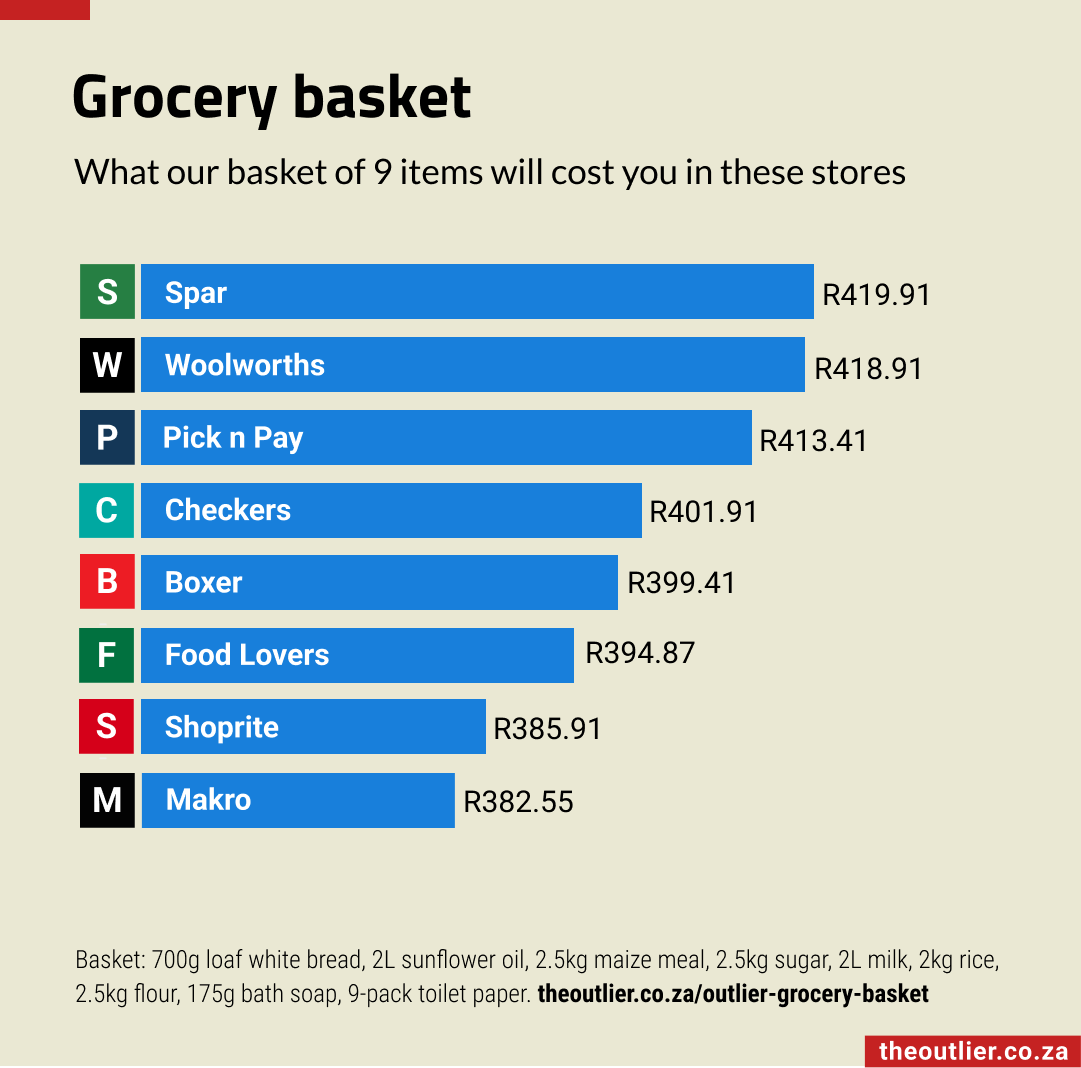

The gap between what minimum wage workers earn in South Africa and the cost of a basic food basket is widening.

The

The cost of this basket shot up during the Covid-19 pandemic in 2020 – and has never really recovered. Over the past five years, the cost of the same basket has increased by R2,183.

Over the same period, the minimum wage has risen by roughly R1,200 – a 38% increase compared with the 68% increase in the price of the food basket.

In December 2024, minimum wage was around R4,400 a month for full-time work (20 days a month). According to Statistics SA, half of the country’s 13-million ‘employees’ earned R5,414 or less a month in 2022.

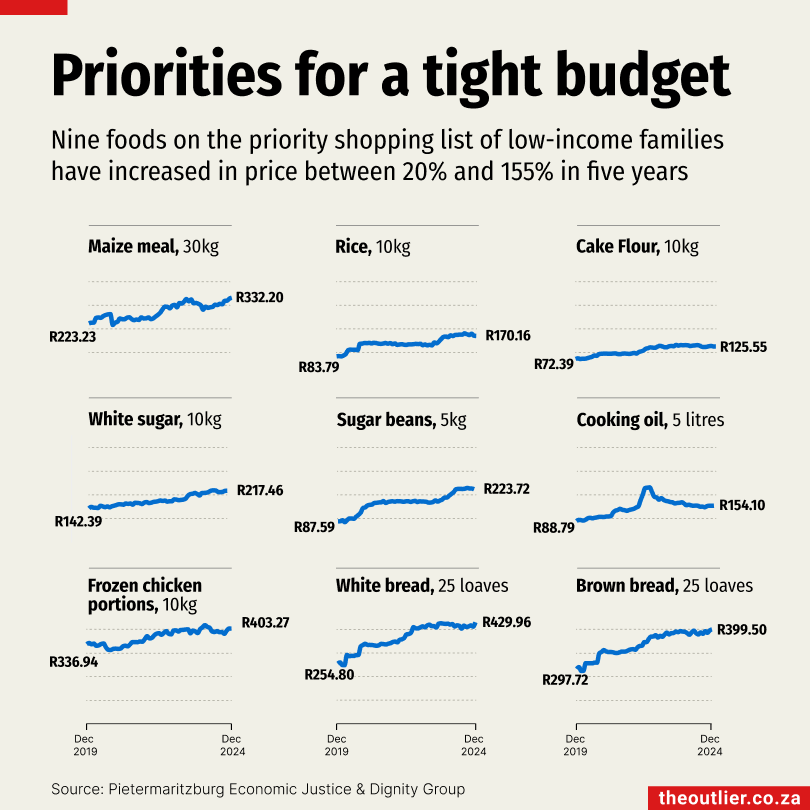

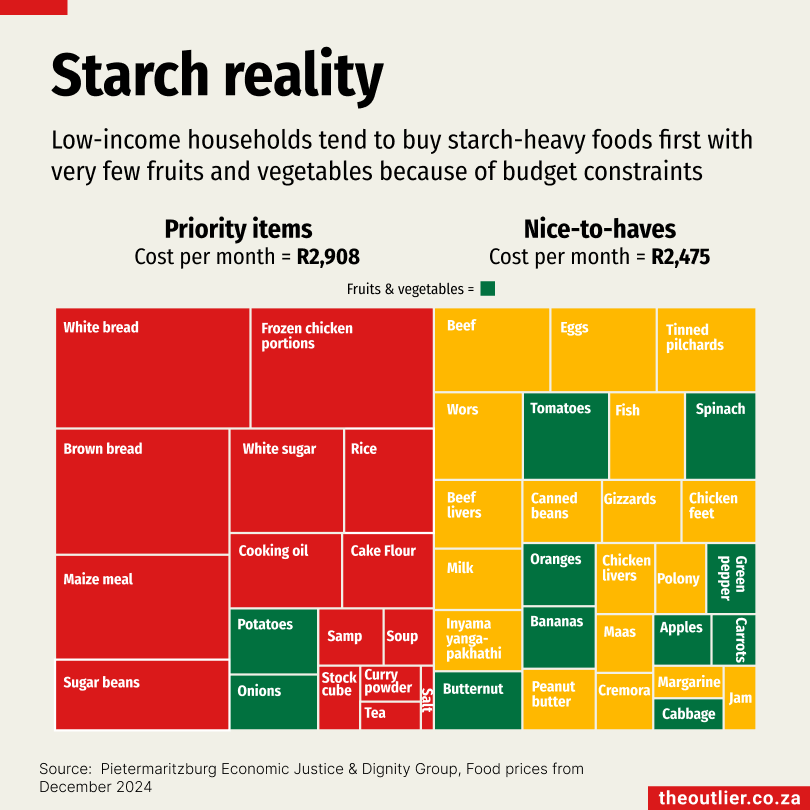

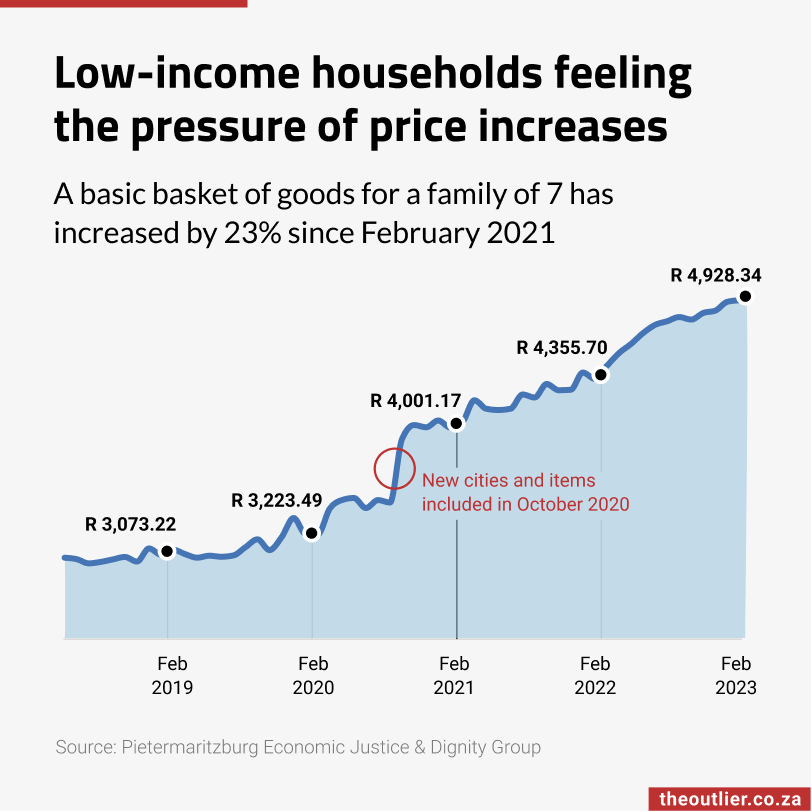

People living on limited budgets have to prioritise what they buy. For their Household Affordability Index, the Pietermaritzburg Economic Justice & Dignity Group (PMBEJD) tracks the prices of 44 items that are typically bought by women in low-income households of seven members.

The data includes items that women buy first to ensure their families are fed. The charts above highlight the price changes over five years for nine items considered essential, such as maize meal, rice and bread.

To buy just these items costs R2,900 a month. The price of sugar beans, a key staple, has risen by 155% in the past five years.

The priority foods may be filling, but include only two vegetables. Adding diversity to the meals with vegetables, proteins and other nutrients would cost an additional R2,475 a month. Prices of fruits and vegetables also tend to fluctuate seasonally, which can strain budgets even further.

People living on limited budgets have to prioritise what they buy. For their Household Affordability Index, the Pietermaritzburg Economic Justice & Dignity Group (PMBEJD) tracks the prices of 44 items that are typically bought by women in low-income households of seven members.

The data includes items that women buy first to ensure their families are fed. The charts above highlight the price changes over five years for nine items considered essential, such as maize meal, rice and bread.

To buy just these items costs R2,900 a month. The price of sugar beans, a key staple, has risen by 155% in the past five years.

The priority foods may be filling, but include only two vegetables. Adding diversity to the meals with vegetables, proteins and other nutrients would cost an additional R2,475 a month. Prices of fruits and vegetables also tend to fluctuate seasonally, which can strain budgets even further.

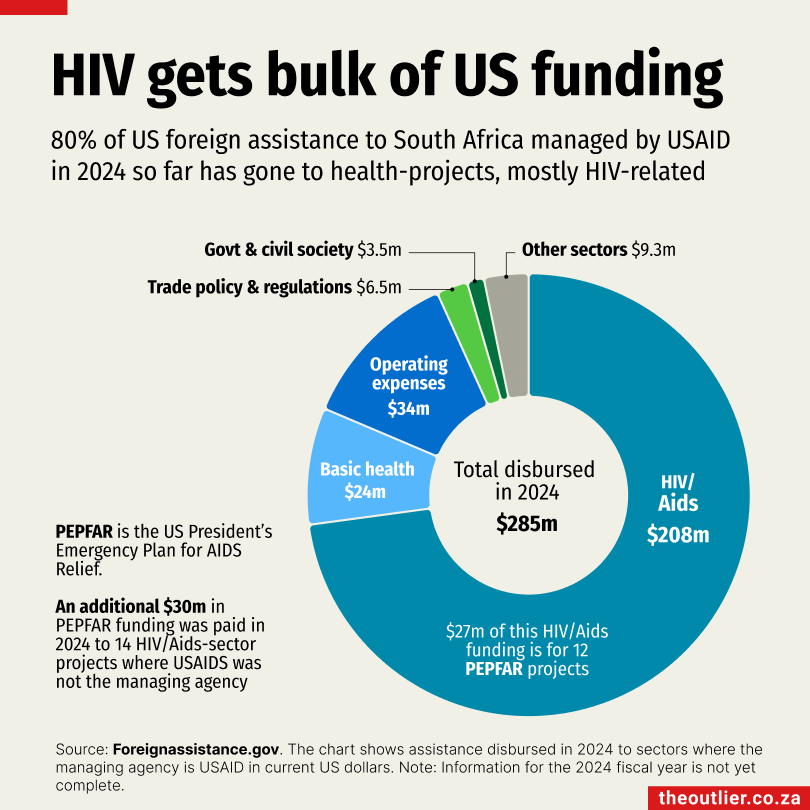

South Africa receives millions of dollars in aid from the US government, primarily for HIV/Aids programmes. On his first day as US president, Donald Trump froze all US foreign aid for 90 days, halting international programmes, causing layoffs and confusion.

According to ForeignAssistance.gov, the US paid out $72-billion in aid in 2023 and $41-billion so far in 2024. Programmes in SA received $545-million in 2023 and $335-million this year, mostly for health-related projects, like the President’s Emergency Plan for Aids Relief (Pepfar).

Pepfar was granted a waiver on 1 February to continue ‘urgent life-saving HIV treatment services’. But activities involving family planning, abortions, gender, diversity or inclusion programmes remain excluded.

USAID has managed 85% of this year’s payouts, including $27-million in Pepfar funds. A further $30-million was disbursed to Pepfar projects managed by other US agencies.

The six ‘top implementing partners’ are Wits University, Anova Health Institute, Right to Care, the TB/HIV Care Association, Aurum Institute and Health Systems Trust.

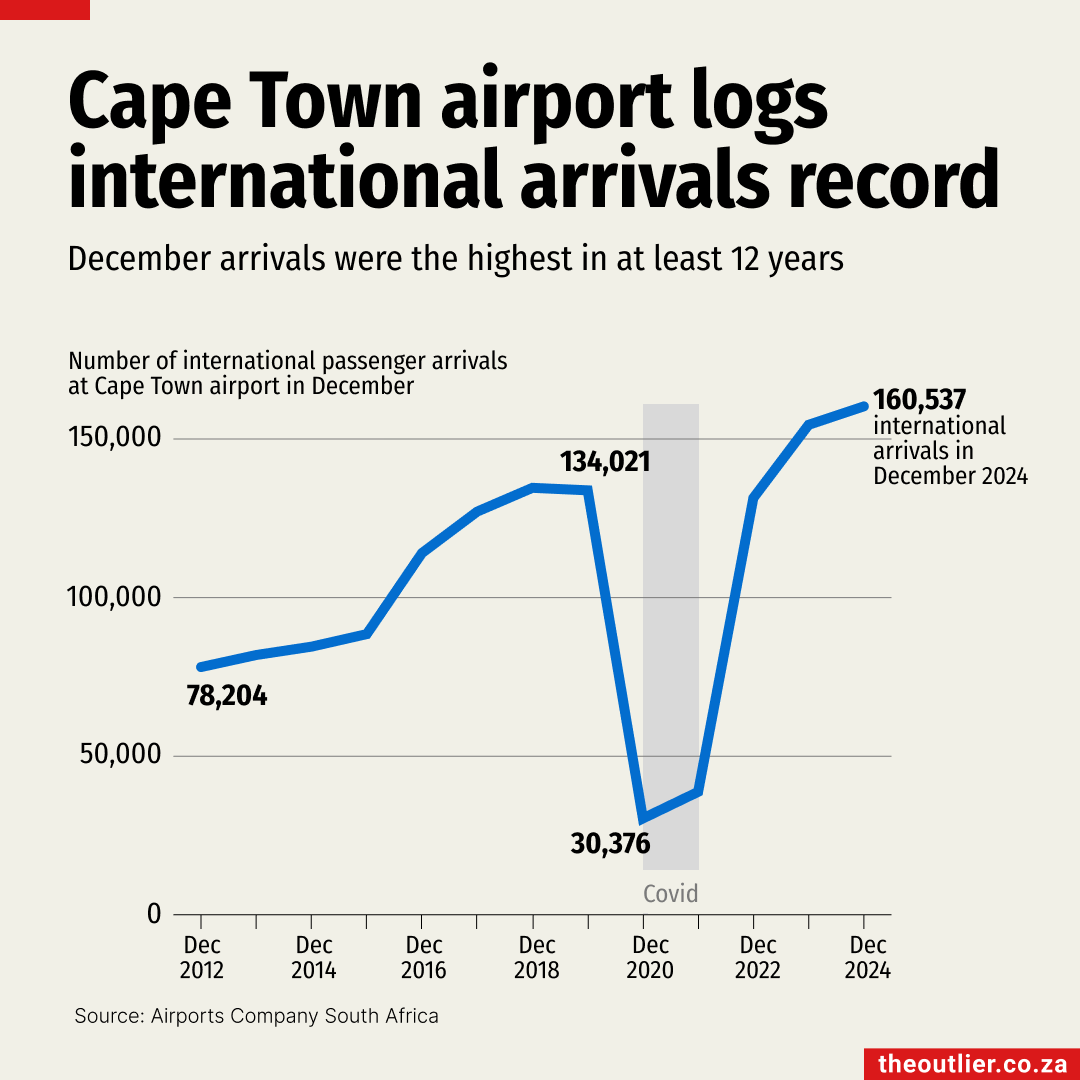

International flights carried more than 160,000 passengers to Cape Town International Airport in December 2024 – the highest number recorded for at least 12 years. December is the city’s busiest month for international arrivals, followed by January.

Overall, 2024 was a good year for Cape Town, with just over 1.4-million foreign visitors flying in, 120,000 more than 2023.

Cape Town airport’s international arrivals have clearly recovered from the Covid pandemic slump, unlike OR Tambo International in Johannesburg, South Africa’s busiest airport. Between 2017 and 2019, before pandemic travel restrictions were imposed, more than 4.5-million international passengers landed in Joburg a year. In 2024, just under 3.8-million arrivals were logged.

Direct flights from Europe appear to be driving the increase in arrivals in Cape Town. Three European airlines are set to offer more flights in 2025, according to Wesgro, the Western Cape’s tourism, trade and investment promotion agency.

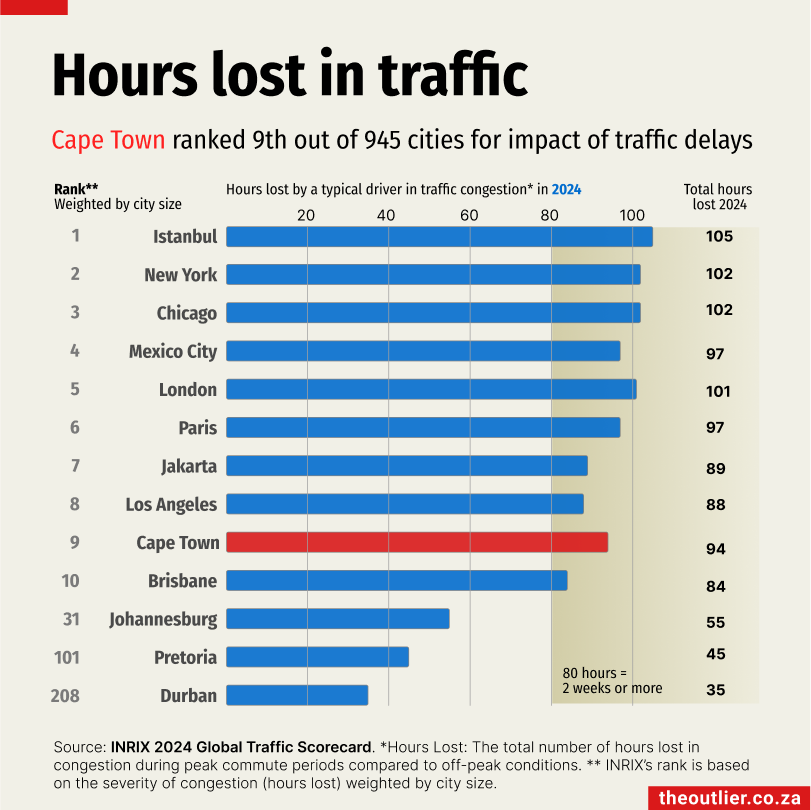

Cape Town was ranked ninth for traffic congestion out of more than 945 cities in the world in 2024. A typical driver lost 94 hours sitting in traffic, according to INRIX, a company that provides mobility data, in its 2024 Traffic Scorecard. That’s over two weeks lost just sitting in traffic.

Cape Town’s congestion appears to be worse than it was in 2023, when a typical driver lost 83 hours, according to INRIX’s calculations. Johannesburg ranks 31st on the INRIX scale, with drivers losing 55 hours to traffic congestion in 2024.

INRIX describes the total time lost as “the difference between driving during commute hours versus driving at night with little traffic”. Cities are ranked based on the severity of congestion (hours lost) weighted by city size.

Unfortunately, the 2024 Traffic Scorecard doesn’t include any African urban centres outside of South Africa, which is a pity because it would be interesting to see how Lagos, Nairobi and even Harare compare to Cape Town.

Istanbul was ranked as the city most-impacted by congestion in 2024, with 105 hours lost.

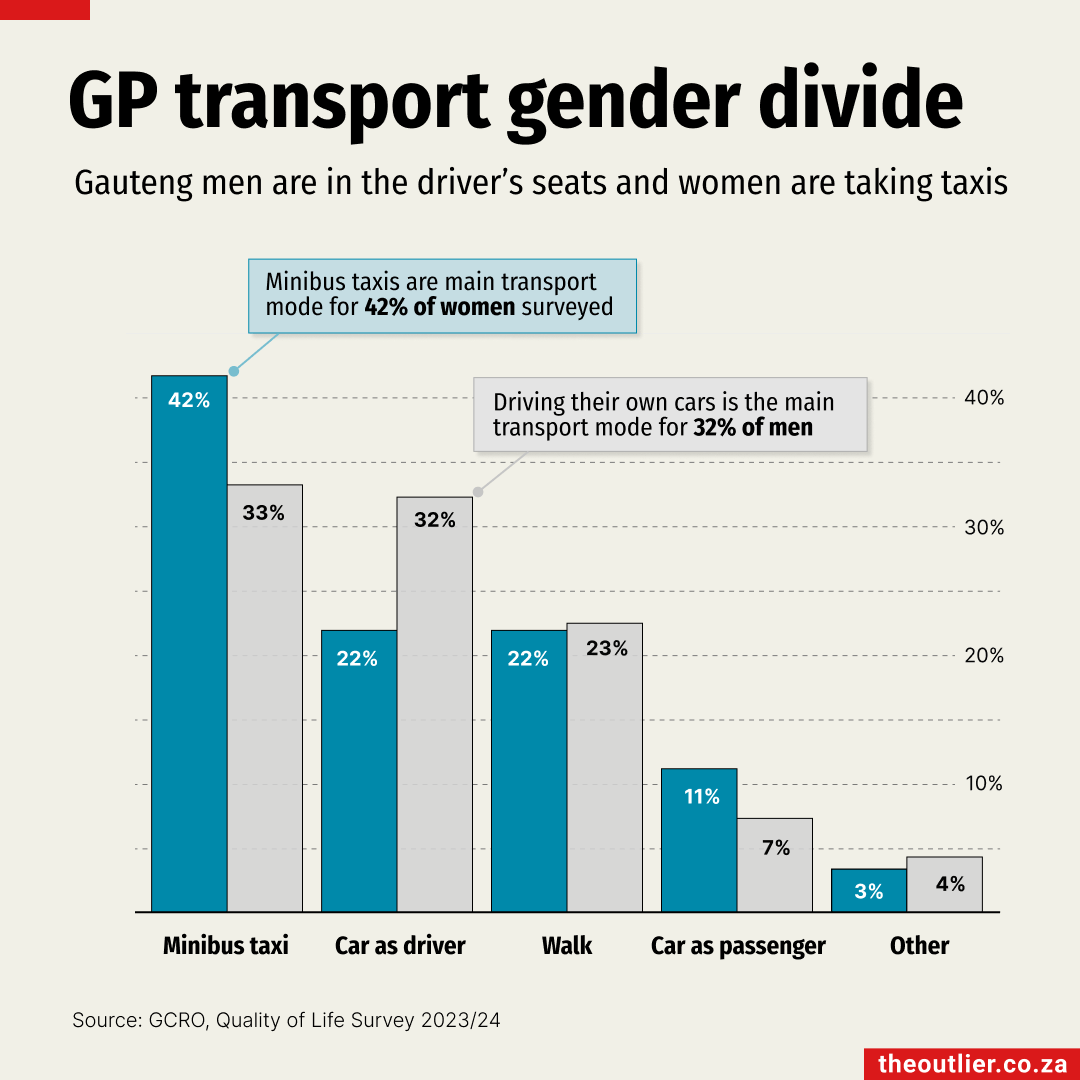

- 42% of women in Gauteng take minibus taxis, 33% of men

- Almost one-third of men in GP drive cars to get around

- Women are more likely to be passengers than men

A striking gender divide in transport choices is highlighted by the latest Gauteng-City Region Observatory’s Quality of Life survey: women are more reliant on minibus taxis than men, and men are more likely to drive cars as their main mode of transport.

Of the more than 3,700 people interviewed, 42% of the women said they primarily travelled by minibus taxi compared with 33% of men; whereas 32% of men said driving was their main way of getting around, against just 22% of women.

Women are also more likely to be passengers in private cars than men. Passengers include people getting a ride with someone they know or paying for a ride in a private car, but excludes e-hailing and meter taxis.

The 2017/18 survey showed that 51% of women relied on minibus taxis, while only 16% drove cars. There has also been an increase in men driving cars – only 27% were driving in 2017.

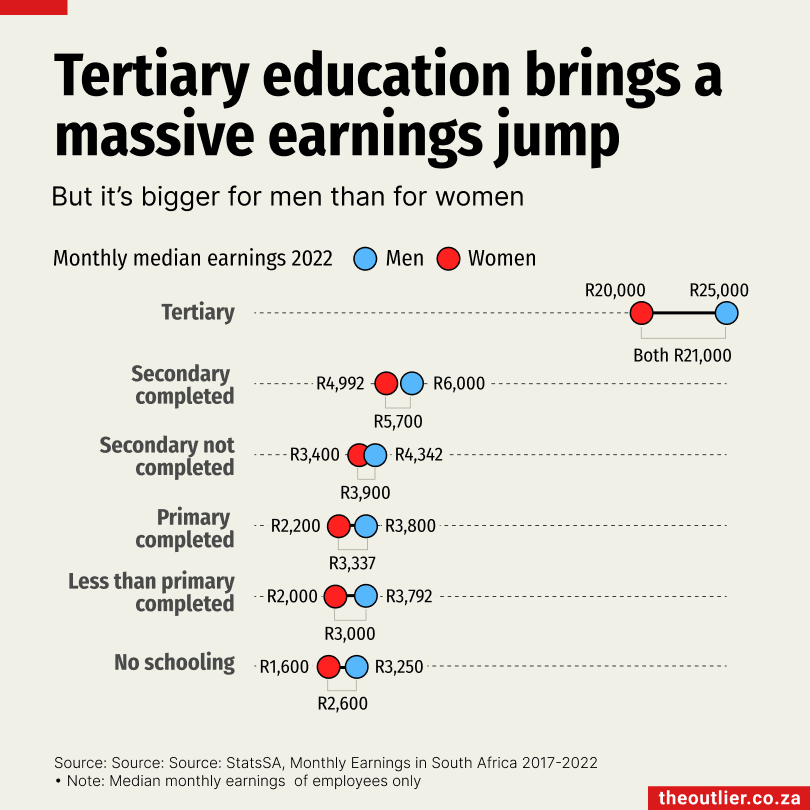

- Employees with tertiary qualification earn higher salaries

- Post-school education results in +R15,000 gap in median monthly earnings

- Women with tertiary education earn 25% less than men

Education has a big effect on earnings. Employees with tertiary education earn a lot more than people who are less educated, but regardless of the level of education, men still earn more than women, according to Statistics SA’s Monthly Earnings in South Africa 2017-2022 report.

The median monthly earnings of people with tertiary education who work for an employer were R21,000. This is R15,583 (or 288%) higher than the national median earnings of R5,417 for all employees.

For those who completed high school, median earnings were R5,700, slightly above the national median, but still far below those who carried on studying to obtain a post-school qualification.

For female employees with tertiary education, however, the median earnings were R5,000 (or 25%) lower than for male employees. Female employees who completed high school had median earnings of R4,992 a month, while male employees’ earnings were R6,000 a month, a 20% pay gap.

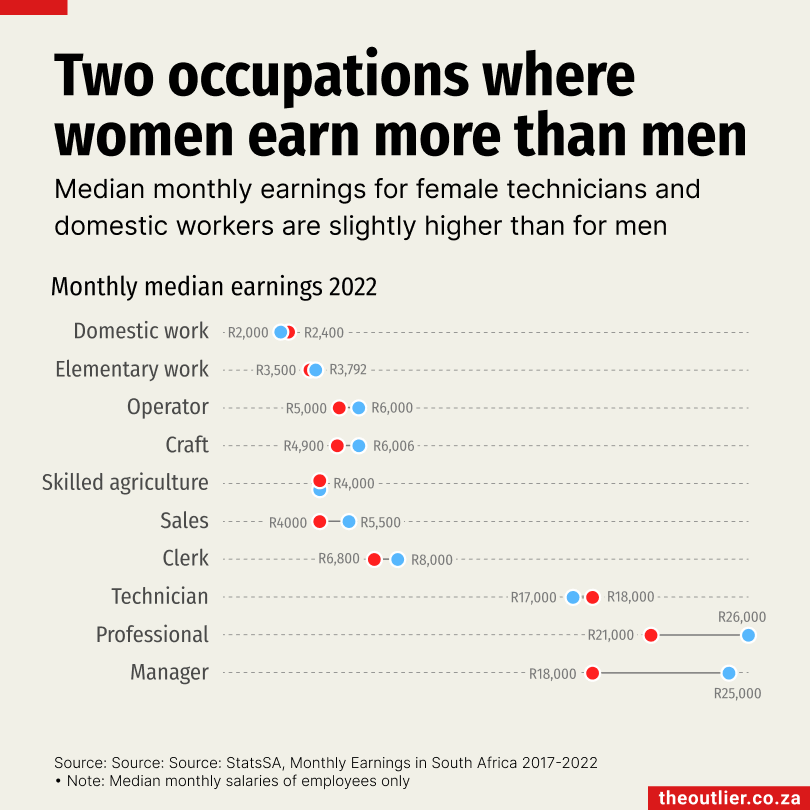

- The gender pay gap in SA grows wider in higher-paying roles

- Male managers earn R7,000 a month more than female managers

- Female technicians and domestic workers earn more than men

Women in South Africa earn 25% less a month than men, according to Statistics SA. Its report on monthly earnings between 2017 and 2022 shows that the median earnings for female employees were R4,800 a month, while the median for men was R6,000.

This gender pay gap typically grows wider in higher-paying roles, with men consistently earning more than women in most occupations. Male managers earned a median of R25,000, R7,000 more than female managers’ R18,000. Among professionals, the gap was R5,000, with men earning R26,000 compared with R21,000 for women in the same role.

There are, however, two exceptions where women’s median monthly earnings surpass those of men. Female technicians earned R18,000 a month in 2022, slightly higher than male technicians’ median of R17,000. Domestic work also saw women earning more, with female domestic workers earning a median of R2,400 compared with R2,000 for men.

- Women generally earn more in Gauteng and the Western Cape

- Gauteng’s median earnings are R2,000 higher than national median

- Earnings growth is slower in provinces such as Limpopo and KZN

There are significant regional differences in women’s median earnings across the country, according to a Statistics SA report which tracks South Africans’ earnings between 2017 to 2022.

Women in Gauteng and the Western Cape consistently earned higher salaries compared with other provinces, with Gauteng’s median earnings reaching R7,000 by 2022 – higher than the national median for men (R6,000 a month). In contrast, provinces such as Limpopo and KwaZulu-Natal saw slower growth, with women in Limpopo earning a median R3,700 a month and R4,200 in KwaZulu-Natal. The national median for both sexes is R5,417 a month.

Other provinces such as the Eastern Cape and Free State have seen slower salary increases over time, with the median earnings of women in the Eastern Cape reaching just R4,000 by 2022.

In general, all employees earn more in Gauteng than anywhere else in the country. Overall median earnings are R2,000 higher there than the national median.

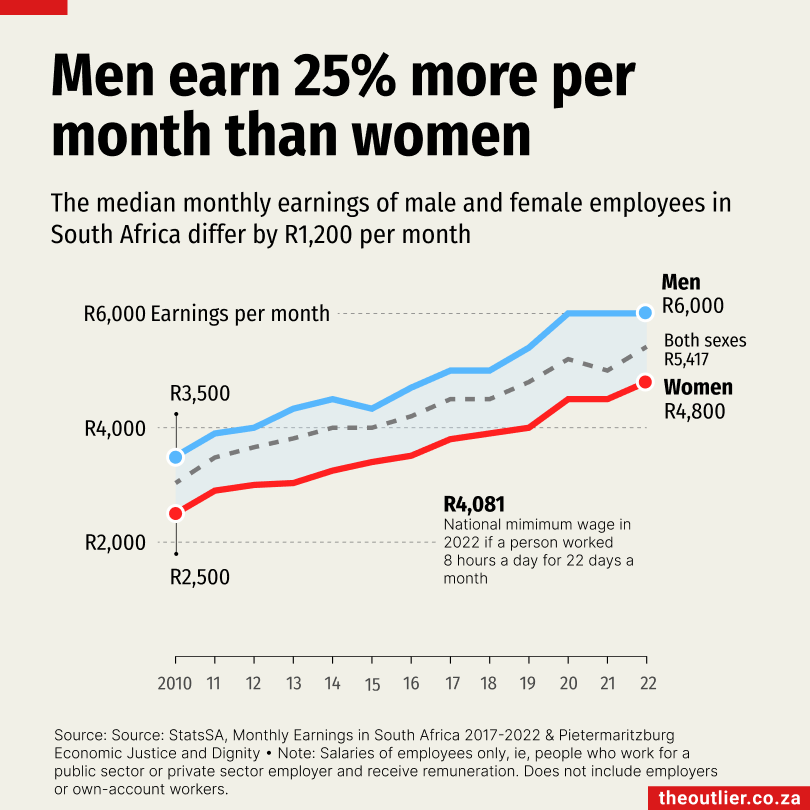

- Female employees earn 25% less than men in South Africa

- Their median monthly earnings in 2022 were R1,200 lower than men’s

- Women’s median earnings were R800 higher than the minimum wage

The median earnings of female employees in 2022 was R4,800 a month, 25% lower than R6,000 median for men.

There were 13-million employees in SA in 2022 – people who ‘work for an employer and receive payment’. Their median monthly earnings were R5,417 a month, according to a new Statistics SA report. Of those employees, 7.5-million were male with half earning less than R6,000 a month and half earning more than that. Of the 6-million female employees, half earned more than R4,800 and half earned less.

Women’s median earnings were slightly above the national minimum wage, which was about R4,000 a month in 2022 (based on working eight hours a day for 22 days). The average food basket for a low-income family cost R4,853.18 in December 2022, according to the Pietermaritzburg Economic Justice & Dignity Group.

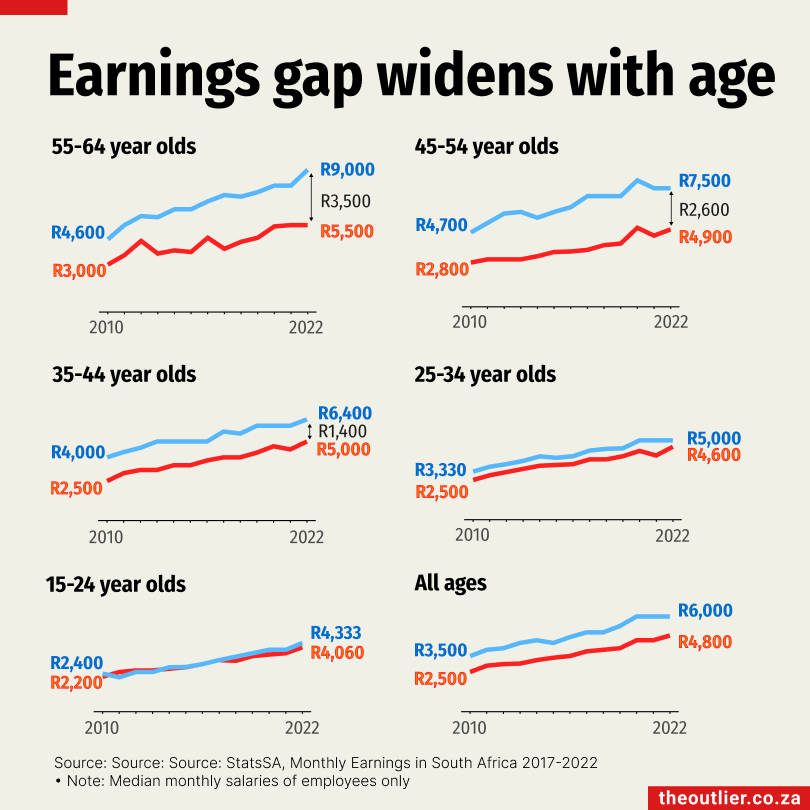

- Median earnings of women aged 55 to 64 are R3,500 less than men of same age

- Those women are out-earned by all men except by those under 34

- Experience rewards men more than women in earnings growth

The gender pay gap in South Africa not only persists but grows wider as employees age. According to Statistics SA’s Monthly Earnings in South Africa 2017-2022 report, women aged between 35 and 44 had median monthly earnings of R5,000 in 2022. This is R1,400 less than their male counterparts, whose median earnings were R6,400.

For women aged 45 to 54, the gap widened to R2,600, with women earning R4,900 compared with R7,500 for men. Among employees aged 55 to 64, the disparity was even greater: women earned a median of R5,500 a month, while men earned R9,000 – a difference of R3,500.

Despite earning more than younger women, women in the oldest age group were out-earned by men in all age groups except the two youngest (15- to 34-year-olds). This trend highlights the unequal value placed on experience and seniority between the sexes, with men seeing greater financial rewards as they age.

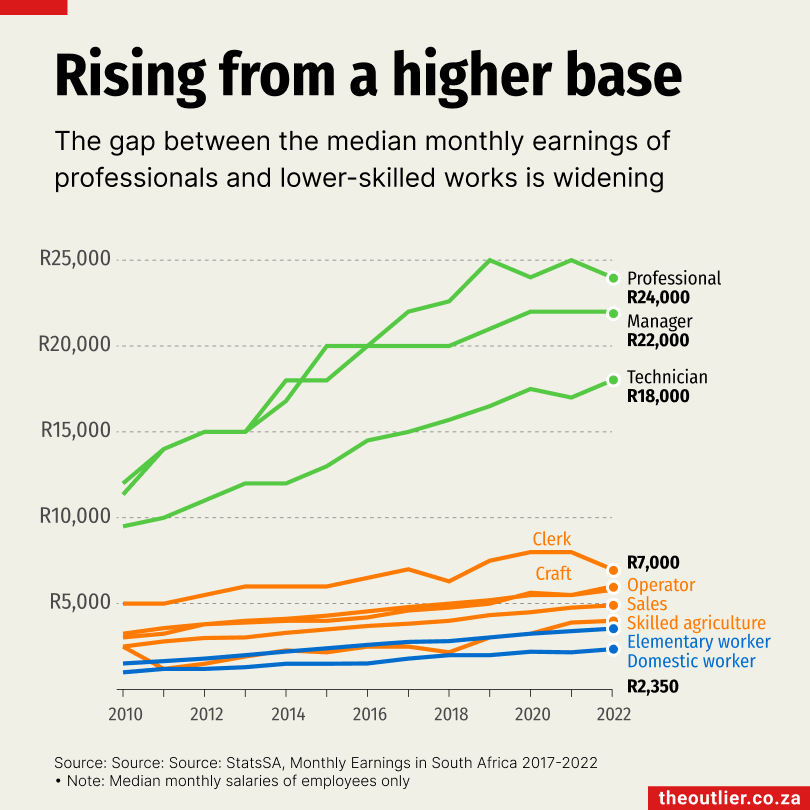

- Earnings gap between skilled and lower-skilled workers is widening

- Professionals’ earnings rise faster than those in lower-skilled jobs

- Managers’ earnings have increased by 83% since 2010, clerks’ by 40%

The gap between the median monthly earnings of skilled and less-skilled workers in South Africa is widening, according to a report on earnings compiled by Statistics SA.

The data, which covers the period 2017 to 2022, shows that professionals, managers and technicians consistently earn far more than employees in less-skilled occupations. By 2022, professionals were earning a median of R24,000 a month, followed by managers at R22,000 and technicians at R18,000. In contrast, workers in less-skilled roles, such as clerks (R7,000), craft workers (R5,000) and domestic workers (R2,350), earn significantly lower wages.

This growing disparity is evident when looking at the rate of increase in earnings over time. While skilled occupations (green lines) have seen steady growth, those in less-skilled roles (blue and orange lines) have experienced much slower growth. Managers earn 83% more than they did in 2010, while clerks’ earnings have increased by 40%.

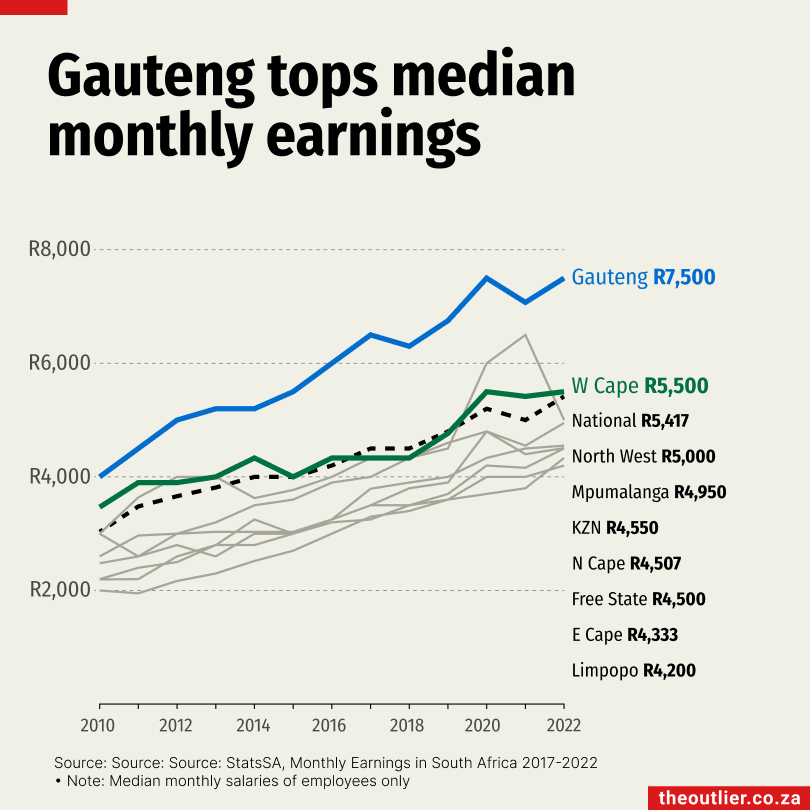

- Employees in Gauteng earn more than those in other provinces

- Median earnings in Gauteng were R7,500 a month in 2022

- This was R2,000 more than the median in the Western Cape

Where you live in South Africa influences what you earn. Employees – people who work for an employer and receive payment – earn more in Gauteng than anywhere else in the country. The median monthly earnings in Gauteng were R7,500 a month, R2,000 higher than the Western Cape, which had the second-highest median at R5,500, according to StatsSA’s Monthly Earnings in SA 2017-2022 report.

Median earnings represent the middle point in the range, so 50% of employees earn less than the median and 50% earn more. The national median in 2022 was R5,417. Gauteng and the Western Cape were the only two provinces with median earnings higher than the national median.

The two provinces with the lowest median earnings were the Eastern Cape and Limpopo, both of which were more than R3,000 lower than Gauteng.

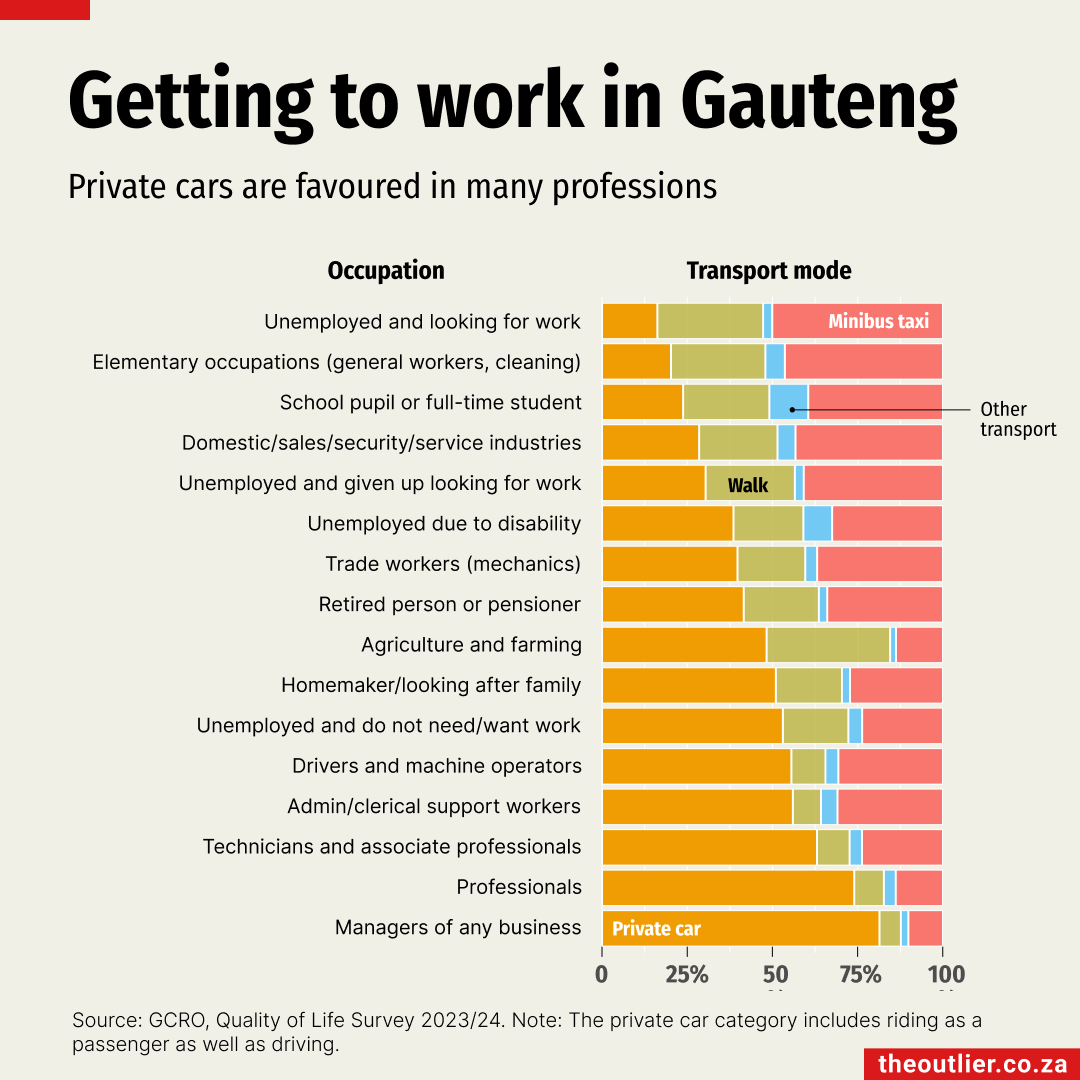

- Seven out of 10 GP residents in higher-income jobs use private cars

- More than a quarter of lower-income workers also rely on cars

- 50% of the job seekers surveyed say they rely on minibus taxis

Minibus taxis and private cars are the two primary modes of transport for people living in Gauteng, according to a province-wide survey conducted by the Gauteng-City Region Observatory (GCRO).

Of the 13,700 respondents, 36% said they relied on private cars and 38% said they used minibus taxis, with the choice differing according to their primary occupation.

More than 70% of respondents in professions generally associated with higher incomes, such as managers and professionals, use private cars, which includes driving as well as riding as a passenger. Even among employed people in lower-income roles, more than a quarter use private cars.

In contrast, car usage drops significantly for students, job seekers and those in elementary occupations (gardeners, general workers and cleaners). For these groups, less than 25% said they used private cars.

Half of the survey’s respondents who are unemployed and looking for work said they relied on minibus taxis.

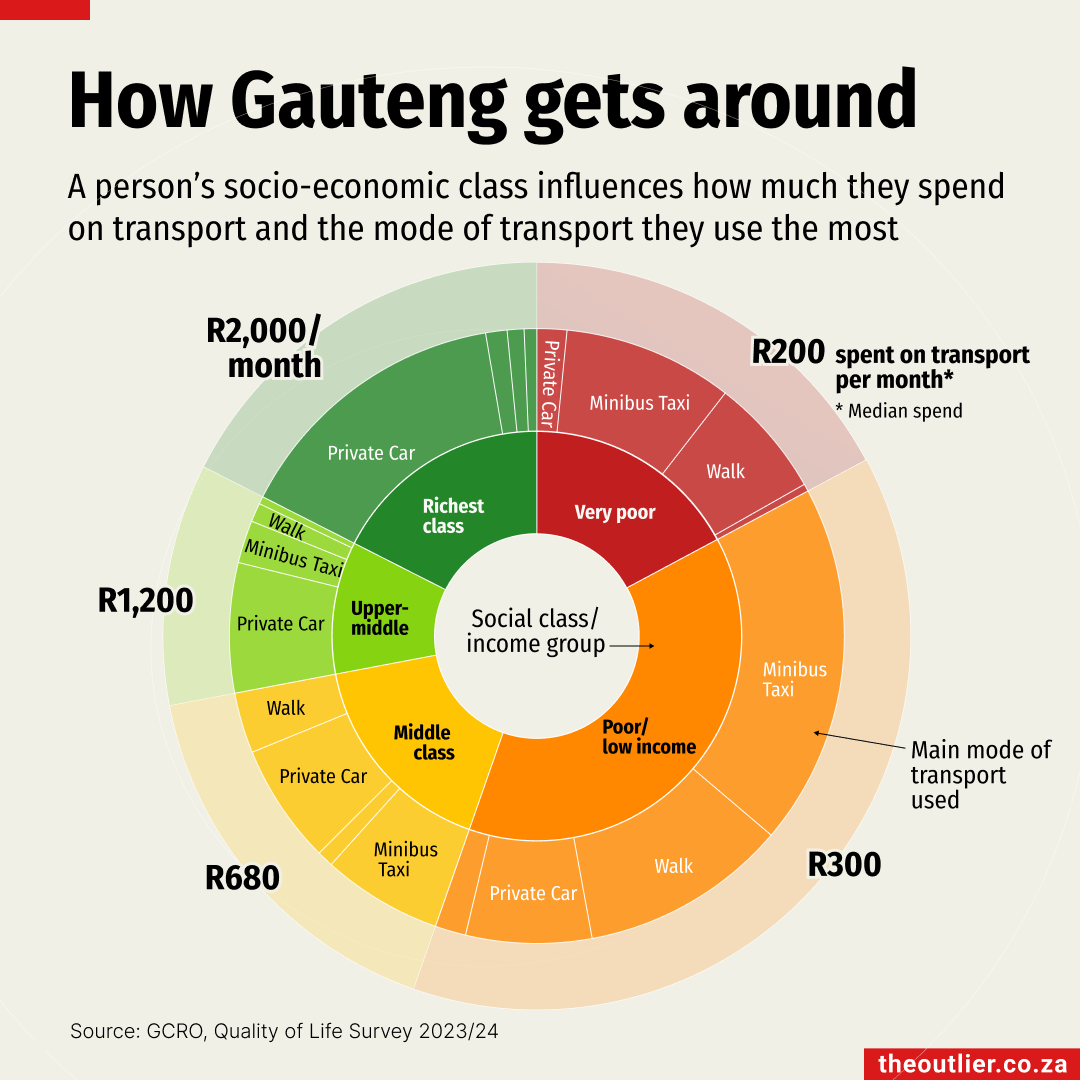

- Wealthier Gauteng residents are increasingly using private cars for transport

- They spend between R1,200 to R2,000 a month on getting around

- Transport spend for the province’s poorest is R200 to R300 a month

Most Gauteng residents fall in the lower socioeconomic class brackets and rely mostly on minibus taxis to get around. However, many say they opt for private cars when they can – either as drivers or passengers, according to the data from the Gauteng-City Region Observatory.

The GCRO’s 2023/24 Quality of Life survey shows that despite private cars being one of the most expensive options, the proportion of people driving has increased from 17% to 27% in the past 10 years.

The survey measures socioeconomic class on a one-to-10 scale based on factors such as household income, employment, education, medical aid membership and internet access. In general, the ratio of cars to other modes of transport increases with each wealth bracket: the higher the class, the more people use cars.

The survey also collects monthly transport spend from each respondent. The poorest spend as little as R200 a month on transport, while the wealthiest spend R2,000.

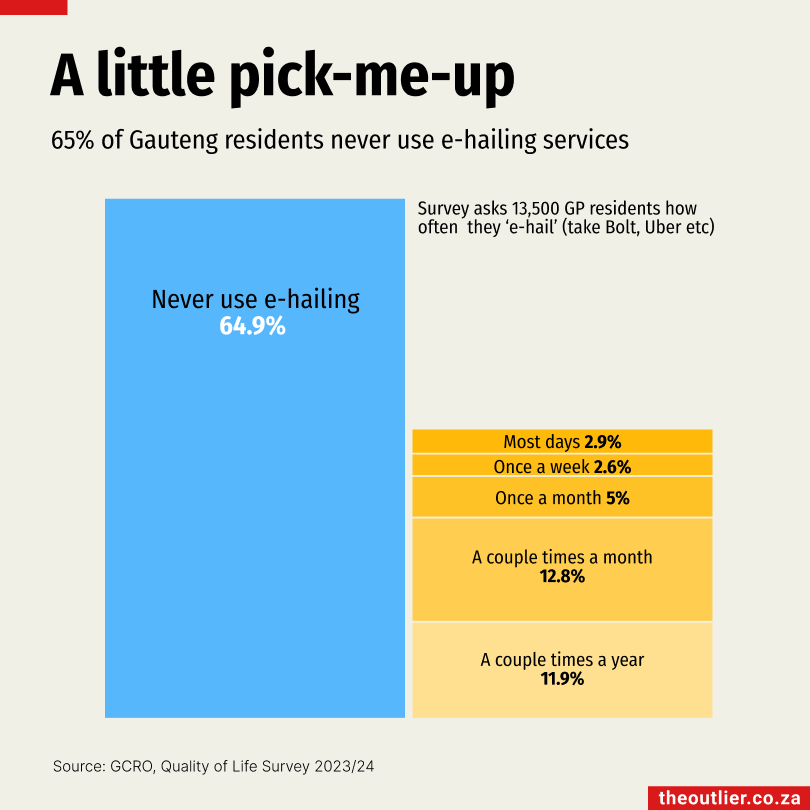

- Almost two-thirds of Gauteng residents never use e-hailing

- Survey shows only 1.2% use e-hailing as primary transport

- More women than men regularly use e-hailing services

Despite Bolt and Uber bringing massive changes to the transport landscape in South Africa’s cities, the Gauteng-City Region Observatory’s 2023/24 Quality of Life survey shows that few Gauteng residents make regular use of e-hailing services.

Of the people 13,700 people surveyed, almost two-thirds said they never use e-hailing services at all. For those who do, most only e-hail a couple of times a month. Only 1.2% said they use ‘e-hailing or metered taxis’ as their main mode of transport.

The GCRO surveyed people across the province, including areas far from the big metros where e-hailing services are primarily available. The 2023/4 survey included a separate question on e-hailing specifically.

The majority of regular e-hailing users rely primarily on minibus taxis. They likely take Ubers when minibus taxis aren’t available. More women than men e-hail, and the majority of e-hailing taxi users are in the lower and middle social class brackets.

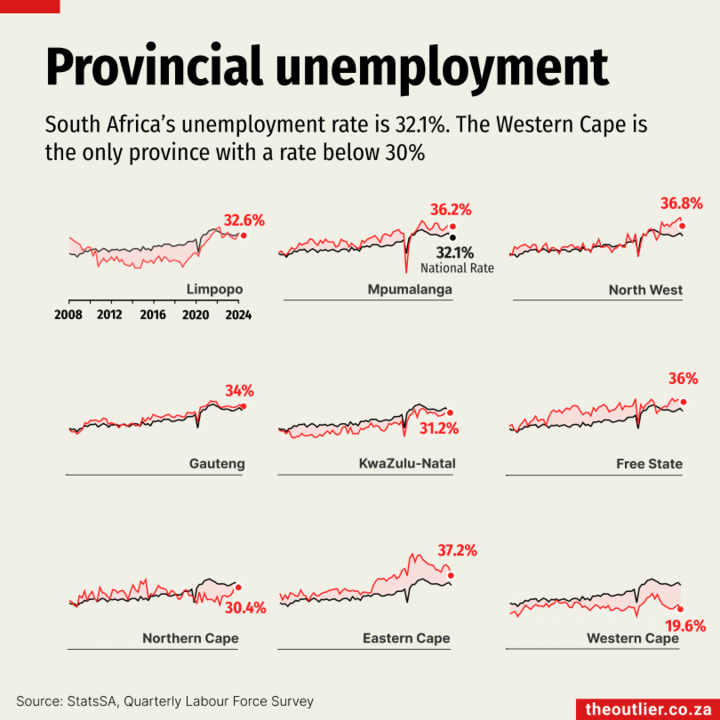

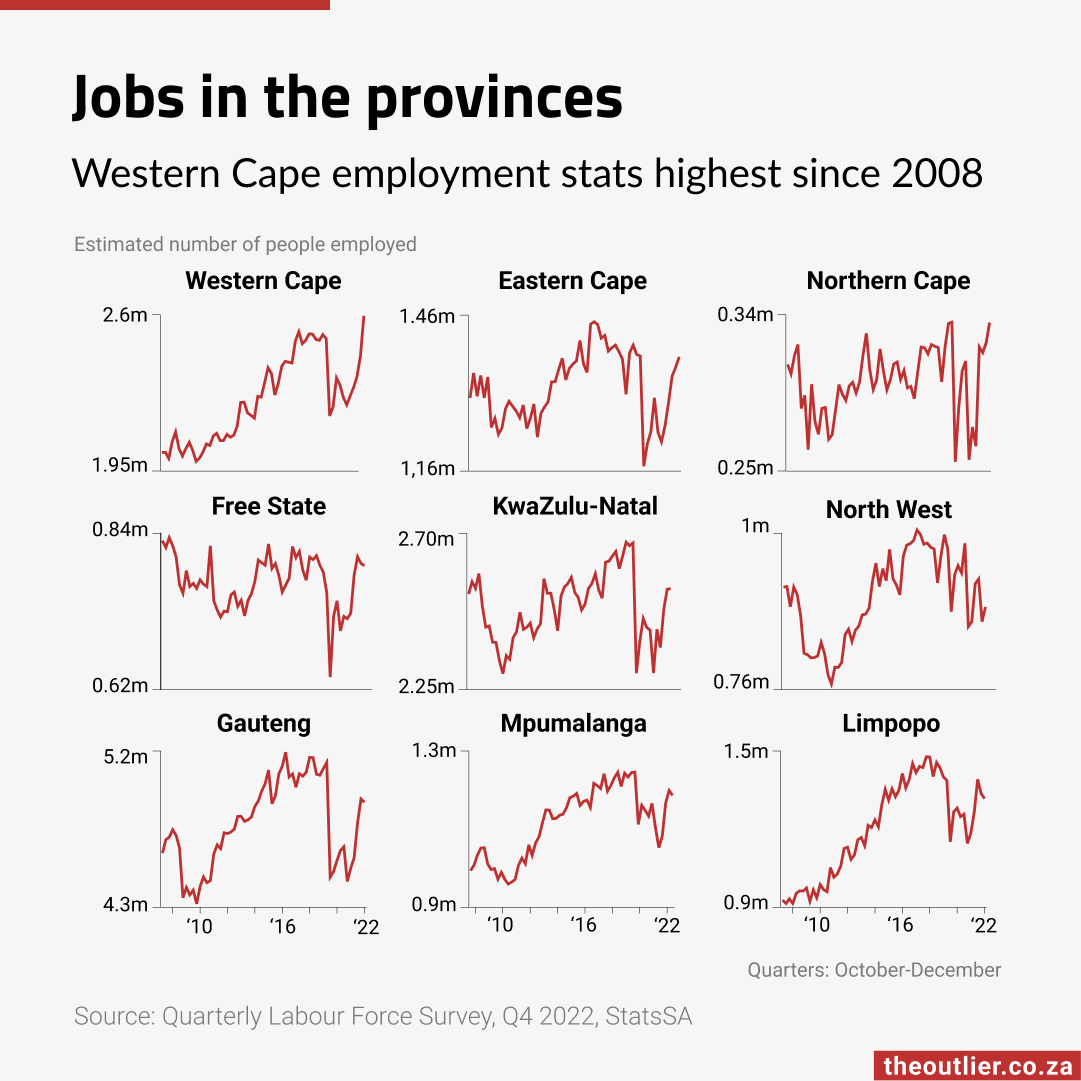

- The Western Cape has the lowest provincial unemployment rate at 19.6%

- Gauteng, which has the largest labour force, has unemployment of 34%

- The Eastern Cape has the highest at 37.2%, but improved since a Covid peak

Unemployment is not evenly distributed across South Africa. The national unemployment rate was 32.1% for the July to September 2024 period, according to Statistics SA’s Quarterly Labour Force Survey.

The Western Cape is the only province with an unemployment rate below 30%. Currently at 19.6%, it has consistently remained below the national average since 2008.

Gauteng, the country’s economic powerhouse with the largest labour force of 7.6-million people, has an unemployment rate of 34%. KwaZulu-Natal, which has the second-largest labour force of 4-million people, has an unemployment rate of 31.2%. Its employment rate has been slightly below the national rate for more than a decade.

The Eastern Cape has the highest provincial unemployment rate at 37.2%, but the good news is that is has been improving since it peaked during the Covid pandemic.

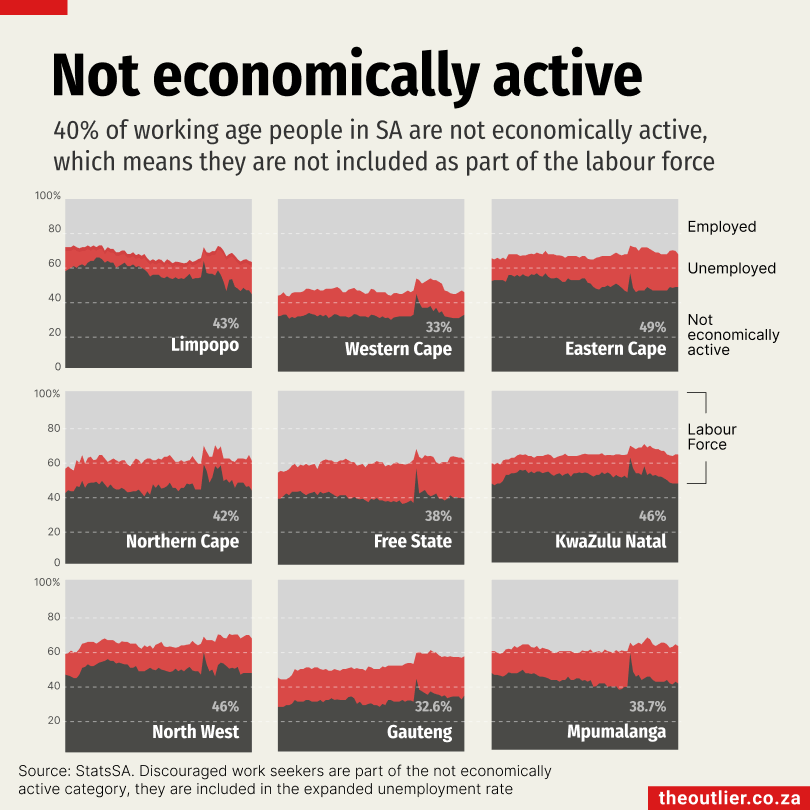

- Half of South Africa’s working-age population is under 35

- Only 6-million people under the age of 35 are employed

- Unemployment rate for 15- to 24-year-olds is 60%. Global rate is 13%

Young people under the age of 35 make up half of South Africa’s working-age population. Yet only an estimated 6-million young people out of a potential 21-million are employed, according to Stats SA’s Quarterly Labour Force Survey for July to September 2024.

The 60.2% unemployment rate for those aged 15 to 24 is far higher than the global average, which the International Labour Organization estimates at 13%.

The unemployment rate is the percentage of the labour force that is unemployed. But the labour force excludes people classified as not economically active – including students, home-makers, people who are ill or have disabilities, people too young or old to work as well as discouraged work seekers.

In the 15 to 24 age group, 73% are not economically active, which is expected as many are still in the education system. In the 25 to 34 age group, where the unemployment rate is 40%, about one in four are classified as not economically active.

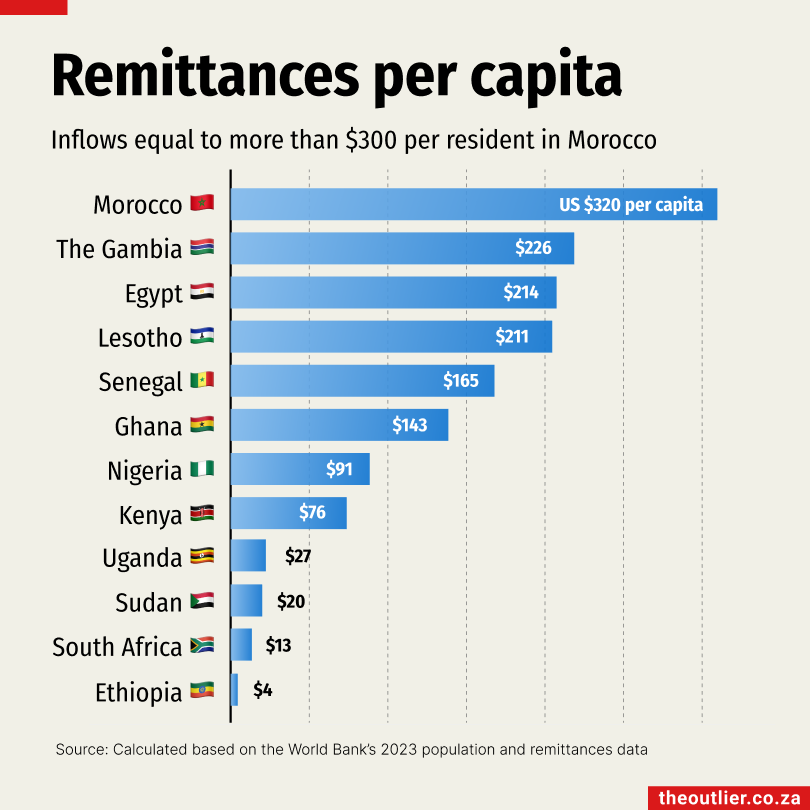

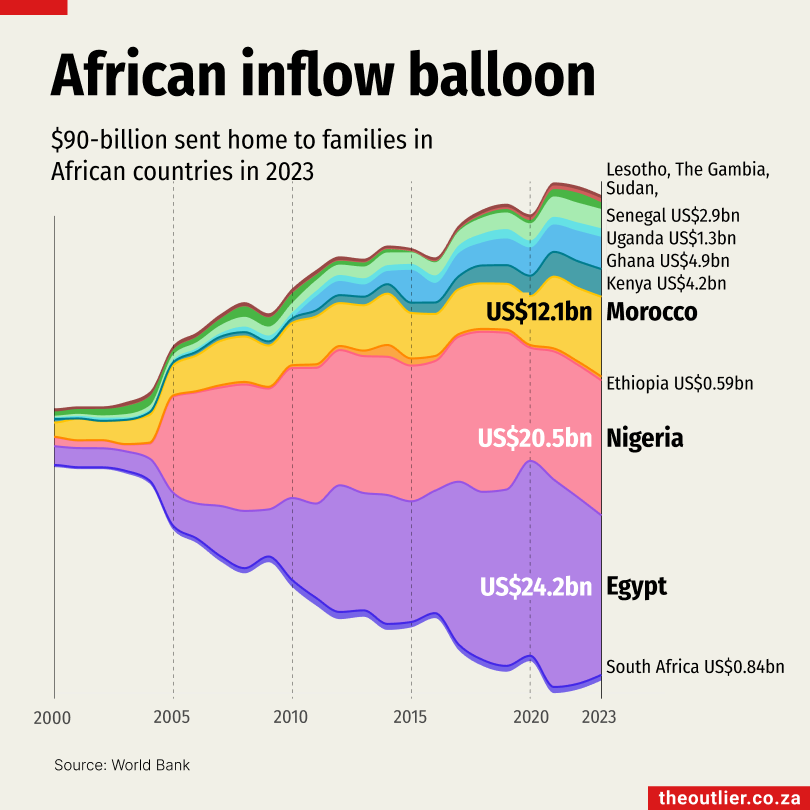

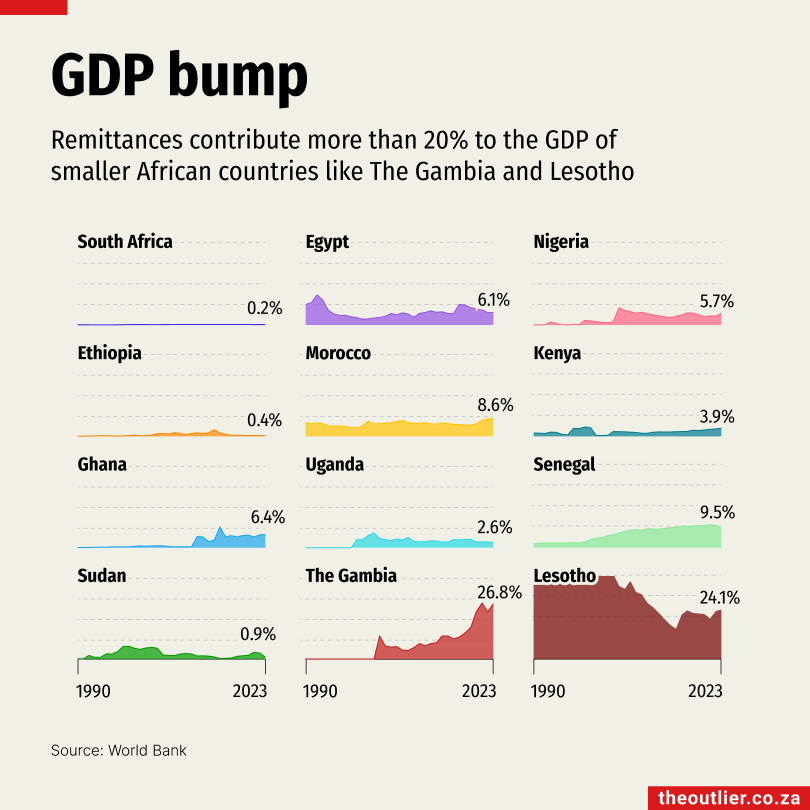

- In Morocco, remittances are worth $320 a person a year

- Ethiopia’s large population dilutes remittances to $4 a person

- Remittances in at least 13 African nations equate to +$100 a person

Remittance per capita highlights the effect of population size on how far incoming funds stretch. What would it look like if the total money sent home every year by citizens working abroad were divided equally among everyone in the country?

Nigeria, Africa’s second-largest remittance recipient in 2023, received $20-billion. But as the most-populous African nation, this amounts to just $91 a person – about R4 a day or R1,600 for the year.

For the 126-million people in Ethiopia, the remittance of $591-million only comes to $4 per citizen for the year. But in at least 13 countries including Ghana, Senegal, Lesotho, Egypt and The Gambia, remittances equate come to more than $100 a person, which gives us insight into the impact of sending money home.

In this thought experiment, Moroccans are the real winners. In a country with a population of 38-million, the $12-billion sent home last year equates to $320 a citizen.

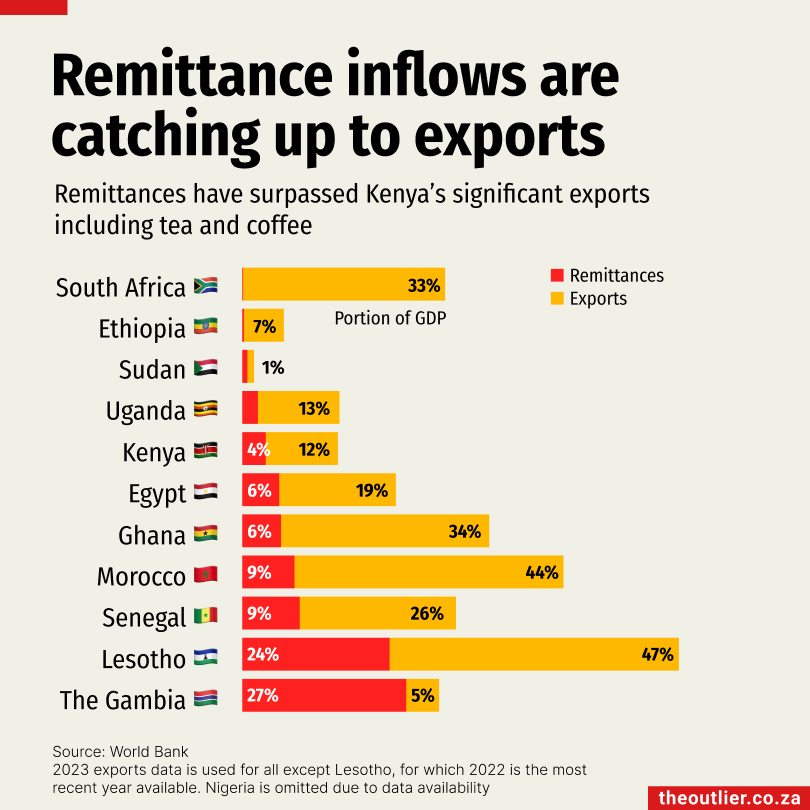

- Remittances form significant portion of GDP for many African countries

- Exports still lead, but remittance contributions catching up

- Remittance value is more than double Kenya’s main export: coffee and tea

Although exports still contribute more to the GDP of most African states, remittances are beginning to surpass some major export categories.

Kenya’s biggest goods export category – coffee, tea, mate and spices – makes up almost 25% of all its exports and is valued at $1.6-billion, according to 2023 UN Comtrade data.

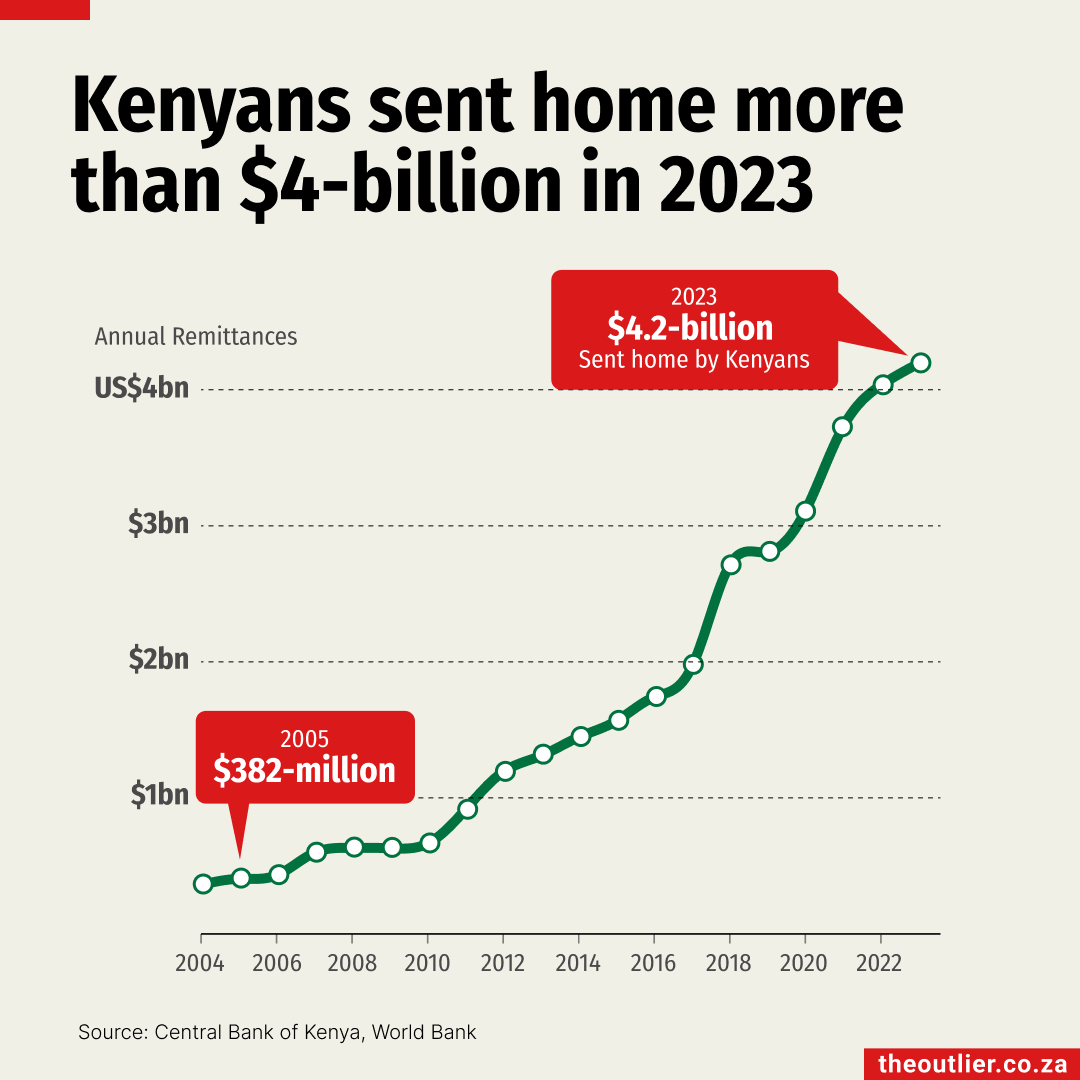

Although Kenya’s exports constitute a significantly larger portion of its economy than remittances, the gap is narrowing, with remittances reaching $4-billion in 2023.

In Senegal, the $2.9-billion it received in remittances contributed the equivalent of one-third of the country’s export value to GDP.

Kenya’s central bank accounts for the ‘steady and resilient flow’ of remittances as a result of the development of mobile money platforms, internet-based channels of remittances and supportive policy.

The only African countries where remittances exceed total export value are Comoros and The Gambia.

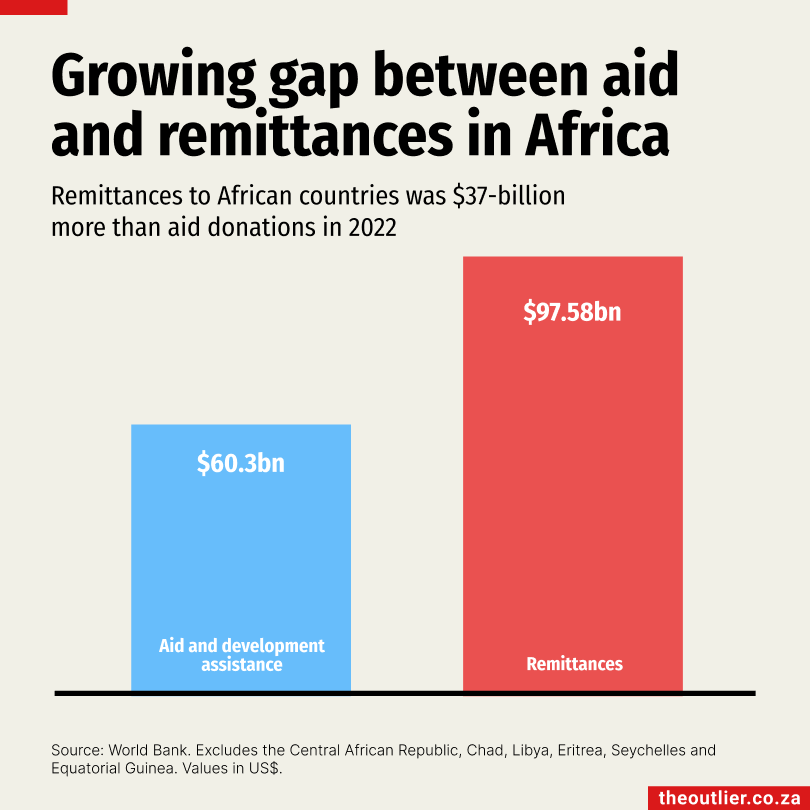

- African states receive more money from citizens abroad than from aid

- Families in rural areas are particularly reliant on remittances

- Remittances in 2022 surpassed development assistance by $37-billion

There is a perception that charity, donations and development aid given by the Global North is what is keeping African citizens and economies afloat. Yet the combined totals of foreign aid and development assistance to Africa in 2022 was $37-billion less than formal remittances from the African diaspora.

Because remittance money is often directly sent to people in rural areas who may have no other sources of income, the decrease in aid to African countries likely means that family members working abroad have been bearing the cost of everyday necessities normally associated with foreign aid, such as medical care. The Covid pandemic illustrated recipients’ reliance on remittances when other finance flows declined.